Narratives are currently in beta

Key Takeaways

- Aging Capesize fleet coupled with environmental regulations may boost spot rates and improve net margins with decreased capacity.

- Simandou mine ramp-up and Chinese demand trends likely to enhance revenue growth through increased tonne-mile demand and higher freight rates.

- Dependence on volatile markets, increased operational costs, and derivative losses threaten revenue and dividend stability, impacting profitability and investor returns.

Catalysts

About Golden Ocean Group- A shipping company, owns and operates a fleet of dry bulk vessels worldwide.

- The ramp-up of the Simandou high-grade iron ore mine from Q4 2025 is expected to increase export capacity, potentially tripling the sailing distance if replacing Australian volumes, thereby significantly boosting tonne-mile demand for Capesize vessels, positively impacting future revenues.

- Continued healthy global commodity demand, with growth expectations in iron ore and bauxite exports, particularly driven by Chinese infrastructure and manufacturing demands, suggests an increase in shipping volumes which could drive revenue growth.

- The Capesize fleet is aging, and with over half of it expected to be over 15 years old by 2028, coupled with tightening environmental regulations, fleet capacity may decrease, leading to improved net margins due to higher spot rates for newer vessels.

- Chinese economic stimulus, including support for the property sector and commitments to growth targets, signals potential stabilization and growth in steel demand, which supports higher freight rates and thus enhances future earnings.

- The limited additions to the Capesize order book, due to shipyard capacity constraints and high newbuilding prices, provide a favorable supply-demand balance, expected to support higher freight rates and improve net margins.

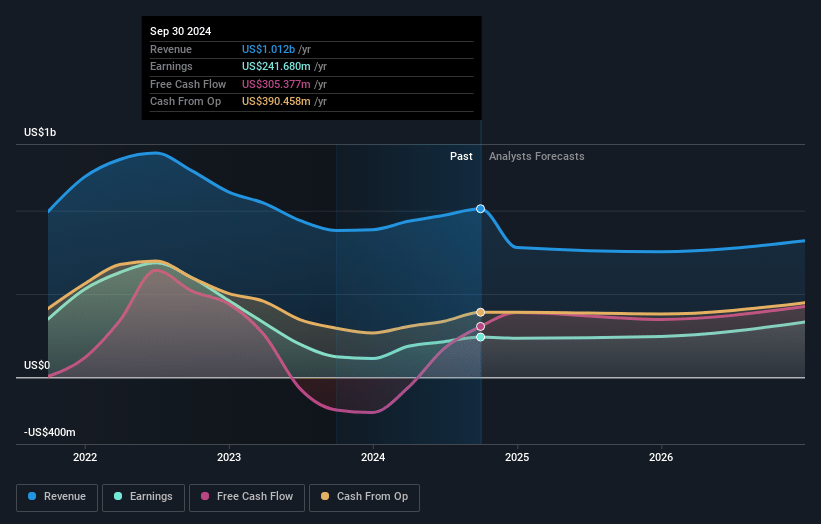

Golden Ocean Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Golden Ocean Group's revenue will decrease by -9.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 23.9% today to 47.7% in 3 years time.

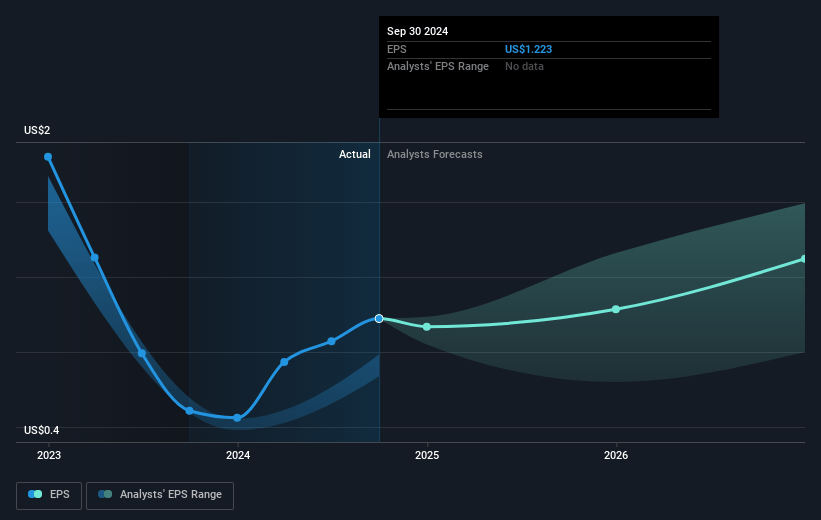

- Analysts expect earnings to reach $354.9 million (and earnings per share of $1.74) by about December 2027, up from $241.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $405.6 million in earnings, and the most bearish expecting $208 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.8x on those 2027 earnings, up from 8.2x today. This future PE is greater than the current PE for the GB Shipping industry at 4.4x.

- Analysts expect the number of shares outstanding to grow by 0.6% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.57%, as per the Simply Wall St company report.

Golden Ocean Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's Q3 earnings per share have decreased compared to Q2 and there is discussion of potentially lower earnings per share ($0.25 from $0.28), which could impact dividend stability and investor returns. This impacts net earnings and dividend payout ratios.

- Increased operating expenses, including higher charter hire expenses and dry dock costs, could pressure net margins as they remained higher than in the previous quarter. This impacts profitability and net income margins.

- Financial results include a substantial $12 million loss on derivatives, contrasting with a gain in the previous quarter, potentially affecting financial income and net earnings stability.

- The fleet's need for frequent dry dockings and environmental investments raises operational costs and reduces fleet capacity, impacting revenue generation during those periods.

- Excessive reliance on market conditions, such as the Chinese steel market and geopolitical uncertainties, creates risks in revenue stability due to fluctuating demand for commodities like iron ore and coal.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $13.79 for Golden Ocean Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $17.17, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $744.0 million, earnings will come to $354.9 million, and it would be trading on a PE ratio of 9.8x, assuming you use a discount rate of 7.6%.

- Given the current share price of $9.95, the analyst's price target of $13.79 is 27.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives