Key Takeaways

- Strategic acquisitions and innovation in edge computing and automotive software position NXP for faster growth and higher margins in connected vehicles and IoT markets.

- Localized manufacturing and rigorous operational efficiency measures strengthen supply chain resilience and support stable, long-term earnings expansion.

- Exposure to geopolitical risks, sector concentration, rising competition, weak demand recovery, and costly regulatory or acquisition pressures could threaten margins and future profitability.

Catalysts

About NXP Semiconductors- Offers various semiconductor products in China, the United States, Germany, Japan, Singapore, South Korea, Mexico, the Netherlands, Taiwan, and internationally.

- NXP’s strategic acquisitions in AI edge computing (Kinara), in-vehicle connectivity (Aviva), and automotive software (TTTech Auto) position the company to capture higher content per vehicle and enable differentiation in advanced driver assistance systems and EV platforms. This can drive above-market revenue growth and support higher gross margins as semiconductor value in electric and autonomous cars accelerates.

- The rapid expansion of connected devices in industrial, smart home, and IoT markets increases demand for secure edge compute and embedded solutions, an area where NXP’s product portfolio and recent Kinara deal create a scalable platform. As edge AI becomes critical for latency, security, and real-time decision-making, NXP is positioned for outsized revenue growth and margin expansion in these higher-value segments.

- NXP’s local-for-local manufacturing strategy, especially the “China for China” initiative and foundry joint ventures in Europe and Asia, reduces supply chain and tariff risks while improving access to growth markets. This strategic flexibility supports stable, resilient earnings growth, even as global trade dynamics remain volatile.

- Progress on operational efficiency, including restructuring to absorb acquisitions and a targeted reduction in operating expenses to 23% of revenue, is set to enhance operating leverage. As top-line growth returns, these cost controls are expected to materially increase operating margins and drive faster earnings per share growth.

- Industry-wide increases in semiconductor content per device, notably in vehicles and industrial automation, creates a long-tail opportunity for sustained revenue growth for NXP as content per end product rises, supporting both top-line and gross margin expansion as adoption rates accelerate.

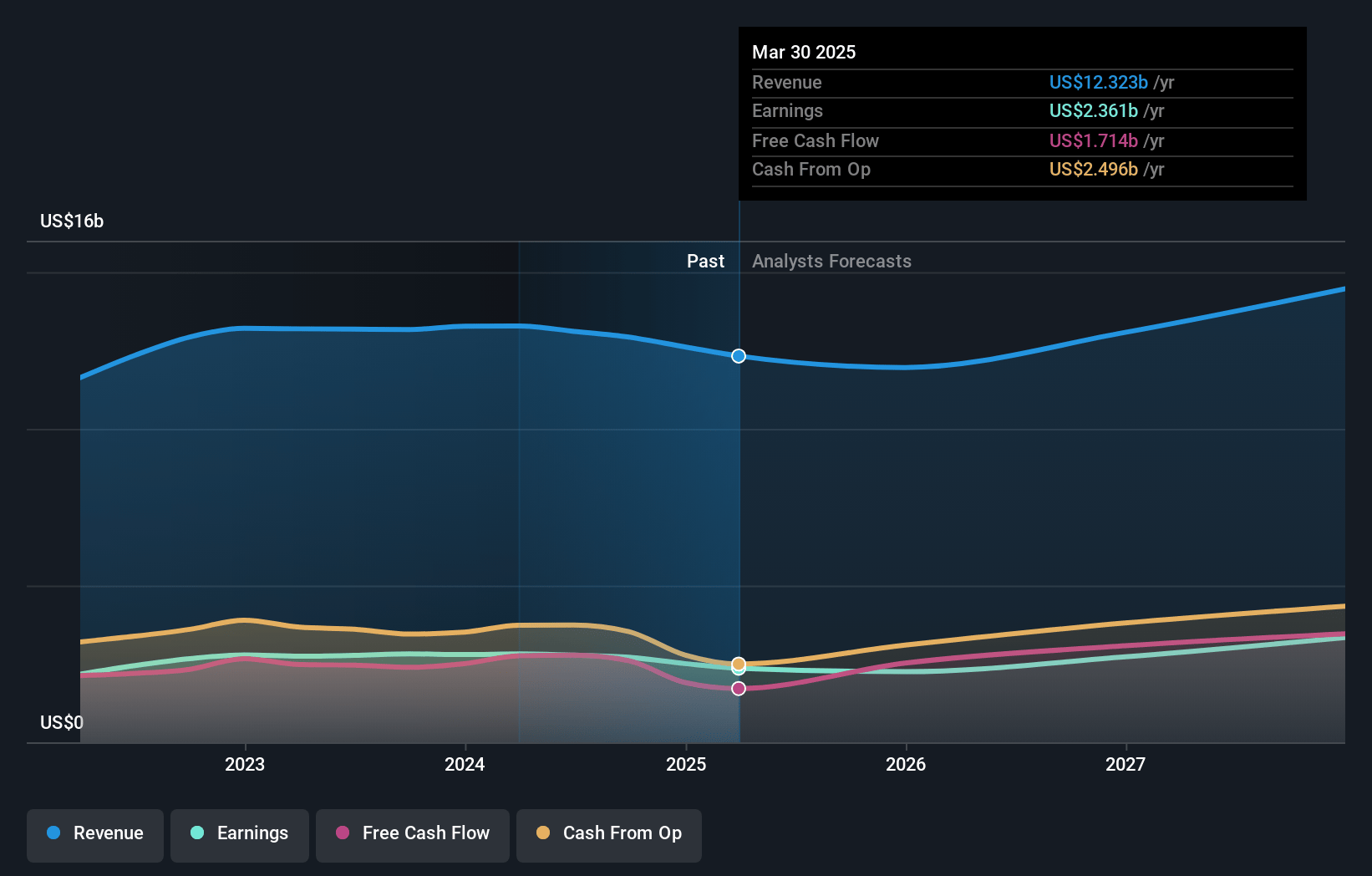

NXP Semiconductors Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on NXP Semiconductors compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming NXP Semiconductors's revenue will grow by 7.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 19.2% today to 24.1% in 3 years time.

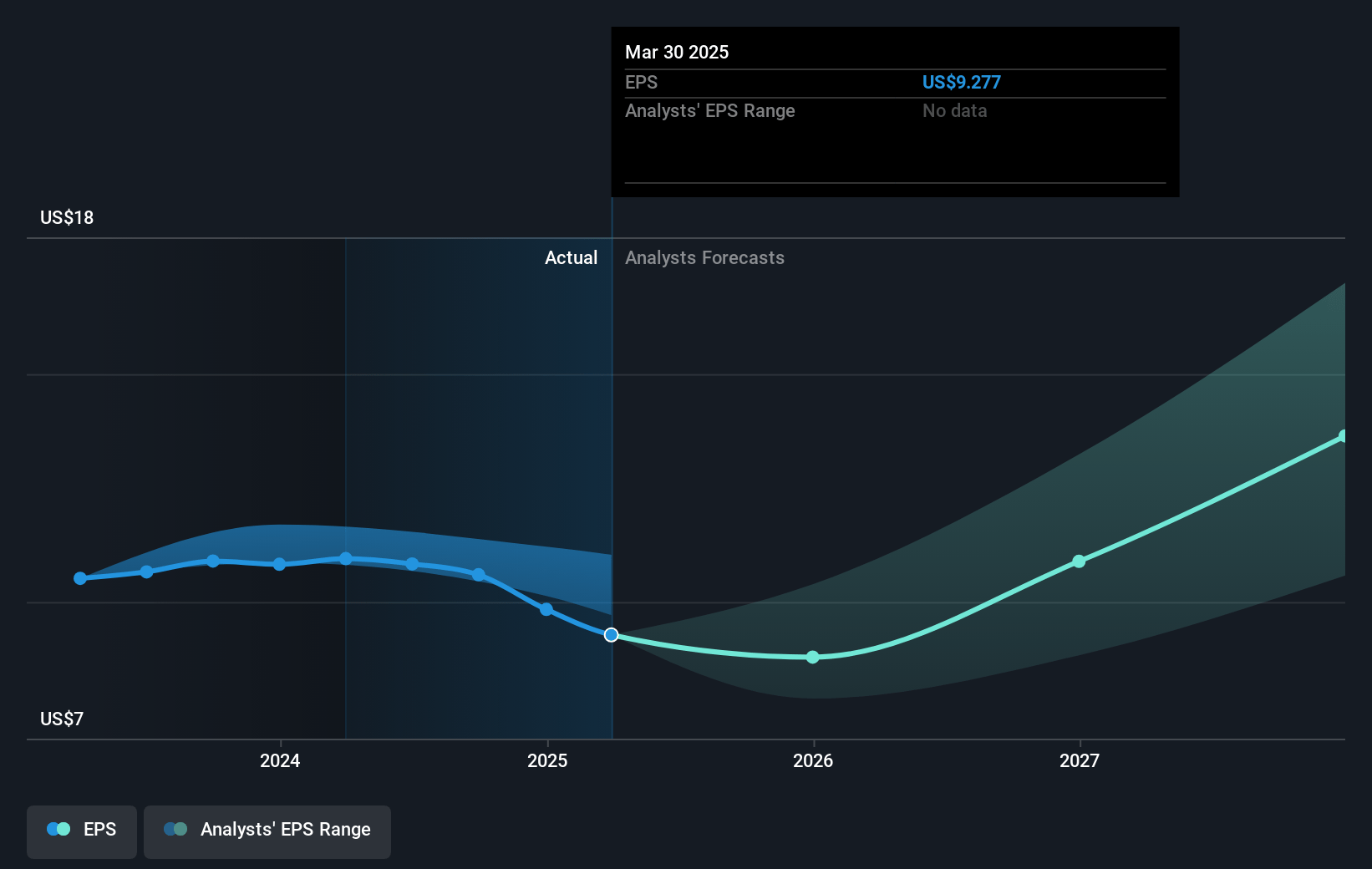

- The bullish analysts expect earnings to reach $3.7 billion (and earnings per share of $14.65) by about April 2028, up from $2.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 26.6x on those 2028 earnings, up from 19.6x today. This future PE is greater than the current PE for the US Semiconductor industry at 22.9x.

- Analysts expect the number of shares outstanding to decline by 0.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.62%, as per the Simply Wall St company report.

NXP Semiconductors Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces significant geopolitical and macroeconomic uncertainty, particularly from tariffs and shifting global trade dynamics, which could disrupt supply chains, limit access to key markets, and raise operational costs, ultimately putting downward pressure on both revenues and net margins.

- NXP’s heavy reliance on automotive and industrial sectors exposes it to sector-specific downturns; a sustained slowdown, such as the indicated year-on-year declines and weak outlooks in these segments, could reduce its topline revenue and limit diversification benefits.

- Intensifying competition, especially from subsidized Asian fabs and established Western peers, threatens to create price wars and accelerate commoditization in core semiconductor functions, risking gross margin compression and lower net earnings for NXP in the longer term.

- The slow pace of end-market recovery indicated by management, combined with ongoing inventory digestion issues at key Tier 1 auto customers and high internal days of inventory, could signal muted demand, further pressuring revenue growth and creating risk for future margin improvement.

- Growing pressure to meet sustainability goals and comply with stricter environmental regulations may require costly changes to manufacturing, while large pending acquisitions and high operating expenses could prevent meaningful profitability expansion and put future net margins at risk if revenue growth disappoints.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for NXP Semiconductors is $301.06, which represents two standard deviations above the consensus price target of $239.23. This valuation is based on what can be assumed as the expectations of NXP Semiconductors's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $301.12, and the most bearish reporting a price target of just $170.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $15.3 billion, earnings will come to $3.7 billion, and it would be trading on a PE ratio of 26.6x, assuming you use a discount rate of 9.6%.

- Given the current share price of $182.62, the bullish analyst price target of $301.06 is 39.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:NXPI. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.