Narratives are currently in beta

Key Takeaways

- Strategic investments in innovation across high-growth sectors position Microchip Technology for future revenue growth in clean energy, automotive, aerospace, and data centers.

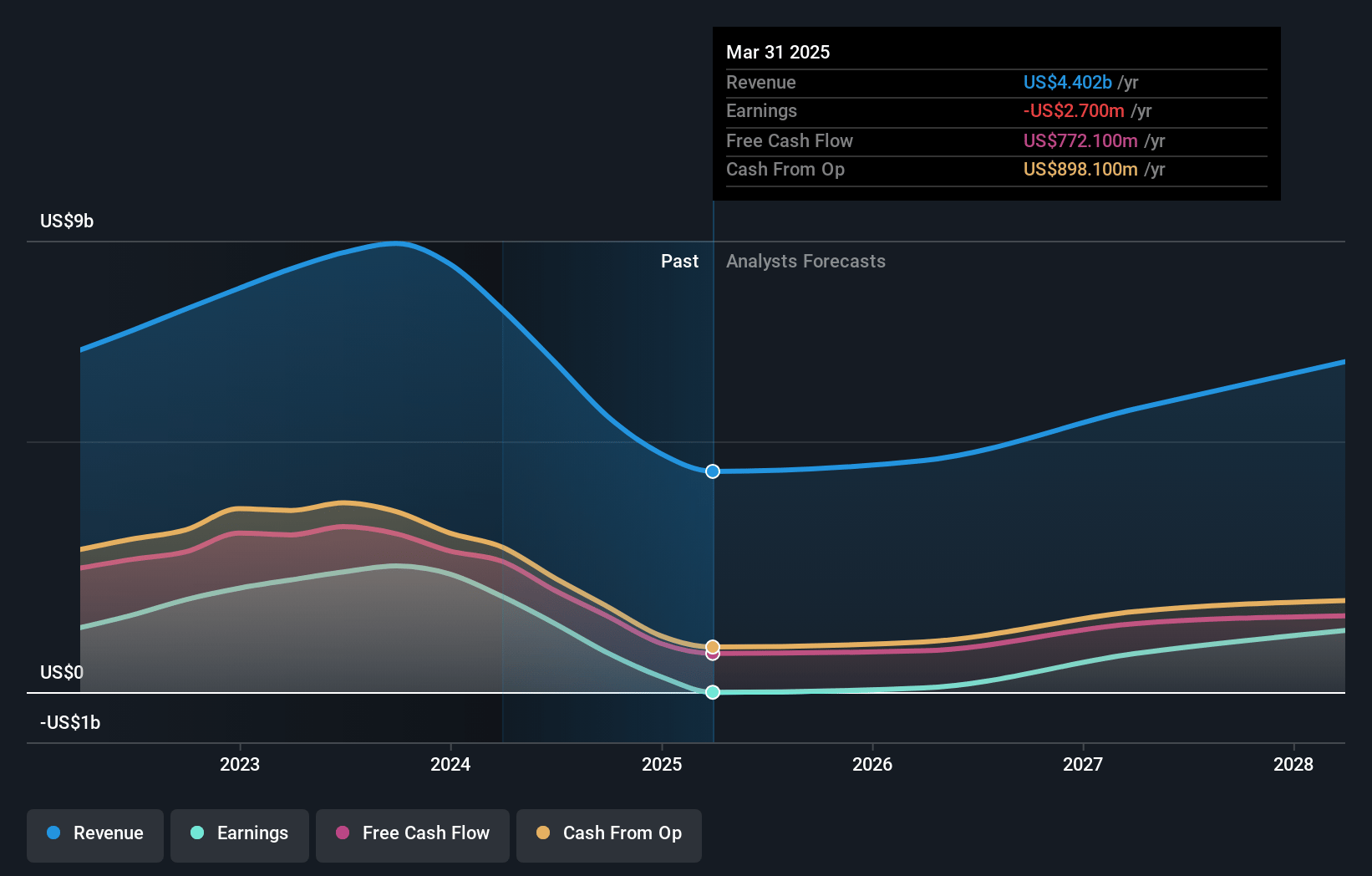

- Leveraging excess inventory and underutilized capacity for the up cycle aims to improve free cash flow and enhance net margins.

- Prolonged macroeconomic challenges and high inventory levels could impact revenue recovery, gross margins, and long-term growth amidst low customer demand visibility.

Catalysts

About Microchip Technology- Engages in the development, manufacture, and sale of smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia.

- Microchip Technology is strategically investing in and launching innovative technologies across high-growth sectors, such as electric vehicle charger designs, enhanced MPU offerings, high-performance space computers, PCIe switches, and AI accelerator solutions, positioning them well for future revenue growth in clean energy, automotive, aerospace, defense, and data centers.

- The company is experiencing an increase in design-in activity following a period during which customers focused on mitigating shortages, setting the stage for future revenue growth driven by innovation and new product launches.

- A potential 200 basis points favorable adjustment to Microchip's non-GAAP tax rate could occur if new tax rules allowing companies to capitalize R&D expenses are repealed or postponed, positively impacting future net margins and earnings.

- Microchip plans to leverage excess inventory and underutilized capacity for the expected up cycle, which will reduce the need for capital expenditures and improve free cash flow, contributing to better net margins going forward.

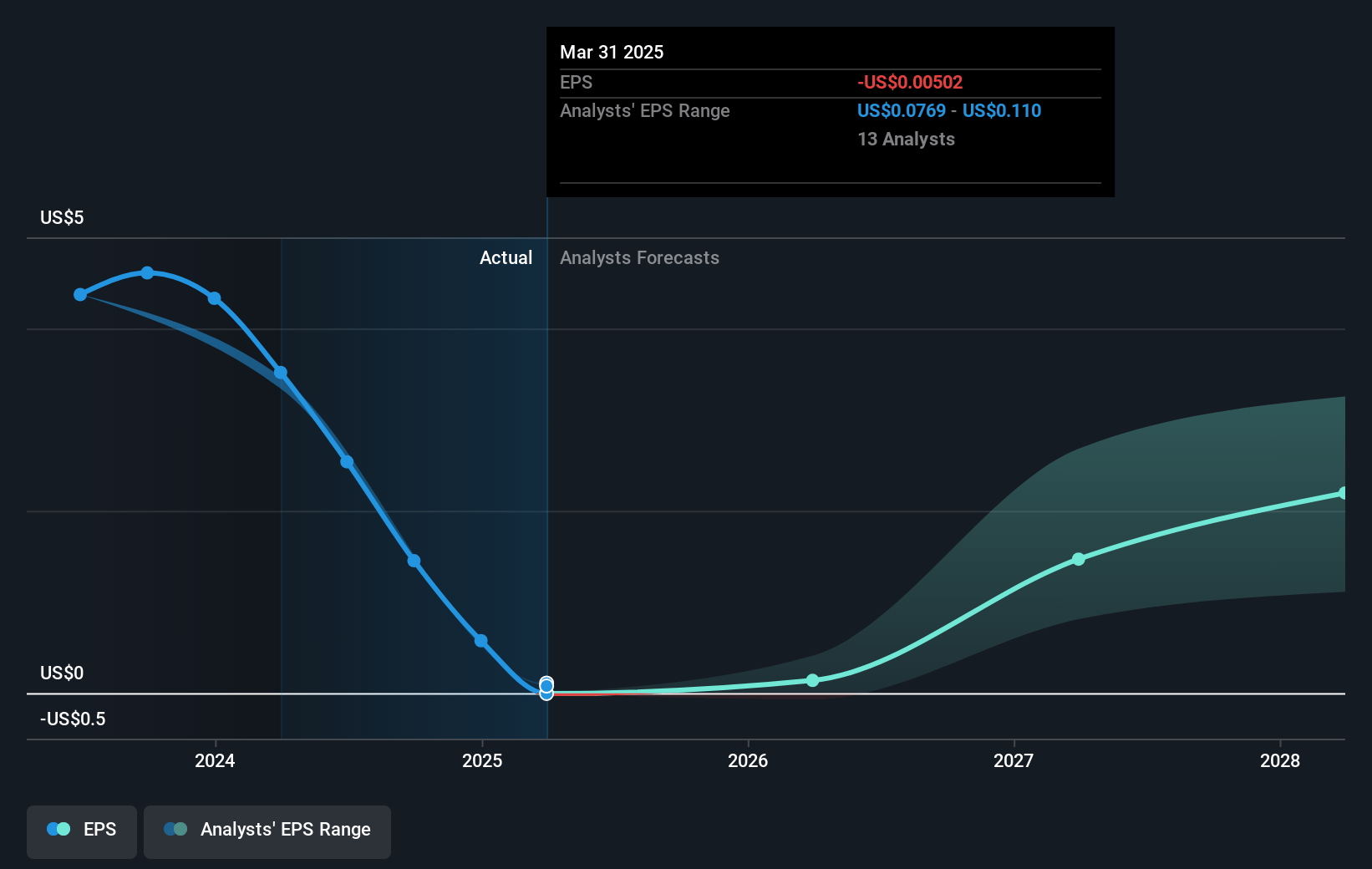

- The company remains committed to returning 100% of adjusted free cash flow to shareholders through dividends and share buybacks, which is expected to continue driving EPS growth over time.

Microchip Technology Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Microchip Technology's revenue will grow by 10.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.2% today to 25.6% in 3 years time.

- Analysts expect earnings to reach $1.9 billion (and earnings per share of $3.61) by about November 2027, up from $781.6 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $2.4 billion in earnings, and the most bearish expecting $978 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.3x on those 2027 earnings, down from 45.8x today. This future PE is about the same as the current PE for the US Semiconductor industry at 30.3x.

- Analysts expect the number of shares outstanding to decline by 0.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.62%, as per the Simply Wall St company report.

Microchip Technology Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing macroeconomic uncertainty, high interest rates, and weak customer confidence are causing low visibility and reduced new orders, which could impact future revenue recovery.

- High levels of inventory destocking across regions and end markets, particularly in Europe, and the industrial and automotive sectors, could prolong the pressure on revenue and affect working capital.

- Capacity underutilization charges and high inventory reserves are negatively impacting gross margins, which may continue if customer confidence does not improve and orders remain weak, affecting earnings.

- The substantial decrease in cash flow from operating activities due to timing of interest and tax payments, along with increased debt levels, could pressure net margins and financial flexibility.

- The prolonged and challenging down cycle with reduced visibility in customer demand and market recovery could affect the long-term growth trajectory and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $85.35 for Microchip Technology based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $98.0, and the most bearish reporting a price target of just $70.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $7.4 billion, earnings will come to $1.9 billion, and it would be trading on a PE ratio of 30.3x, assuming you use a discount rate of 8.6%.

- Given the current share price of $66.59, the analyst's price target of $85.35 is 22.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives