Narratives are currently in beta

Key Takeaways

- Anticipated demand for AI chips and increased process control intensity will boost KLA's future revenue and margin growth.

- Sustainable revenue growth supported by the Service business's high-margin nature and consecutive growth record.

- Trade restrictions, market competition, and spending pattern shifts could significantly hinder KLA's revenue and earnings growth, especially in China and emerging markets.

Catalysts

About KLA- Engages in the design, manufacture, and marketing of process control, process-enabling, and yield management solutions for the semiconductor and related electronics industries worldwide.

- KLA is expecting long-term growth in the Foundry & Logic sectors due to the scaling and incorporation of new technologies, leading to increased capital intensity, which is set to boost future revenue.

- Investments in AI technology and high-bandwidth memory are positioned to drive growth in the semiconductor wafer fab equipment industry in 2025, positively impacting KLA's revenue and earnings.

- The advanced packaging portfolio is expected to generate over $500 million in revenue in 2024, with continued growth in 2025, supporting revenue expansion.

- Anticipated growth in demand for AI chips and the associated increase in process control intensity provides a significant catalyst for KLA's future revenue and margin growth as the company is a key contributor to this space.

- KLA's consistent growth in its Service business, marked by a 49th consecutive quarter of year-over-year growth, supports sustainable revenue growth and contributes positively to net margins with its high margin nature.

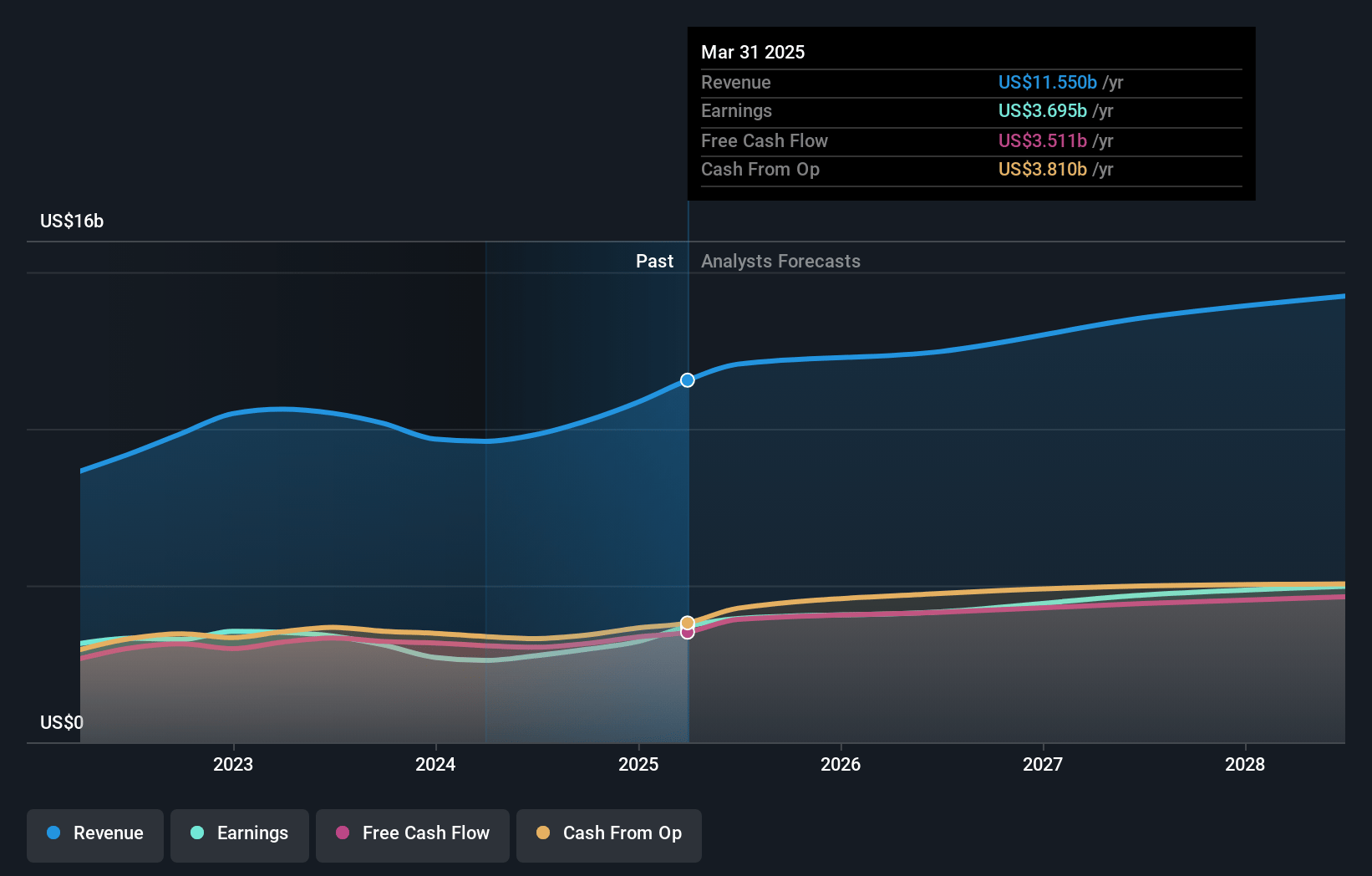

KLA Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming KLA's revenue will grow by 10.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 28.9% today to 35.9% in 3 years time.

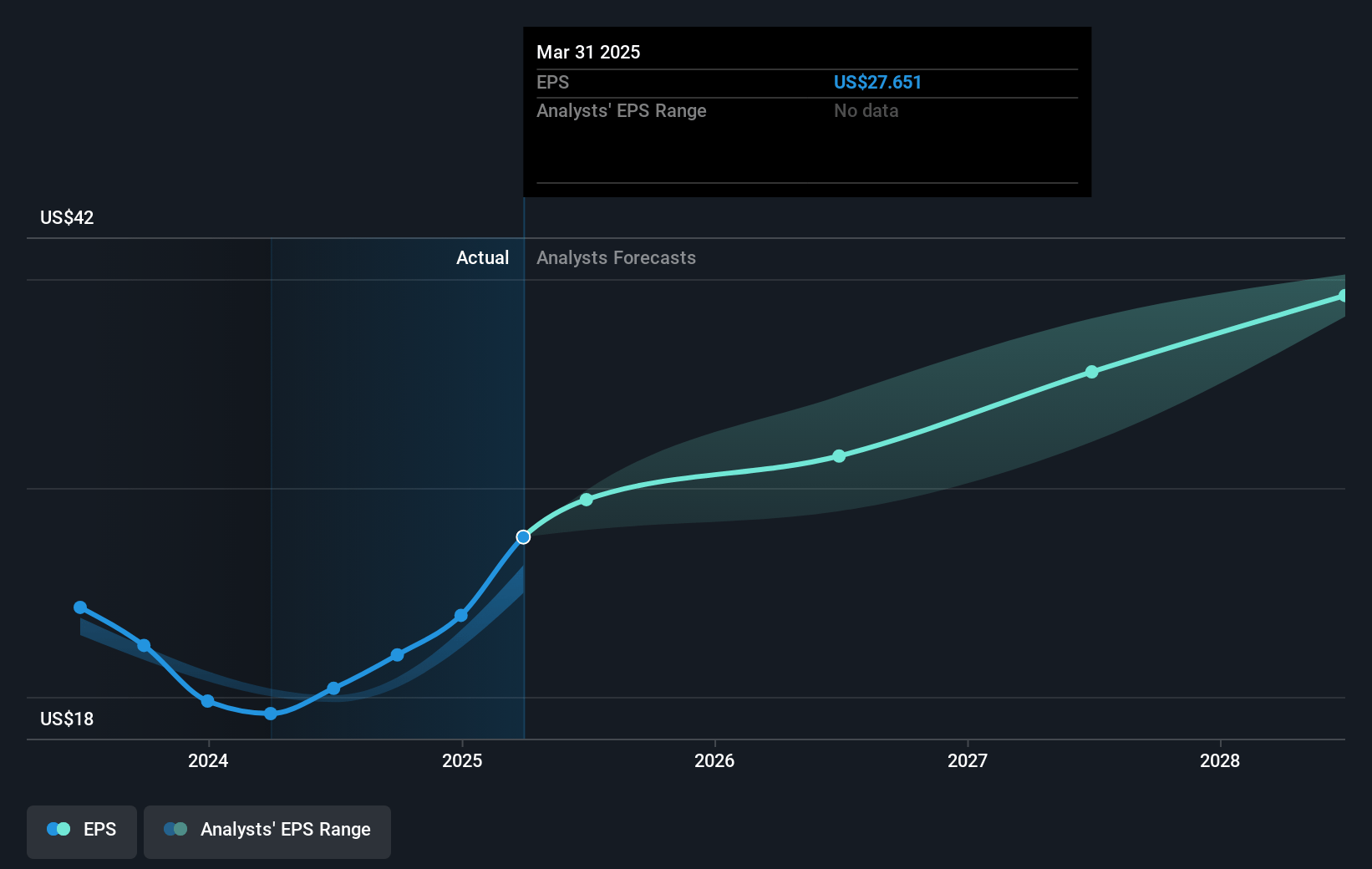

- Analysts expect earnings to reach $5.0 billion (and earnings per share of $37.72) by about November 2027, up from $3.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.2x on those 2027 earnings, down from 29.1x today. This future PE is lower than the current PE for the US Semiconductor industry at 30.3x.

- Analysts expect the number of shares outstanding to decline by 0.58% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.29%, as per the Simply Wall St company report.

KLA Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Potential trade restrictions or export controls affecting China could reduce KLA's sales, as a significant portion of revenue (historically around 30-42%) comes from China. This would directly impact KLA's revenue from this region.

- Changes in customer spending patterns, particularly declines in DRAM or NAND investments, could lower demand for KLA's equipment. This would negatively affect revenue and earnings growth if these segments do not see expected improvements.

- Increased competition or decreased demand in newer markets, such as advanced packaging, could challenge KLA's growth plans, impacting future revenue projections and potentially affecting net margins if costs do not adjust accordingly.

- Currency fluctuations or geopolitical uncertainties could influence the cost structure and price competitiveness of KLA's products, affecting gross margins and net income.

- Dependence on leading-edge customers for growth, like TSMC, increases exposure risk. If these customers reduce spending or face unforeseen market challenges, KLA's revenue and earnings could be adversely affected.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $809.1 for KLA based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $950.0, and the most bearish reporting a price target of just $670.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $13.8 billion, earnings will come to $5.0 billion, and it would be trading on a PE ratio of 27.2x, assuming you use a discount rate of 8.3%.

- Given the current share price of $644.55, the analyst's price target of $809.1 is 20.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives