Key Takeaways

- Strategic technology integration and government-supported projects enhance U.S. manufacturing, aiming to boost revenue and competitive positioning through diversified chip technologies.

- Long-term growth potential is reinforced by automotive electronics and communications, supported by design wins and strategic expense management to improve profitability.

- GlobalFoundries faces challenges from asset impairment, revenue decline, lower wafer prices, and inventory issues, potentially impacting future growth and profitability.

Catalysts

About GlobalFoundries- A semiconductor foundry, provides range of mainstream wafer fabrication services and technologies worldwide.

- GlobalFoundries is focusing on strategic technology transfers to its Fab 8 facility in Malta, which includes integrating essential chip technologies. This diversification is expected to strengthen their manufacturing capabilities in the U.S., impacting their revenue positively as they cater to demand for U.S.-made chips and enhance their competitive position.

- The anticipated long-term growth in automotive electronics is supported by GlobalFoundries' robust design win pipeline. With the expansion in autonomous vehicle, battery management systems, and related markets, this is set to drive incremental increases in revenue and profits.

- The development of the Advanced Packaging and Photonics Center in Malta, supported by U.S. government incentives, positions GlobalFoundries to meet growing demand in sectors like AI, automotive, and aerospace. This strategic move aims to boost their gross margins by adding high-value services and capabilities that enhance product offerings.

- The company expects to benefit from cumulative design wins in communication infrastructure and data center end markets. With projected revenue growth driven by optical components and satellite communication technologies, bottom-line earnings are likely to improve due to increased market penetration in these high-potential areas.

- As GlobalFoundries continues to strategically manage its expenses, including a 15% reduction in depreciation and amortization, this is expected to positively impact net margins. Combined with disciplined SG&A and R&D investments, the company is poised to improve its overall cost structure and profitability in the coming fiscal year.

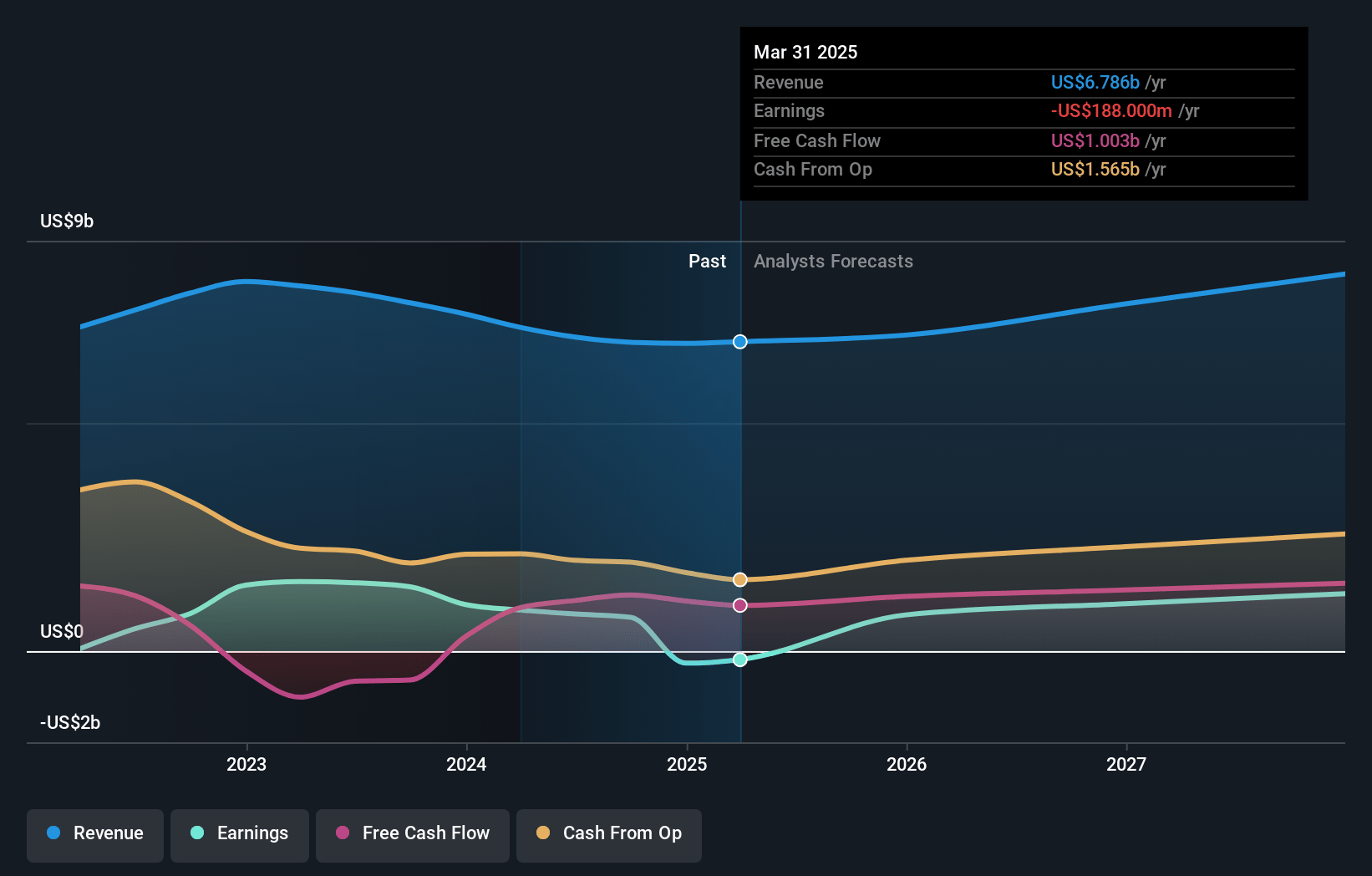

GlobalFoundries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on GlobalFoundries compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming GlobalFoundries's revenue will grow by 7.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -3.9% today to 15.3% in 3 years time.

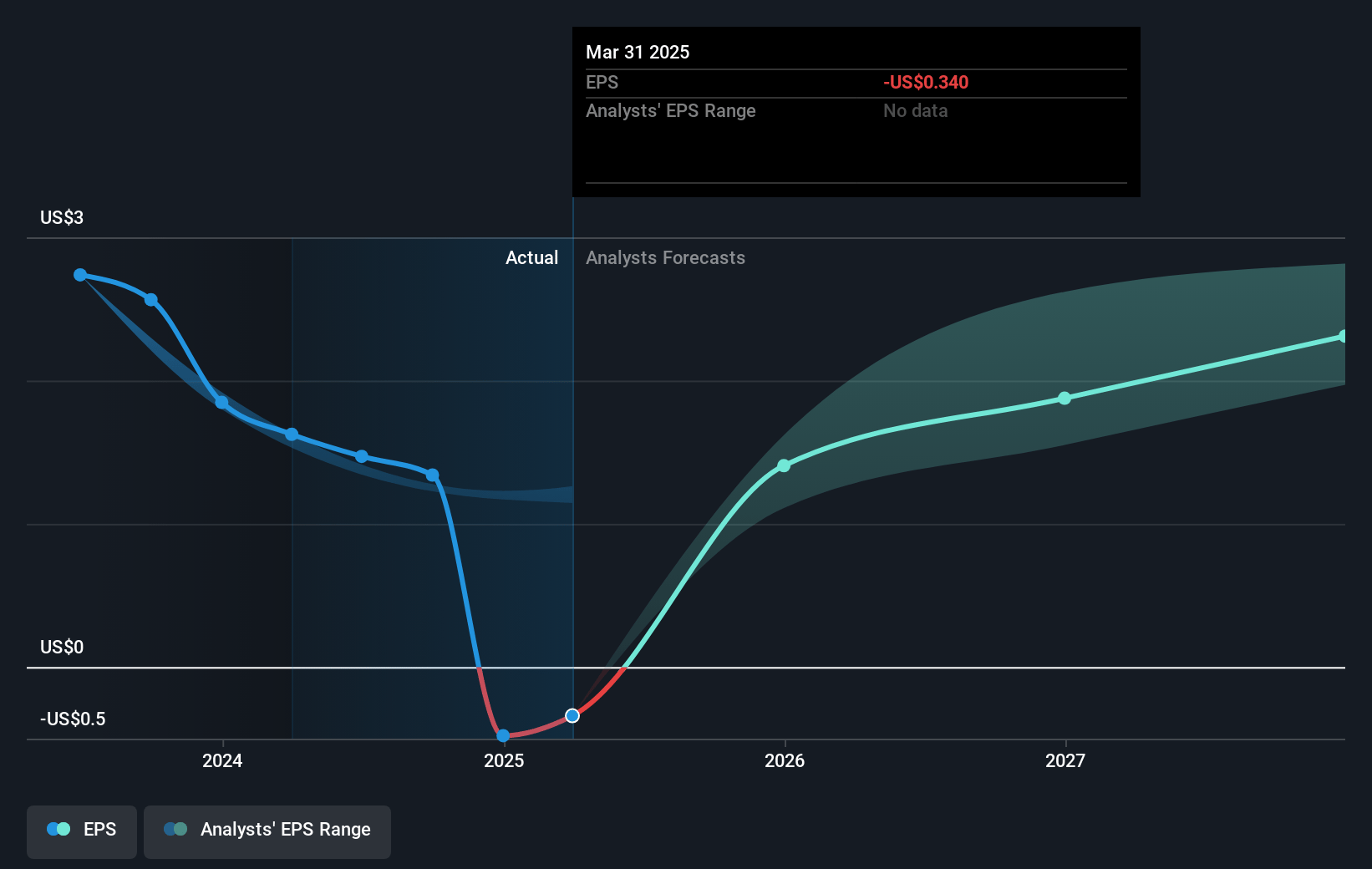

- The bearish analysts expect earnings to reach $1.3 billion (and earnings per share of $2.28) by about April 2028, up from $-265.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 21.9x on those 2028 earnings, up from -69.0x today. This future PE is lower than the current PE for the US Semiconductor industry at 22.3x.

- Analysts expect the number of shares outstanding to decline by 0.46% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.28%, as per the Simply Wall St company report.

GlobalFoundries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- GlobalFoundries faced a one-time $935 million impairment charge on long-lived assets related to legacy investments in their Malta facility, which could indicate past financial missteps that might affect future net margins.

- Revenue for 2024 was down 9% year-over-year, driven by a prolonged industry downturn and weak economic conditions, which risks continued pressure on revenue growth.

- Average selling price per wafer decreased approximately 5% year-over-year, largely influenced by product mix and reduced underutilization payments, potentially impacting gross margins and overall profitability.

- In the smart mobile devices market, although revenue grew slightly year-over-year, the market environment was characterized by elevated inventory levels and soft consumer demand, which could impede future revenue growth.

- The IoT segment saw a revenue decline of 13% year-over-year for the fourth quarter, attributed to customers managing down inventory levels, posing a risk to immediate revenue recovery.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for GlobalFoundries is $39.27, which represents one standard deviation below the consensus price target of $45.76. This valuation is based on what can be assumed as the expectations of GlobalFoundries's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $65.0, and the most bearish reporting a price target of just $35.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $8.3 billion, earnings will come to $1.3 billion, and it would be trading on a PE ratio of 21.9x, assuming you use a discount rate of 9.3%.

- Given the current share price of $33.08, the bearish analyst price target of $39.27 is 15.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystLowTarget holds no position in NasdaqGS:GFS. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.