Advanced Micro Devices, Inc. (AMD) continues to thrive in the semiconductor industry, leveraging strategic expansions and innovations against surging demand driven by AI and data center growth. With AMD reporting third-quarter 2024 results, investors and analysts pay close attention to revenue breakdowns, profitability, and market positioning relative to strengths and potential headwinds.

Strong revenue growth in Data Center and Client segments

AMD's Data Center segment in Q3 2024 furthered the current growth well, buoyed by the rapid adoption of AI applications and high-performance computing. Revenue in the Data Center business reached $3.5 billion, up 122% from $1.6 billion in Q3 2023. That only illustrates the phenomenal growth related to AMD's footprint in data centers and strong positioning within AI infrastructure. Operating income for the segment increased 240% year-over-year, growing from $306 million to $1.041 billion. These most certainly underpin the profitability achieved with the segment growth.

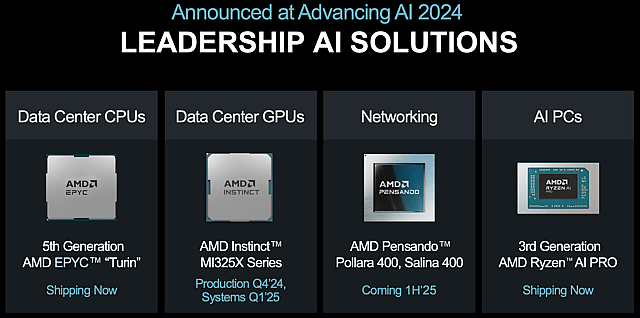

Success in the Data Center segment was driven by the substantial ramp-up of AMD Instinct GPU shipments, and growth realized through AMD EPYC CPU sales. The EPYC 9005 Series, based on the “Turin” architecture, delivered record-breaking performance and energy efficiency, making it a popular choice among enterprise customers. AMD’s MI325X accelerators also introduced enhanced memory capabilities, providing the necessary performance for the most demanding AI workloads. Key cloud providers like Microsoft and Oracle Cloud expanded their MI300X public cloud instances, solidifying AMD’s position as a leader in AI and cloud solutions.

Source: AMD Q3 Presentation

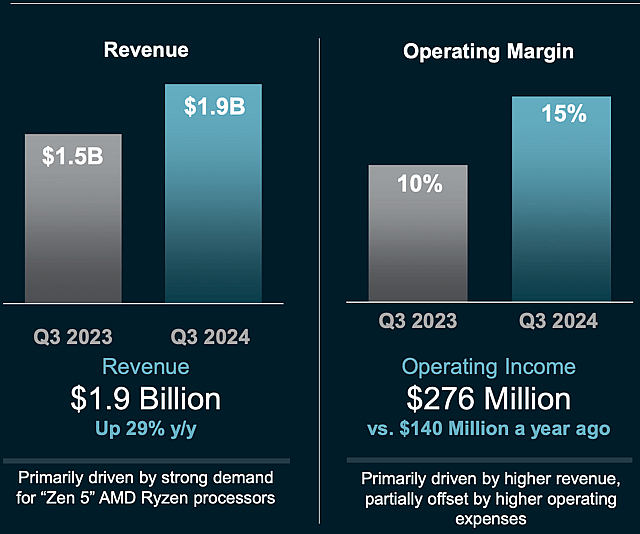

AMD generated $1.9 billion in revenue in the Client segment, a 29% year-over-year increase from $1.5 billion in Q3 2023. This growth was primarily fueled by solid demand for AMD’s Ryzen 9000 series processors built on the “Zen 5” architecture. Operating income within the Client segment nearly doubled, reaching $276 million compared to $140 million a year earlier.

AMD’s Client segment strategy, which includes launching processors with advanced AI capabilities like the Ryzen AI PRO 300 Series, has resonated well with consumers and enterprises. Key OEMs such as Acer, HP, Lenovo, and Asus have integrated these processors into their new consumer and commercial notebooks, strengthening AMD’s foothold in these markets.

Source: AMD Q3 Presentation

Expanding Market Share with Strategic Product Adoption

AMD’s Data Center segment has seen significant traction with major cloud providers, expanding AMD’s market share in AI and enterprise workloads. The company’s EPYC CPUs have seen a notable increase in adoption, particularly in public cloud deployments, where instances using AMD’s processors rose by 20% year-over-year.

Key partners such as Meta, which deployed over 1.5 million EPYC CPUs, demonstrate AMD’s strength in supporting large-scale data center needs. AMD’s fifth-generation EPYC CPUs have achieved over 130 performance records in areas critical to cloud and AI applications, such as virtualization and memory capacity, making them an attractive choice for cloud providers focused on cost efficiency and high performance.

Moreover, AMD’s MI300X accelerators are capturing attention in the AI space. The MI300X series has doubled AI inferencing and training capabilities, optimized through regular updates to the ROCm software stack. This has made AMD’s accelerators highly competitive for training and deploying AI models. Microsoft and Meta have adopted these accelerators for large-scale inferencing, and several AI-specialized cloud providers have added MI300X-powered instances. The acquisition of ZT Systems, a leader in rack-scale hardware, further strengthens AMD’s capabilities to deliver tailored solutions for hyperscalers, enhancing AMD’s market appeal in the fast-growing AI infrastructure sector.

AMD's market share in AI is poised for further expansion as the global AI accelerator market is projected to grow by 60% annually and is expected to reach $500 billion by 2028. With the combined power of the EPYC CPUs, MI300X accelerators, and ZT Systems' expertise, AMD is well-positioned to capitalize on this rapidly expanding market, driving demand from leading cloud providers and enterprise customers

Future Outlook: Opportunities and Risks

Looking ahead, AMD’s opportunities in AI and data centers remain robust, with EPYC processors and MI300X accelerators positioned to capture continued market demand. The acquisition of ZT Systems and expanded partnerships with cloud giants reinforce AMD’s competitive advantage and broaden its addressable market, particularly as the AI infrastructure market grows.

Nevertheless, challenges in Gaming and Embedded persist. Increased competition, especially from NVIDIA, and a pressured Embedded market underscore potential risks to AMD’s top-line and bottom-line performance in these areas. Moreover, with high valuation levels, any failure to meet growth expectations could impact AMD’s stock performance.

Conclusion

AMD’s Q3 2024 results highlight both its strategic wins and ongoing challenges. Strong growth in data centers and AI markets solidifies AMD’s role as a critical player in high-performance computing. At the same time, the Gaming and Embedded segments continue to weigh on the company’s overall performance.

Have other thoughts on Advanced Micro Devices?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

The user yiannisz has a position in NasdaqGS:AMD. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.