Key Takeaways

- Whitestone REIT's focus on high-value retail spaces and strategic acquisitions aims to boost revenue and earnings growth through flexibility and higher rental rates.

- Leverage reduction and redevelopment plans support funding growth initiatives, ensuring strong dividends and consistent earnings growth.

- Whitestone REIT's flexible lease strategy and capital recycling may risk revenue consistency and earnings, with market conditions impacting lease success and financial outcomes.

Catalysts

About Whitestone REIT- Whitestone REIT (NYSE: WSR) is a community-centered real estate investment trust (REIT) that acquires, owns, operates, and develops open-air, retail centers located in some of the fastest growing markets in the country: Phoenix, Austin, Dallas-Fort Worth, Houston and San Antonio.

- Whitestone REIT's strategy of concentrating on high-value, high-return shop spaces (77% of their ABR) allows them to capitalize on market changes, potentially increasing future earnings growth. This focus is likely to enhance revenue streams as these spaces allow flexibility and higher rental rates.

- The company aims for consistent organic core Funds From Operations (FFO) growth of 4% to 6% driven by 3% to 5% same-store net operating income growth, which is expected to boost future earnings. This growth is supported by contractual escalations, lease spreads, and returns from redevelopment capital spend.

- Strategic acquisitions and developments, such as their recycling program and targeting accretive acquisitions, are expected to add an additional 100 basis points of core FFO growth. This approach is likely to improve revenue and overall earnings by leveraging accretive asset acquisition.

- Redevelopment plans focusing on upgrading tenants and enhancing property value are anticipated to add up to 100 basis points to same-store NOI growth starting in 2026, contributing to revenue and earnings growth.

- Expected leverage reduction (from debt-to-EBITDAre of 9.2x in Q4 '21 to 6.6x in Q4 2024) alongside strong cash flows positions Whitestone to fund growth initiatives, maintain a secure, growing dividend, and potentially increase per-share earnings.

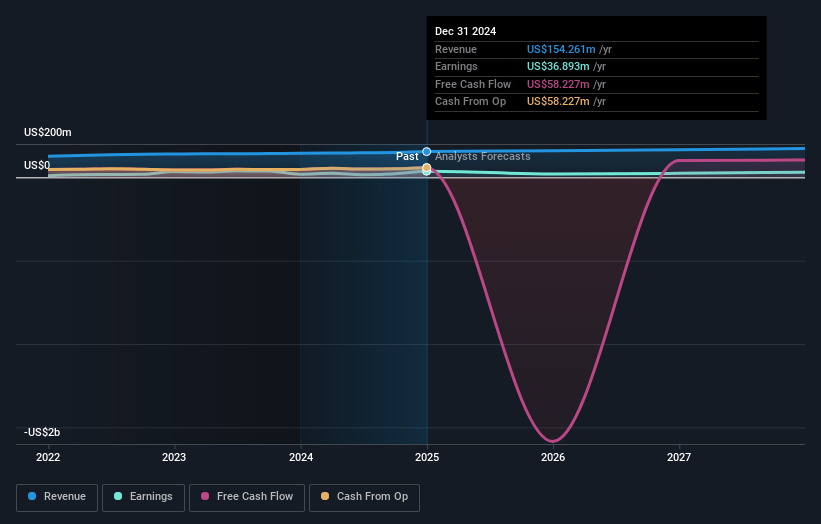

Whitestone REIT Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Whitestone REIT's revenue will grow by 3.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 23.9% today to 17.7% in 3 years time.

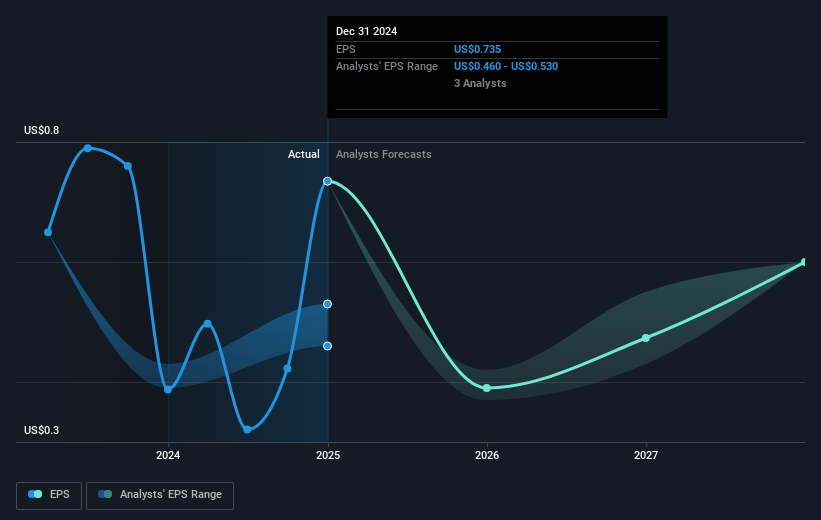

- Analysts expect earnings to reach $30.6 million (and earnings per share of $0.6) by about May 2028, down from $36.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.6x on those 2028 earnings, up from 18.1x today. This future PE is greater than the current PE for the US Retail REITs industry at 31.6x.

- Analysts expect the number of shares outstanding to grow by 1.87% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.04%, as per the Simply Wall St company report.

Whitestone REIT Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Whitestone REIT's reliance on shorter lease structures, although providing flexibility, might result in fewer long-term commitments from tenants, posing a risk to consistent revenue streams.

- The company’s capital recycling strategy involves strategic dispositions, which can be influenced by market conditions and may not always yield favorable results, potentially affecting earnings.

- Redevelopments and acquisitions require significant capital outlay, and delays or cost overruns in these initiatives could impact net margins and earnings.

- Interest rates and leverage levels play a critical role, as indicated by their historical impact on earnings, and an unfavorable rate environment could affect earnings and interest expense.

- The effectiveness of tenant upgrades and achieving the anticipated leasing spreads are dependent on market conditions, and any failure to capture anticipated growth could impede revenue targets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $16.429 for Whitestone REIT based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $19.0, and the most bearish reporting a price target of just $15.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $172.6 million, earnings will come to $30.6 million, and it would be trading on a PE ratio of 36.6x, assuming you use a discount rate of 8.0%.

- Given the current share price of $13.09, the analyst price target of $16.43 is 20.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.