Key Takeaways

- Expansion in DDR5 interfaces and product rollouts is set to boost demand and revenue, positively impacting the company's financials.

- Strong cash flow and a diversified model support sustained earnings growth, leveraging AI and data center market trends.

- Geopolitical risks, variable silicon IP revenue, competitive pressures, and cost challenges could impact Rambus's revenue stability, gross margins, and investor confidence.

Catalysts

About Rambus- Manufactures and sells semiconductor products in the United States, South Korea, Singapore, and internationally.

- Rambus expects continued revenue growth driven by their leadership position in DDR5 memory interface chips and the rollout of new products like server PMICs and MRDIMM 12800 chipsets, which are anticipated to see increased sales, impacting revenue positively.

- The introduction of next-generation products and expansion of the product portfolio, such as the CryptoManager Security IP and HBM4, is expected to drive demand significantly, enhancing revenue and potentially improving net margins due to higher-value products.

- Rambus's robust balance sheet and strong cash flows from operations enable ongoing investment in technology leadership and new product development, which is expected to sustain long-term earnings growth.

- The diversified business model with revenue streams from chips, IP, and patents provides financial stability and resilience against market fluctuations, potentially improving net margins and creating consistent earnings.

- Rambus's positioning in AI and data center market expansions aligns with growing industry demand, particularly for high-performance and high-capacity memory subsystems. This strategic focus is expected to drive future revenue growth and possibly increase net margins due to high-value applications requiring specialized silicon solutions.

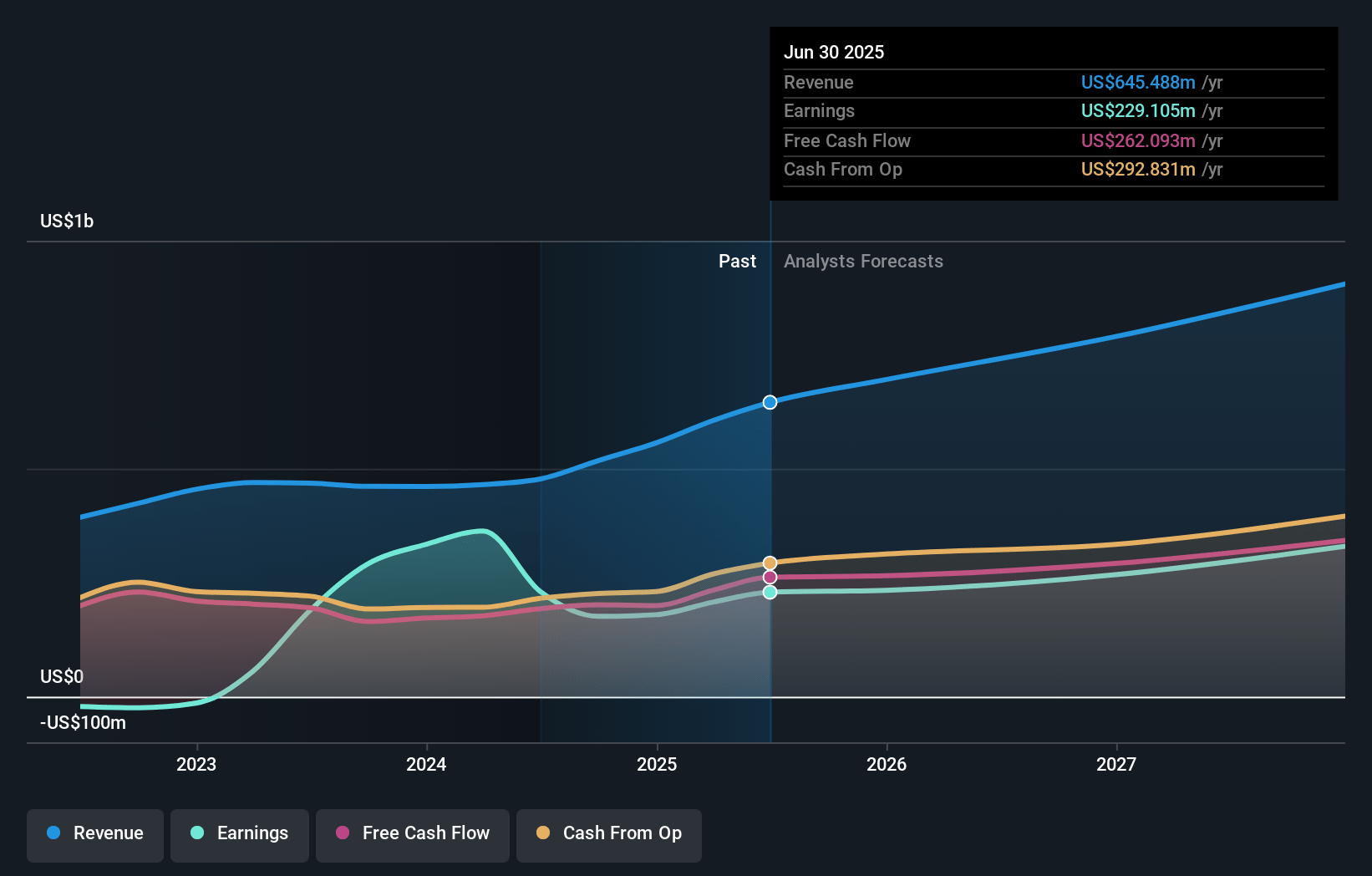

Rambus Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Rambus's revenue will grow by 15.8% annually over the next 3 years.

- Analysts are assuming Rambus's profit margins will remain the same at 34.2% over the next 3 years.

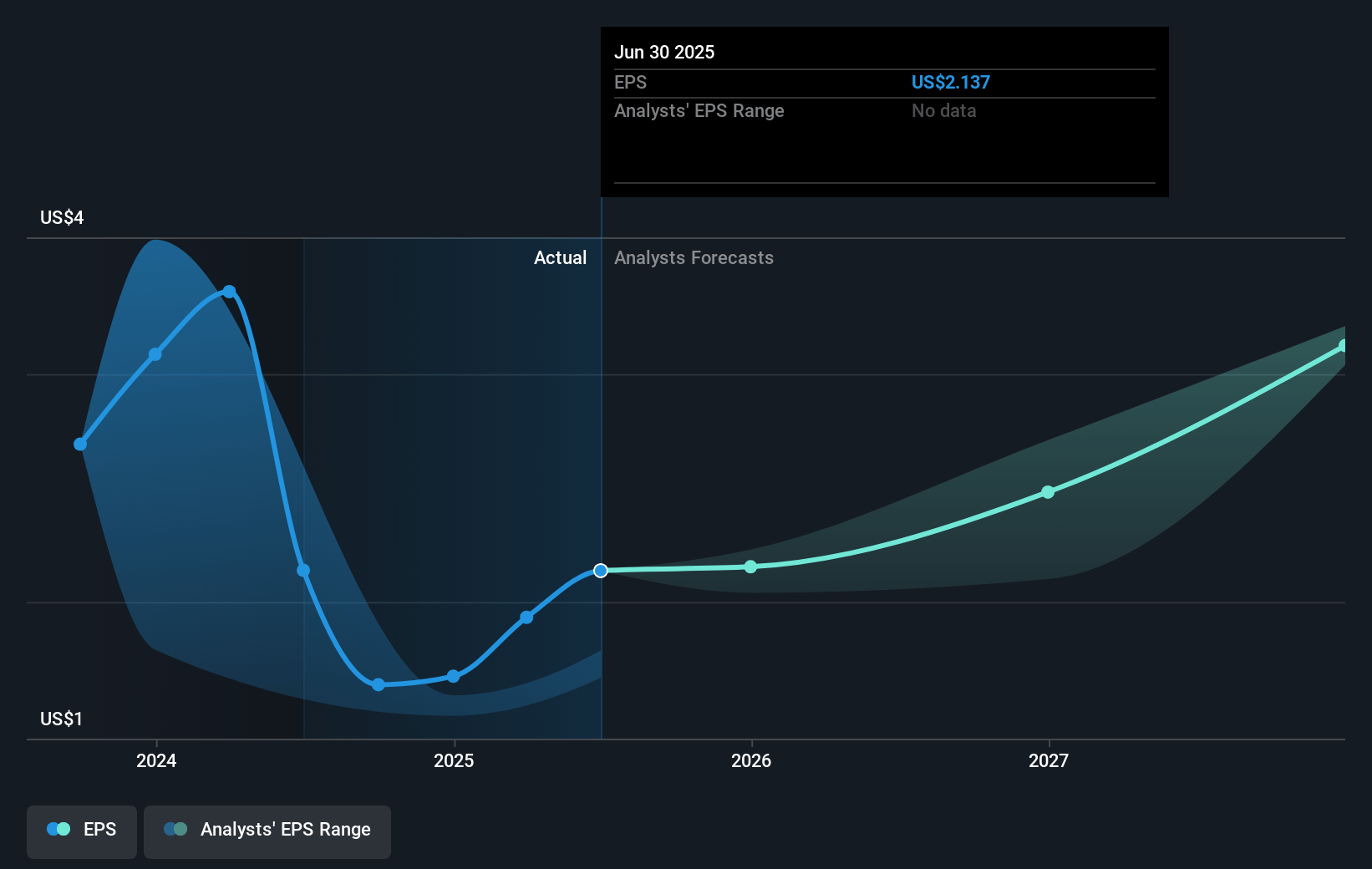

- Analysts expect earnings to reach $321.5 million (and earnings per share of $2.81) by about May 2028, up from $207.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.0x on those 2028 earnings, up from 26.0x today. This future PE is greater than the current PE for the US Semiconductor industry at 22.5x.

- Analysts expect the number of shares outstanding to decline by 0.34% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.09%, as per the Simply Wall St company report.

Rambus Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The evolving geopolitical and macroeconomic environment, including uncertainty around tariffs, poses potential indirect risks that could affect supply chains and operations, impacting Rambus's future revenue and earnings.

- The lumpiness and variability in Silicon IP revenue due to customer program timing and economic conditions could lead to fluctuating and unpredictable financial performance, affecting net margins and overall revenue stability.

- The competitive landscape and rate of adoption of new products and technologies, such as the MRDIMM and client chips, may not meet expectations, leading to slower than anticipated revenue growth and affecting future earnings.

- Potential cost pressures and price erosions, typical in the semiconductor field, could impact the gross margins of Rambus’s chipset products, influencing operating margins and overall profitability.

- Limited visibility beyond the current quarter due to dynamic market factors could create challenges in forecasting and achieving long-term financial targets, affecting investor confidence and stock price stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $74.714 for Rambus based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $90.0, and the most bearish reporting a price target of just $69.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $940.1 million, earnings will come to $321.5 million, and it would be trading on a PE ratio of 32.0x, assuming you use a discount rate of 9.1%.

- Given the current share price of $50.17, the analyst price target of $74.71 is 32.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.