Key Takeaways

- New products in smartphones and expansion into the PC and automotive markets signal potential for diversified revenue growth.

- Stock repurchases are poised to boost earnings per share, bolstered by strong cash reserves.

- Heavy reliance on smartphones and one main customer risks revenue volatility, while new market ventures and growing costs challenge diversification and earnings stability.

Catalysts

About Cirrus Logic- A fabless semiconductor company, develops low-power high-precision mixed-signal processing solutions in China, the United States, and internationally.

- Cirrus Logic's new generation custom boosted amplifier and 22-nanometer smart codec, now shipping in smartphones, are expected to be used across multiple phone generations, indicating sustained future revenue growth.

- Expansion into high-performance mixed-signal content in smartphones—specifically their camera controller products—shows potential for increased revenue diversification and growth as their value and demand rise.

- Initiatives in the PC market, including the launch of their audio solutions in the Intel Arrow Lake reference design and new PC amplifiers and codecs, signal potential for significant new revenue streams.

- Strong interest in automotive and professional audio markets for Cirrus Logic’s timing products and audio solutions reflects potential new revenue opportunities outside traditional smartphone markets.

- Planned stock repurchases are likely to provide long-term benefits to earnings per share (EPS), supported by their strong cash position and continued cash generation.

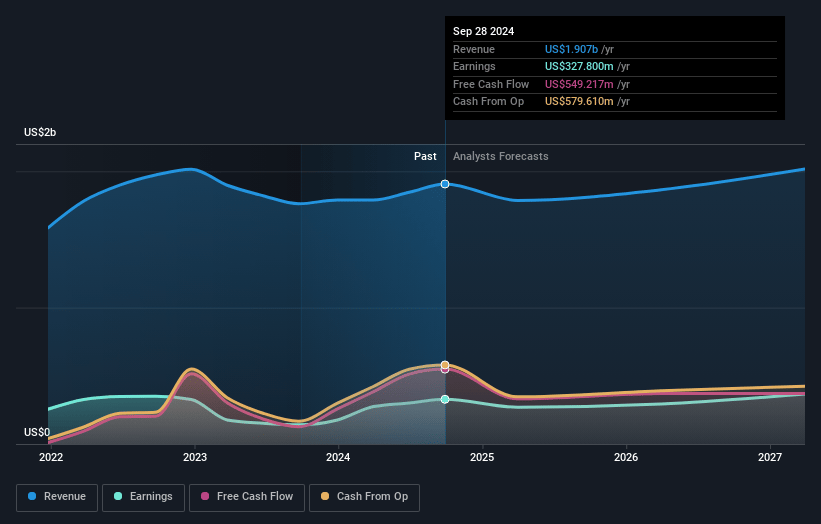

Cirrus Logic Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Cirrus Logic's revenue will grow by 3.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.5% today to 17.3% in 3 years time.

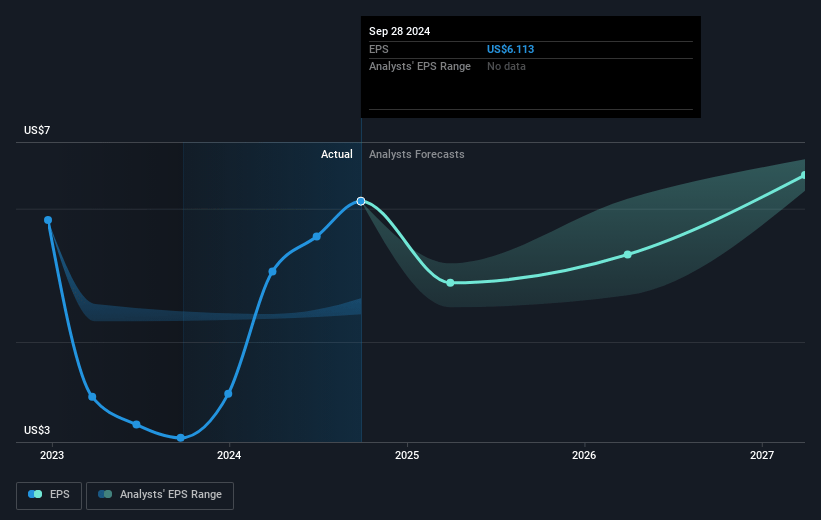

- Analysts expect earnings to reach $356.2 million (and earnings per share of $6.45) by about March 2028, up from $305.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $394.2 million in earnings, and the most bearish expecting $309.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.0x on those 2028 earnings, up from 17.6x today. This future PE is lower than the current PE for the US Semiconductor industry at 29.4x.

- Analysts expect the number of shares outstanding to decline by 0.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.57%, as per the Simply Wall St company report.

Cirrus Logic Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Cirrus Logic's revenue was down 10% year-over-year, partly due to lower smartphone volumes, which if continued, may pose a risk to their future revenue growth.

- The company's future performance in the PC market, where they see potential for growth, is still at early stages of revenue contribution and may take time to become a significant revenue stream, posing a risk to diversify and stabilize earnings.

- The timing product line for automotive applications is a long-term project, meaning significant contributions to revenue and earnings might not be realized for several years, delaying expected benefits.

- The high dependence on the smartphone market, particularly with one major customer, introduces risk of revenue volatility if competition increases or if there are shifts in customer demand.

- Increased R&D and operating expenses, driven by investments in new technologies and employee-related costs, if not matched by revenue growth, may pressure net margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $130.833 for Cirrus Logic based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $140.0, and the most bearish reporting a price target of just $115.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.1 billion, earnings will come to $356.2 million, and it would be trading on a PE ratio of 24.0x, assuming you use a discount rate of 8.6%.

- Given the current share price of $100.86, the analyst price target of $130.83 is 22.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.