Key Takeaways

- Expansion into defense and data center markets, leveraging IC design technologies, could drive revenue growth across emerging and established segments.

- Investments in facility modernization and next-gen telecom solutions enhance operational efficiency and market positioning, boosting long-term margins and revenue.

- Uncertainties in telecom demand, rising expenses, and execution risks in emerging tech could pressure margins and revenue growth despite a strong backlog.

Catalysts

About MACOM Technology Solutions Holdings- Offers analog semiconductor solutions for use in wireless and wireline applications across the radio frequency (RF), microwave, millimeter wave, and lightwave spectrum.

- MACOM plans to expand its market share by leveraging its advanced IC design and semiconductor technologies, focusing on new product lines, particularly within its Industrial & Defense segment, which has record revenue levels due to increasing defense needs. This strategy should positively impact revenue growth as MACOM captures more of the $7-8 billion serviceable addressable market.

- The modernization and expansion of MACOM's fabrication facilities, supported by CHIPS Act funding and state investments, are expected to enhance operating efficiencies and yield improvements over the next 5 years, potentially improving net margins due to better absorption of fixed costs and operational scalability.

- The data center market is set for strong growth driven by optical product demand, including a transition from 800G to 1.6T systems. This product expansion and alignment with customers’ next-gen needs could significantly boost revenues as MACOM capitalizes on secular growth trends in cloud service providers' capital spending.

- MACOM's investment in GaN on silicon carbide solutions for telecom 5G applications is creating growth opportunities, especially in medium and high-power amplifiers. These technological advancements may yield increased market share and higher revenue as the 5G market expands.

- MACOM's development of new products for emerging markets such as LEO satellite communications, and its focus on photonics and linear systems solutions, are expected to drive revenue growth. The company's integration into defense and commercial satellite markets through unique technology offerings positions it for future earnings expansion.

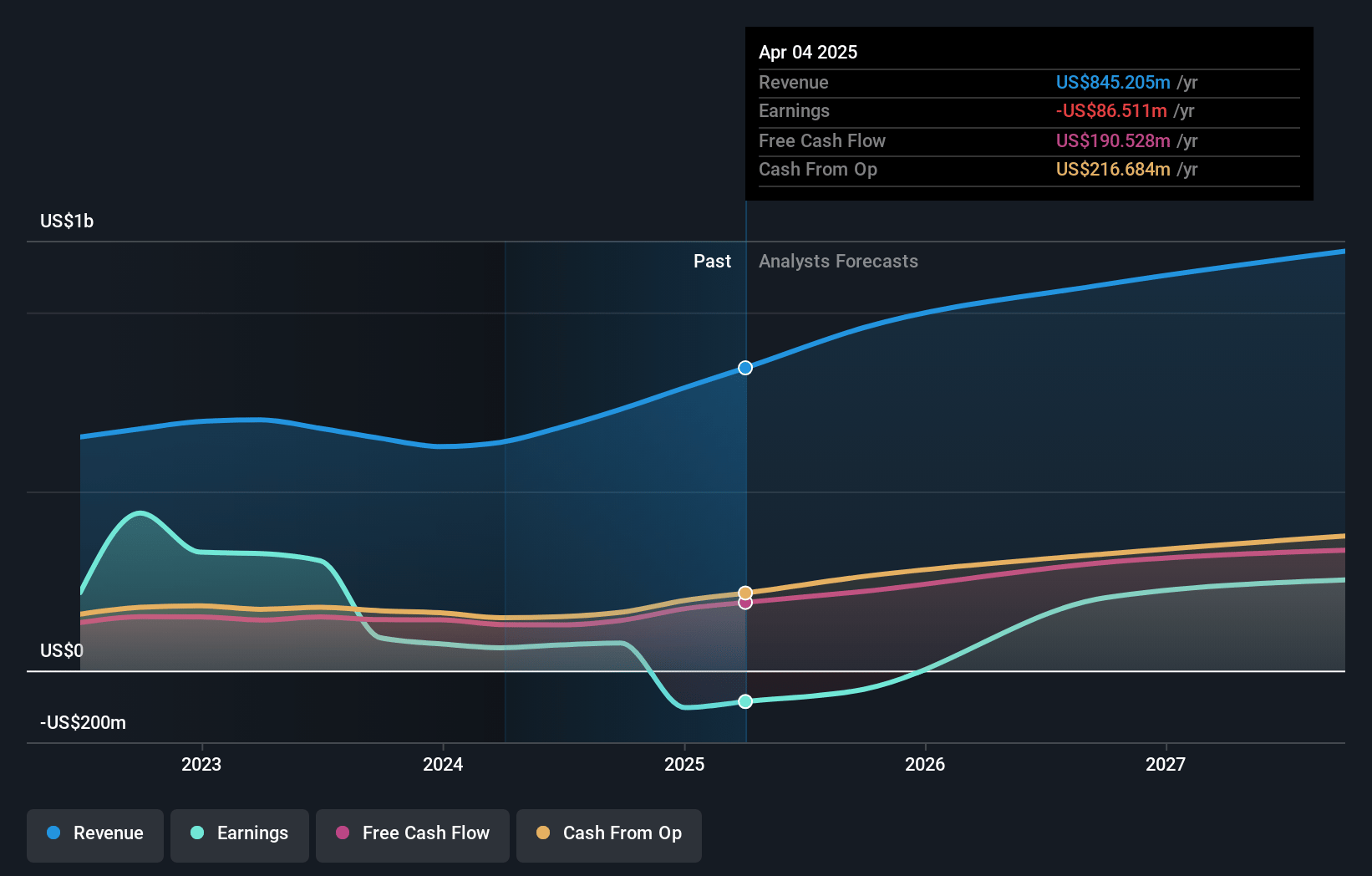

MACOM Technology Solutions Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MACOM Technology Solutions Holdings's revenue will grow by 14.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -13.1% today to 33.2% in 3 years time.

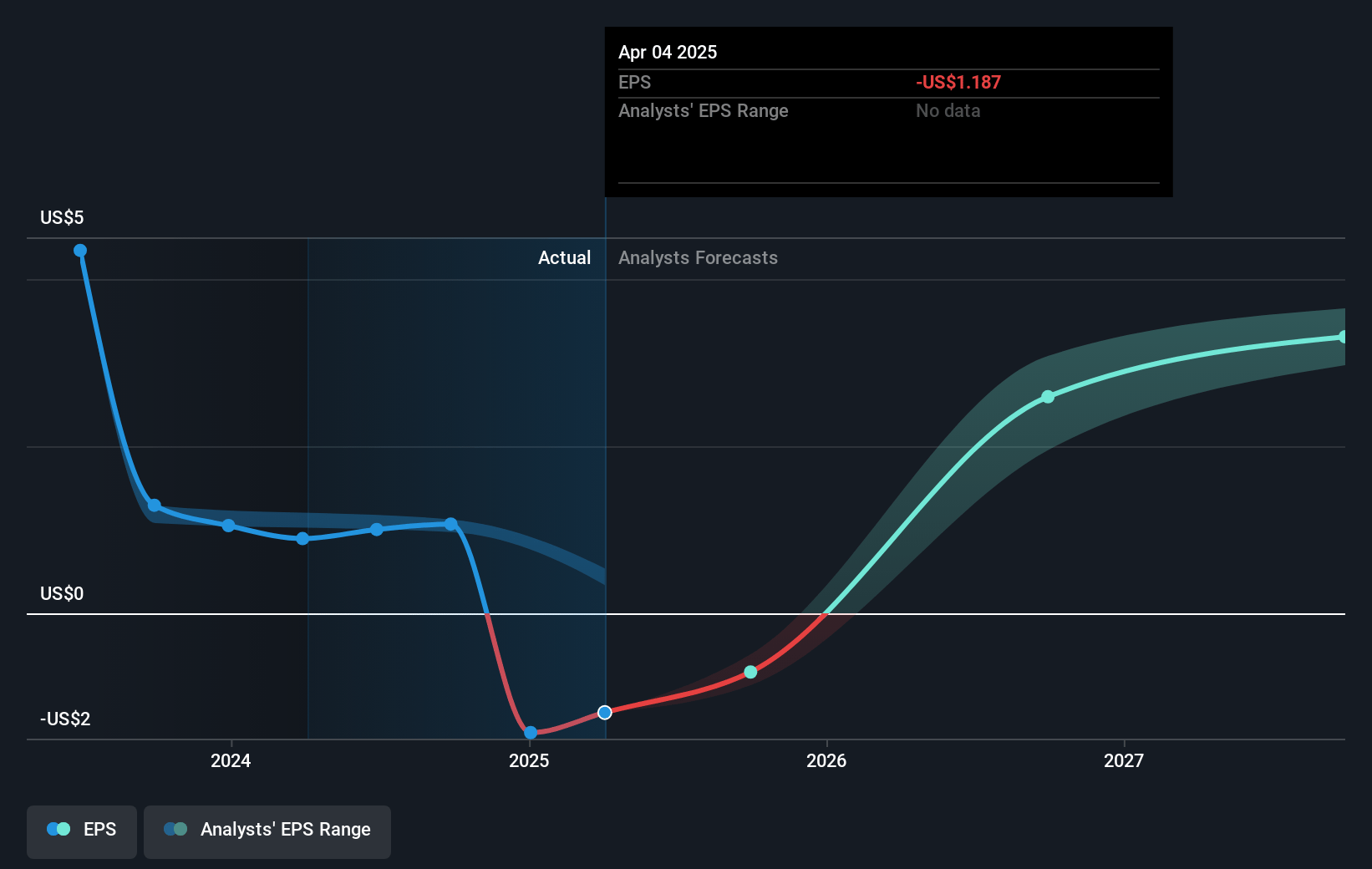

- Analysts expect earnings to reach $397.0 million (and earnings per share of $2.37) by about May 2028, up from $-103.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.3x on those 2028 earnings, up from -79.7x today. This future PE is greater than the current PE for the US Semiconductor industry at 22.5x.

- Analysts expect the number of shares outstanding to grow by 3.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.32%, as per the Simply Wall St company report.

MACOM Technology Solutions Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing softness in certain telecom and industrial markets has led to underutilized wafer volumes in their Lowell fab, affecting gross margins. [Impact: Gross Margins, Earnings]

- An increase in adjusted operating expenses driven by higher R&D costs and annual merit increases may pressure net margins if revenue growth does not keep pace. [Impact: Net Margins, Earnings]

- The CHIPS Act initiatives are at a preliminary stage with undisclosed terms in a nonbinding memorandum, which creates uncertainty in realizing future benefits. [Impact: Future Revenue, Financial Performance]

- Although their backlog is at record levels, pockets of weakness remain across their customer base, specifically in orders for certain wireless platforms and cable infrastructure, potentially affecting future revenue growth. [Impact: Revenue, Earnings]

- The long-term timing and success of new product lines and market expansion, particularly in emerging technology areas such as LEO satellites and higher-speed data center applications, remain uncertain and could face execution risks. [Impact: Revenue, Market Share]

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $136.117 for MACOM Technology Solutions Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $160.0, and the most bearish reporting a price target of just $114.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $397.0 million, and it would be trading on a PE ratio of 36.3x, assuming you use a discount rate of 9.3%.

- Given the current share price of $110.69, the analyst price target of $136.12 is 18.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.