Narratives are currently in beta

Key Takeaways

- Strategic timberland acquisitions and development of Natural Climate Solutions are expected to enhance revenue growth and position Weyerhaeuser for climate-related market opportunities.

- Expansion in renewable energy projects and recovery in lumber operations are projected to boost earnings and improve cost efficiency.

- Market challenges and external risks threaten Weyerhaeuser’s revenue and profitability, while long-term growth via carbon projects faces potential permitting delays.

Catalysts

About Weyerhaeuser- Weyerhaeuser Company, one of the world's largest private owners of timberlands, began operations in 1900.

- The acquisition of 84,000 acres of high-quality timberland in Alabama, with plans to reach $1 billion in strategic timberland acquisitions by the end of 2025, is expected to enhance Weyerhaeuser's portfolio and drive revenue growth through solid returns from these well-managed timberlands.

- The company’s focus on developing its Natural Climate Solutions business, including the expected approval for two forest carbon projects and a strong pipeline of additional projects, positions Weyerhaeuser to benefit from growing demand for high-quality voluntary carbon credits, potentially bolstering future earnings.

- The ongoing strength and expansion in solar and wind energy projects, including three solar developments under construction and two new wind projects expected to come online, highlights the potential for increased revenue and earnings from renewable energy initiatives.

- Weyerhaeuser plans to return its lumber operations to a more normal operating posture in the fourth quarter, driven by improved supply-demand dynamics and increasing lumber prices in the U.S. South, which should reduce manufacturing costs and aid in margin recovery.

- The projected improvement in the U.S. single-family housing market in 2025, supported by demographic trends and underbuilt housing stock, is expected to drive demand for Wood Products, contributing to higher revenues and potentially improved net margins.

Weyerhaeuser Future Earnings and Revenue Growth

Assumptions

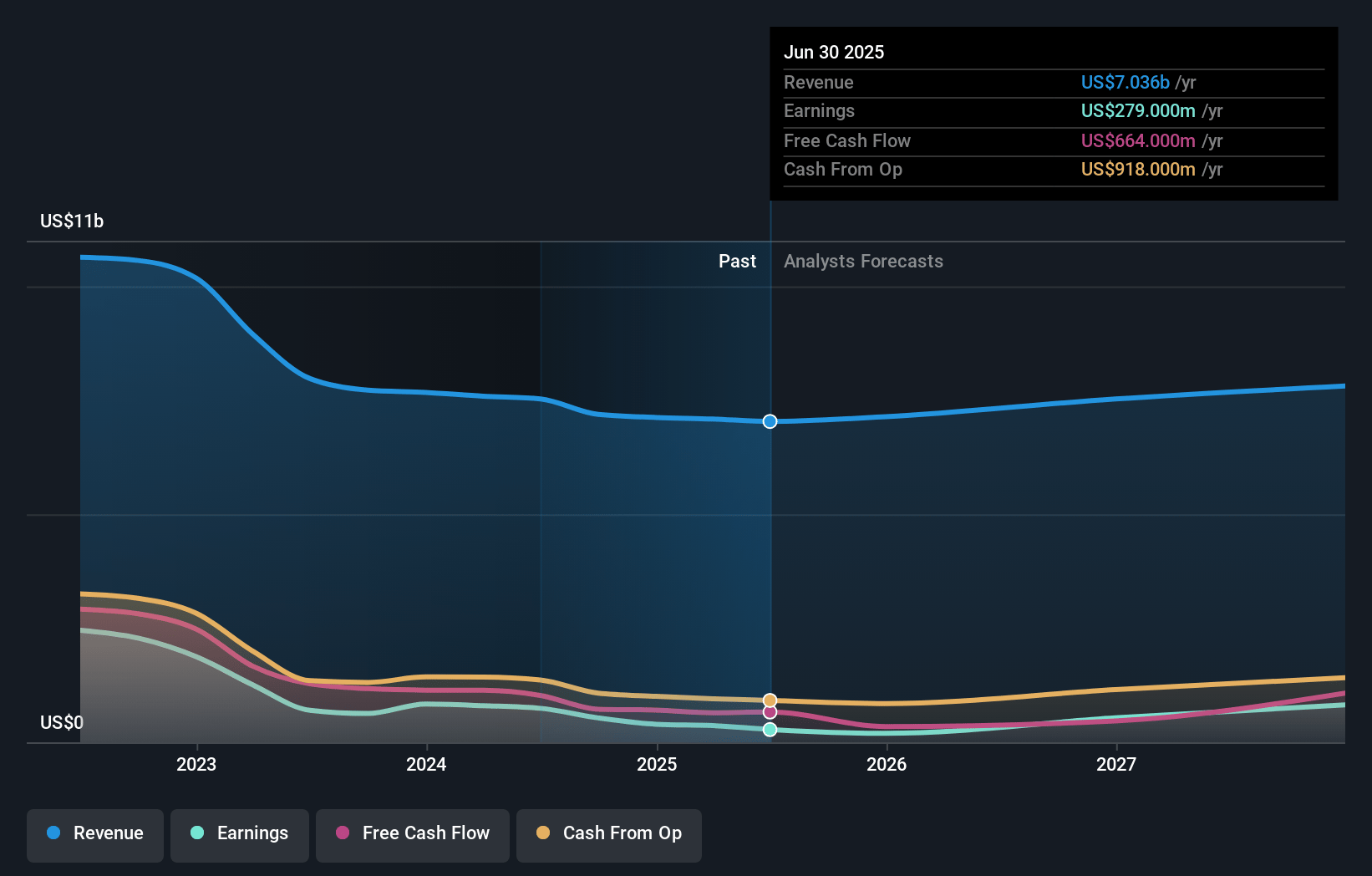

How have these above catalysts been quantified?- Analysts are assuming Weyerhaeuser's revenue will grow by 5.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.4% today to 11.3% in 3 years time.

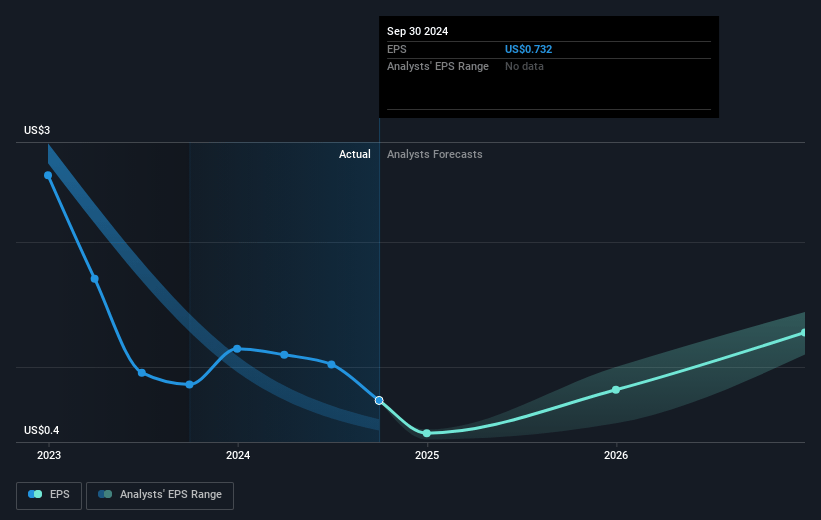

- Analysts expect earnings to reach $966.4 million (and earnings per share of $1.34) by about November 2027, up from $534.0 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $777.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.8x on those 2027 earnings, down from 41.7x today. This future PE is greater than the current PE for the US Specialized REITs industry at 28.4x.

- Analysts expect the number of shares outstanding to decline by 0.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.13%, as per the Simply Wall St company report.

Weyerhaeuser Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Western domestic log market faced downward pressure due to ample log supply and elevated mill inventories, which may continue to impact sales volumes and average sales realizations, affecting revenue and net margins.

- Increased competition in the Japanese market from European lumber imports could lead to decreased demand for Weyerhaeuser's export logs, potentially affecting revenue and earnings from international markets.

- Challenges in the North American lumber market, including historically low benchmark prices driven by cautious buyer sentiment and soft end market demand, could continue to suppress revenue and lead to lower margins.

- Wildfire risks and dry conditions in the Pacific Northwest may result in further operating restrictions, reducing harvest volumes and thereby impacting revenue and overall profitability.

- Potential delays in permitting for carbon capture and sequestration projects may prolong the time before these can contribute significantly to revenue and earnings, affecting long-term financial projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $36.8 for Weyerhaeuser based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $8.5 billion, earnings will come to $966.4 million, and it would be trading on a PE ratio of 32.8x, assuming you use a discount rate of 6.1%.

- Given the current share price of $30.68, the analyst's price target of $36.8 is 16.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives