Narratives are currently in beta

Key Takeaways

- Strategic product diversification and investment in innovative technologies position GlobalFoundries for growth in automotive, IoT, and communications sectors.

- Strong design win pipeline and cash flow generation set GlobalFoundries up for revenue growth, market share gains, and enhanced shareholder value.

- Reliance on customer volume adjustments and the smart mobile market could risk GlobalFoundries' revenue and margins amid declining automotive and factory utilization challenges.

Catalysts

About GlobalFoundries- A semiconductor foundry, provides range of mainstream wafer fabrication services and technologies worldwide.

- The company's focus on diversifying and differentiating its product portfolio, including new design wins with major industry players like NXP on the 22FDX platform, is expected to drive revenue growth, particularly in high-growth sectors such as automotive, IoT, and smart mobile devices.

- GlobalFoundries' strategic investments in innovative technologies such as silicon photonics and RF solutions position it well to capture future growth in data centers and communications infrastructure, potentially increasing revenue and margins.

- Continued expansion of GlobalFoundries' essential chip technology offerings across high-growth market segments will likely lead to market share gains, supporting long-term revenue growth and improving net margins.

- The company's strong pipeline of design wins, with 90% being sole source, demonstrates its competitive advantage and suggests potential for future revenue growth as these designs are commercialized.

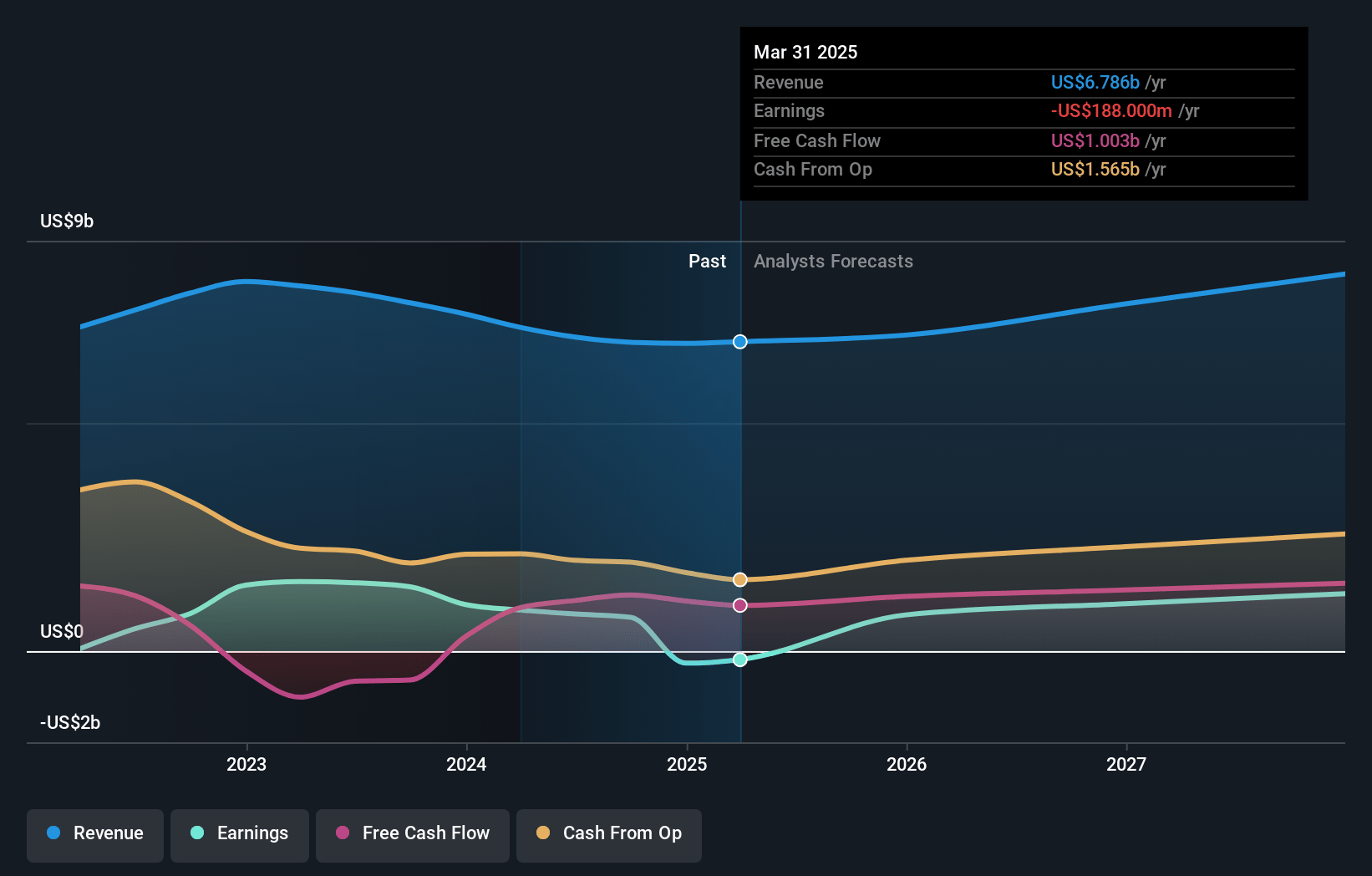

- With a substantial free cash flow generation target approaching $1 billion for the full year 2024, GlobalFoundries is positioned to strengthen its balance sheet, enhance shareholder value, and reinvest in growth opportunities, potentially boosting future earnings per share (EPS).

GlobalFoundries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming GlobalFoundries's revenue will grow by 9.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.0% today to 15.4% in 3 years time.

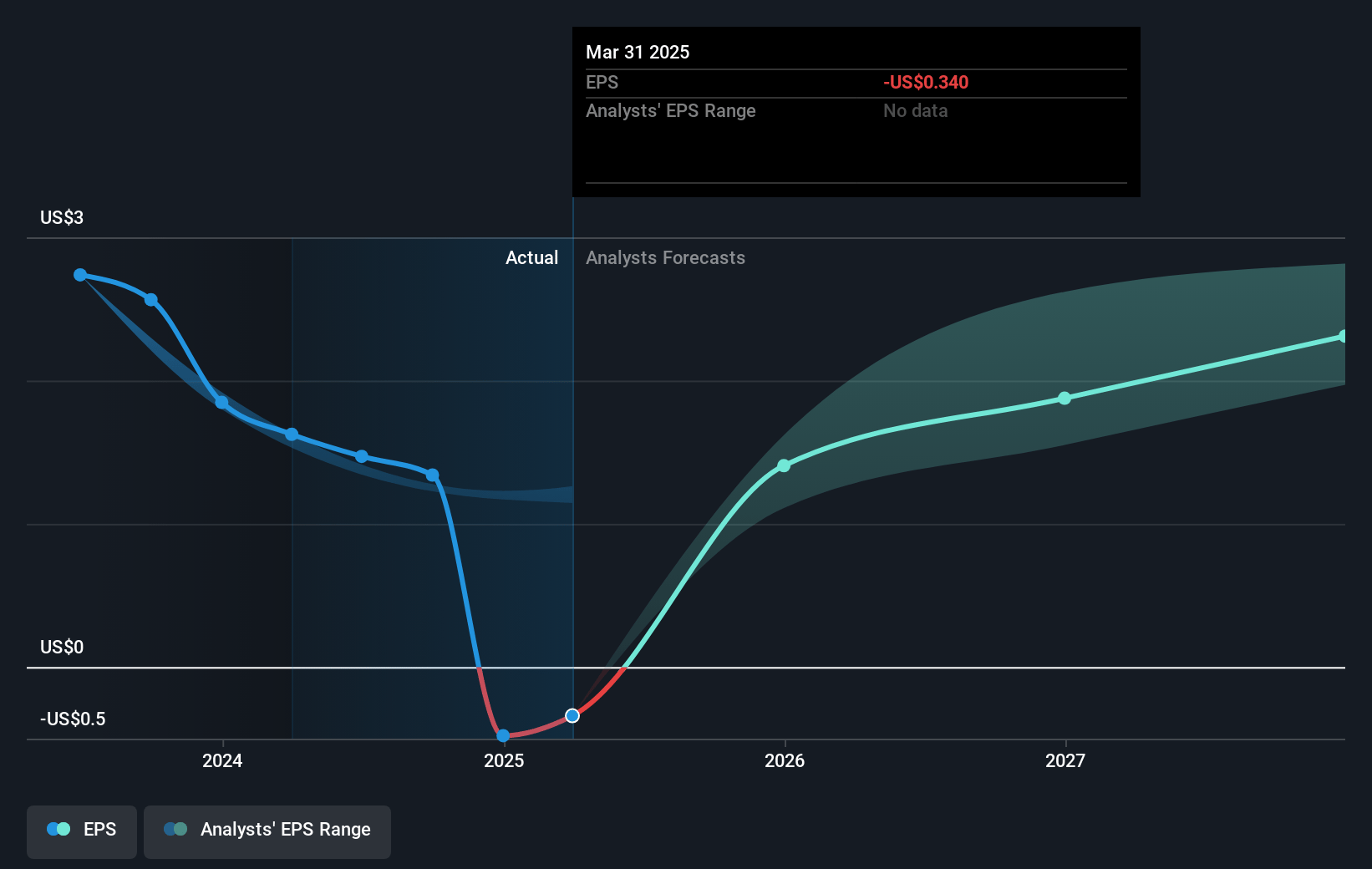

- Analysts expect earnings to reach $1.4 billion (and earnings per share of $2.43) by about November 2027, up from $742.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.8 billion in earnings, and the most bearish expecting $911 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.5x on those 2027 earnings, down from 31.6x today. This future PE is lower than the current PE for the US Semiconductor industry at 30.3x.

- Analysts expect the number of shares outstanding to grow by 0.57% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.44%, as per the Simply Wall St company report.

GlobalFoundries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- There is a reliance on customer volume adjustments for revenue, which could become less favorable over time and impact gross margins as customer agreements expire or are renegotiated. This reliance introduces risk to consistent earnings and profitability growth.

- With a significant portion of revenue dependent on smart mobile devices, fluctuations in the smartphone market, including potential demand declines, could negatively impact GlobalFoundries' revenue and earnings.

- The automotive segment, a key revenue driver, has experienced sequential and year-over-year revenue declines due to inventory management issues. Continued softness in automotive demand could impact overall revenue growth targets.

- The decrease in utilization levels across factories highlights a risk to achieving optimal production efficiency, potentially affecting gross margins if industry conditions do not improve as expected.

- The non-wafer revenue, including reticle and expedite fees, forms a sizeable portion of overall revenue (approximately 10%), which could introduce volatility and affect net margins if these sources dry up or do not grow as anticipated.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $48.64 for GlobalFoundries based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $65.0, and the most bearish reporting a price target of just $40.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $8.9 billion, earnings will come to $1.4 billion, and it would be trading on a PE ratio of 25.5x, assuming you use a discount rate of 8.4%.

- Given the current share price of $42.41, the analyst's price target of $48.64 is 12.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives