Narratives are currently in beta

Key Takeaways

- Proprietary GaN technology and strategic acquisitions in high-power tech are expected to enhance margins and reduce costs long-term.

- Expansion in industrial and automotive sectors, driven by high-voltage projects and geographic growth, will boost revenues and earnings by 2026.

- The company's heavy reliance on the appliance market and challenges in GaN adoption pose risks to revenue growth amid soft demand and competitive pressures.

Catalysts

About Power Integrations- Designs, develops, manufactures, and markets analog and mixed-signal integrated circuits (ICs), and other electronic components and circuitry used in high-voltage power conversion worldwide.

- Power Integrations is poised for strong growth in 2025 due to increased demand in the industrial sector, particularly in high-voltage DC transmission projects that deliver renewable energy efficiently, impacting revenue positively.

- The expansion of the automotive segment, with new design wins and geographic expansion, is expected to contribute to industrial revenues, leading to growth in the earnings in 2025, and a significant inflection in 2026.

- The company's proprietary GaN technology developments are expected to accelerate mass adoption due to cost competitiveness with silicon, ultimately enhancing net margins due to its superior performance and reliability.

- The growth in GaN product adoption across various market segments, including AI data centers, EV onboard chargers, and telecom infrastructure, is expected to expand the total addressable market and increase revenue.

- Strategic acquisitions, such as that of Odyssey Semiconductor, are expected to accelerate the development of high-power GaN technology, potentially reducing manufacturing costs and improving operating margins over the next 3 to 5 years.

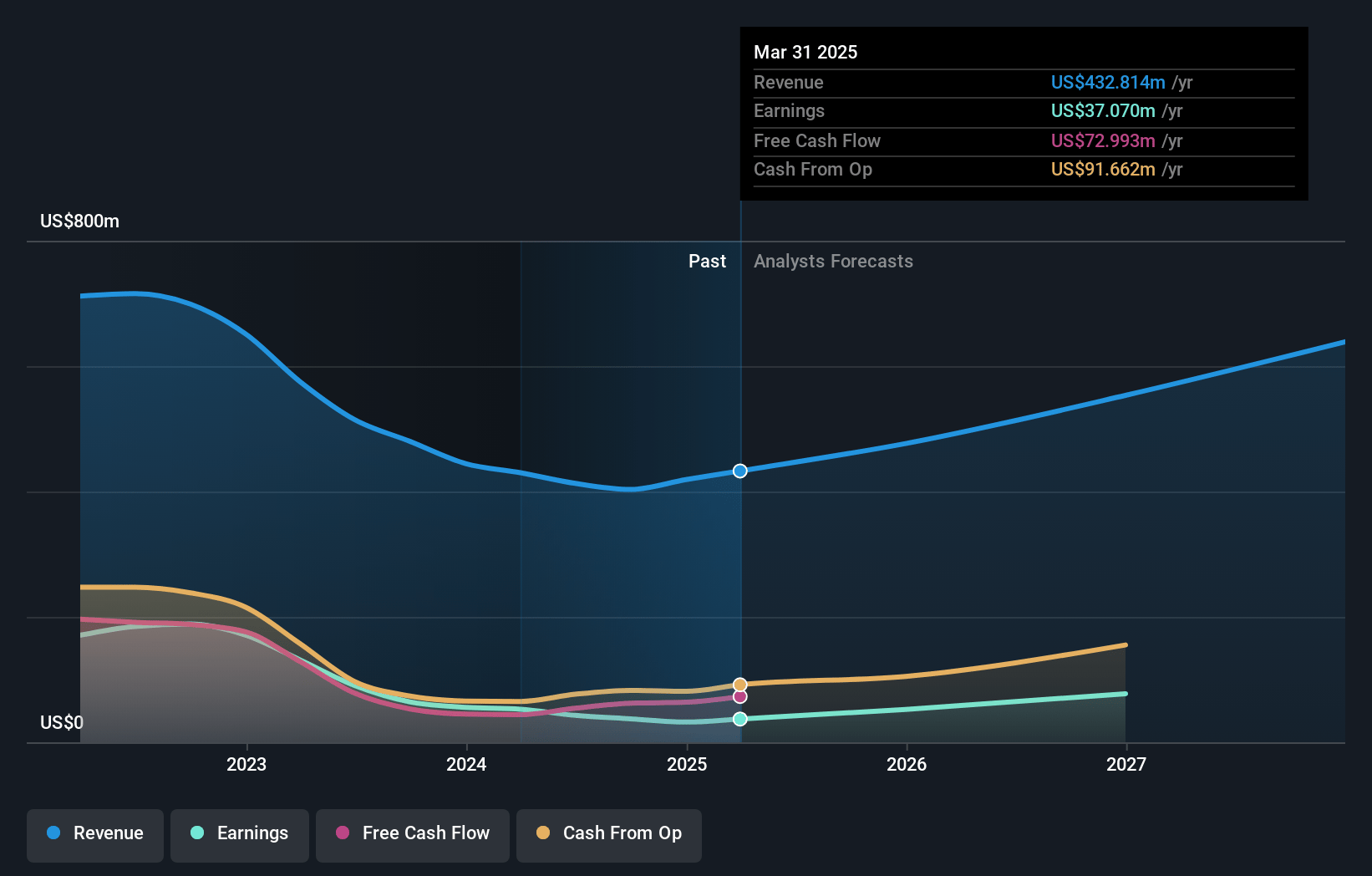

Power Integrations Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Power Integrations's revenue will grow by 15.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.3% today to 17.2% in 3 years time.

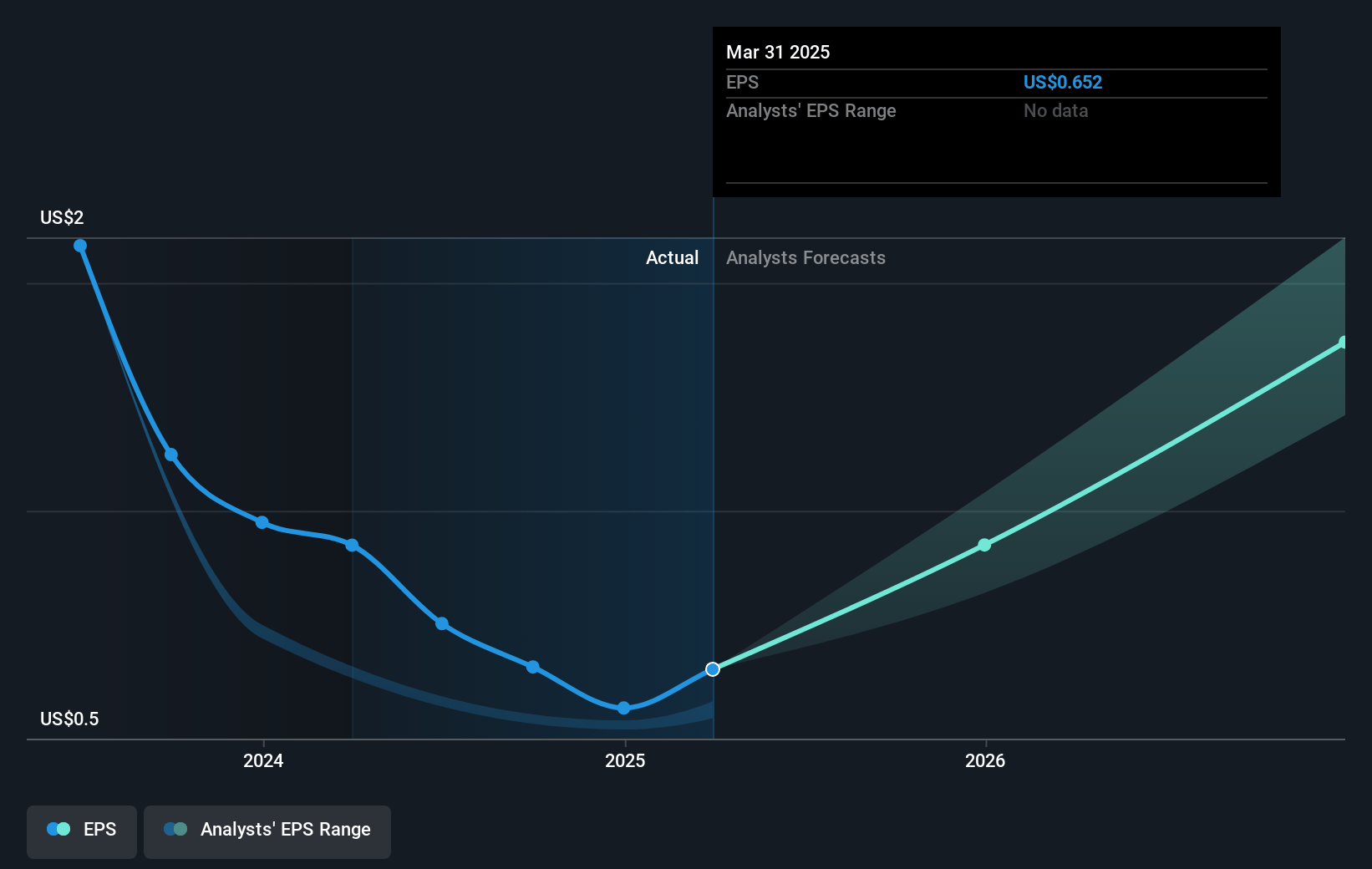

- Analysts expect earnings to reach $107.2 million (and earnings per share of $1.89) by about November 2027, up from $37.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 51.4x on those 2027 earnings, down from 92.0x today. This future PE is greater than the current PE for the US Semiconductor industry at 30.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.06%, as per the Simply Wall St company report.

Power Integrations Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's reliance on the appliance market, which comprises nearly 40% of their sales, faces risks due to a soft demand environment and inventory build-up at Chinese OEMs; this could negatively impact revenue forecasts moving forward.

- Industry-wide demand softness and inventory overhang in the consumer segment due to anticipated but unrealized demand boosts from Chinese government incentives may pressure net margins.

- Competition from silicon carbide in high-power applications, especially as GaN technology is still developing with significant breakthroughs needed for it to be cost-competitive at higher power levels, could affect earnings potential in future markets.

- The company faces execution risks related to expanding GaN product adoption, given the ongoing challenges in achieving cost parity and higher reliability compared to silicon carbide, potentially impacting revenue and growth targets.

- Reduced or uneven impact of government incentives for consumer purchases and the high degree of dependency on energy market regulations could lead to variability in net income as these factors influence market demand unpredictably.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $78.0 for Power Integrations based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $90.0, and the most bearish reporting a price target of just $65.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $624.0 million, earnings will come to $107.2 million, and it would be trading on a PE ratio of 51.4x, assuming you use a discount rate of 8.1%.

- Given the current share price of $60.46, the analyst's price target of $78.0 is 22.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives