Key Takeaways

- Continued investments in AI technology and next-generation accelerators aim to enhance technological leadership and drive future revenue and margins.

- Expanding AI customer base and transitioning to subscription models could boost recurring revenue and improve revenue stability and margins.

- Reliance on a few hyperscale customers and geopolitical risks pose significant threats to Broadcom's AI revenue, while increased R&D spending strains margins.

Catalysts

About Broadcom- Designs, develops, and supplies various semiconductor devices with a focus on complex digital and mixed signal complementary metal oxide semiconductor based devices and analog III-V based products worldwide.

- Broadcom is investing heavily in R&D to push the envelope in AI technology, including creating next-generation accelerators like the industry's first 2-nanometer AI XPU packaging, which could significantly drive future revenue and margins through technological leadership and innovation.

- The company's strategy to enable AI data centers with large-scale clusters for hyperscale customers positions it to capture a substantial serviceable addressable market (SAM) of $60 billion to $90 billion by fiscal 2027, potentially boosting revenue and net margins as these opportunities mature.

- Broadcom is expanding its customer base in the AI space, with engagements with four additional hyperscalers beyond its current three customers. These new partnerships are not yet included in the projected SAM, indicating potential further revenue growth and increased earnings.

- The shift in Broadcom's Infrastructure Software revenue mix from perpetual licenses to full subscription models, coupled with the upselling of customers to full stack VCF, enhances recurring revenue potential, which could positively affect revenue stability and margin expansion.

- Broadcom's focus on integrating VMware's Private AI Foundation as more enterprises adopt AI workloads for their on-prem data centers can drive significant incremental revenue growth in its Infrastructure Software segment, improving earnings and margins.

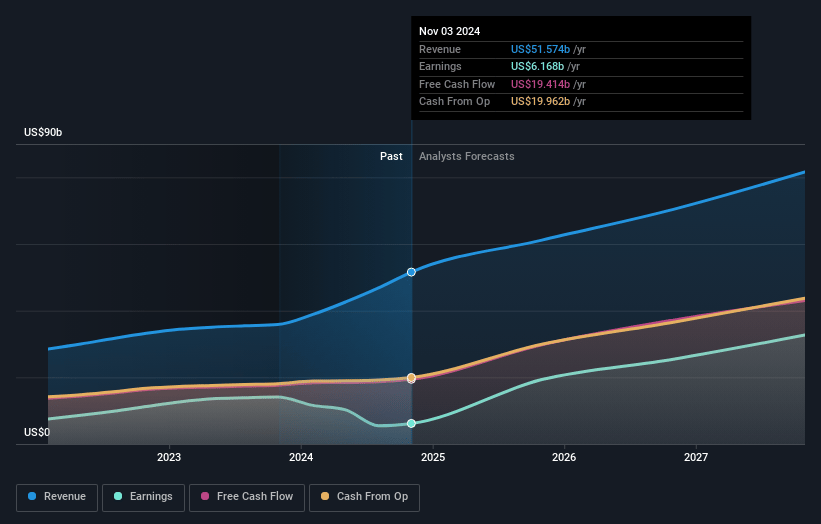

Broadcom Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Broadcom's revenue will grow by 18.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 19.1% today to 41.7% in 3 years time.

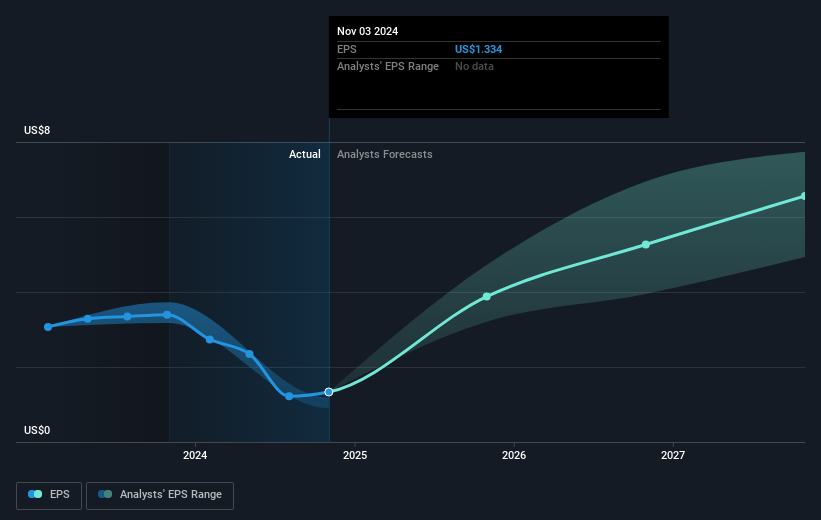

- Analysts expect earnings to reach $37.4 billion (and earnings per share of $7.67) by about April 2028, up from $10.4 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $29.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 41.7x on those 2028 earnings, down from 76.2x today. This future PE is greater than the current PE for the US Semiconductor industry at 24.6x.

- Analysts expect the number of shares outstanding to grow by 1.01% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.76%, as per the Simply Wall St company report.

Broadcom Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The slowdown in non-AI semiconductor revenue, with the Q1 report showing a 9% sequential decrease due to a seasonal decline in wireless and other sectors, suggests potential stagnation in parts of Broadcom's business, impacting revenue and earnings growth outside of AI.

- Increasing R&D investments, such as the development of 2-nanometer AI XPUs and doubling the radix capacity for Tomahawk switches, could strain operating expenses and might not yield immediate revenue, impacting net margins and short-term financial results.

- Dependence on a small number of hyperscale customers for AI-related revenue creates a significant risk. Any adverse changes in these relationships or their technology roadmaps could significantly impact Broadcom's projected AI revenue growth, affecting overall revenue and profitability.

- Concerns over geopolitical issues, including potential tariff threats and disruptions in international trade relations, could impact revenue streams and profit margins, particularly if they affect Broadcom’s operations or customer demand.

- The potential restructuring of technology strategies by large enterprises concerning on-prem versus public cloud data handling (spurred by AI and data sovereignty issues) may lead to unexpected shifts in customer spending patterns, impacting expected revenue from AI and software products.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $250.421 for Broadcom based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $300.0, and the most bearish reporting a price target of just $200.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $89.8 billion, earnings will come to $37.4 billion, and it would be trading on a PE ratio of 41.7x, assuming you use a discount rate of 8.8%.

- Given the current share price of $168.52, the analyst price target of $250.42 is 32.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.