Key Takeaways

- Rescheduling cannabis under federal law and state reforms could boost industry growth and rental income for NewLake Capital.

- Strong liquidity and low debt enable prudent investments and strategic share buybacks, enhancing future earnings and shareholder value.

- Legal uncertainties and tenant financial issues may hamper growth, while economic conditions and strategic caution might limit revenue and shareholder returns.

Catalysts

About NewLake Capital Partners- An internally-managed real estate investment trust that provides real estate capital to state-licensed cannabis operators through sale-leaseback transactions and third-party purchases and funding for build-to-suit projects.

- The potential DEA rescheduling from Schedule I to Schedule III for cannabis could significantly improve the industry's credit quality, which may positively impact revenue by allowing cannabis companies to access more traditional financing options.

- State-level reforms and the potential for broader federal reform, along with a supportive stance from the current administration, could catalyze growth in the cannabis industry and subsequently increase revenue for NewLake Capital Partners through increased leasing opportunities and rental income.

- The company's strong liquidity position and low debt levels provide it with the capacity to invest prudently in new acquisitions, which could enhance future revenue and earnings.

- Strategic initiatives like share buybacks at attractive prices have the potential to create shareholder value by increasing earnings per share (EPS) if executed effectively.

- The focus on high-quality tenants, disciplined underwriting, and investing in limited license states can lead to stable cash flow and potentially improve net margins and earnings as the cannabis market matures and expands.

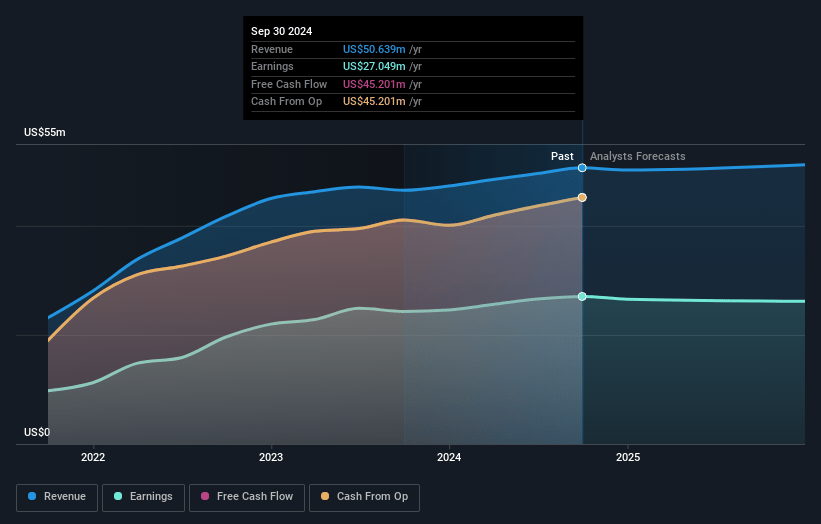

NewLake Capital Partners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NewLake Capital Partners's revenue will decrease by 0.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 52.1% today to 46.6% in 3 years time.

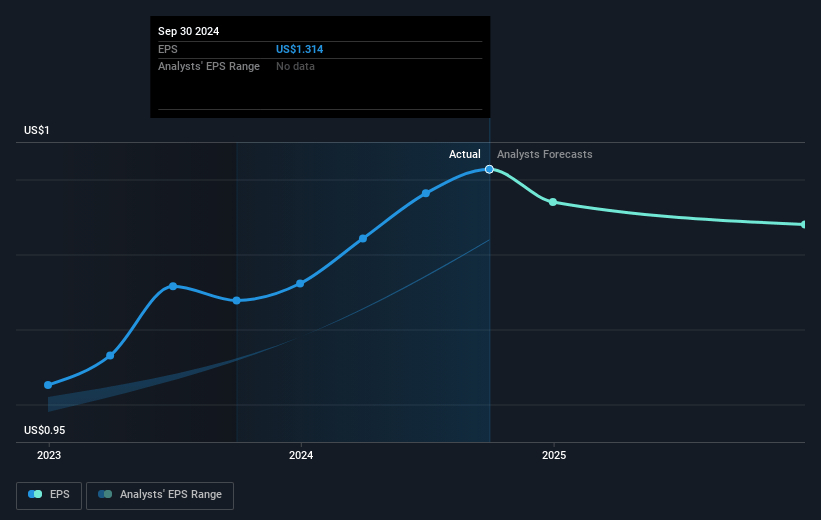

- Analysts expect earnings to reach $23.6 million (and earnings per share of $1.12) by about May 2028, down from $26.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.5x on those 2028 earnings, up from 11.8x today. This future PE is lower than the current PE for the US Industrial REITs industry at 27.3x.

- Analysts expect the number of shares outstanding to grow by 0.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.85%, as per the Simply Wall St company report.

NewLake Capital Partners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing legislative and regulatory uncertainty surrounding cannabis legalization at both the federal and state levels poses a significant risk. Delays in DEA rescheduling and slow legislative changes could impact NewLake's ability to attract new tenants and grow revenue.

- The financial health of some of NewLake's tenants, such as Revolutionary Clinics and Calypso, is concerning. Issues like receivership and rental payment difficulties can lead to uncollectible rents and reduced revenue for the company.

- The specialized nature of cannabis cultivation facilities may limit alternative revenue streams if properties need to be re-tenanted, potentially impacting future revenue and net margins.

- Broader economic conditions and market volatility, reflected by a cautious outlook from management, may restrict available capital for growth and investments, affecting net margins and earnings.

- The company's decision to balance share repurchases and potential ATM offerings reflects caution and could indicate limited growth prospects in the near term, potentially impacting earnings and shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $17.0 for NewLake Capital Partners based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $14.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $50.6 million, earnings will come to $23.6 million, and it would be trading on a PE ratio of 18.5x, assuming you use a discount rate of 6.9%.

- Given the current share price of $14.37, the analyst price target of $17.0 is 15.5% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.