Narratives are currently in beta

Key Takeaways

- Operational improvements and strategic remerchandising drive revenue growth and enhance FFO per share.

- Technology and asset recycling improve tenant success, streamline operations, and enhance earnings.

- Whitestone's revenue growth is at risk due to potential demand downturns, high leverage, restaurant sector exposure, rising real estate taxes, and uncertain asset recycling outcomes.

Catalysts

About Whitestone REIT- Whitestone REIT (NYSE: WSR) is a community-centered real estate investment trust (REIT) that acquires, owns, operates, and develops open-air, retail centers located in some of the fastest growing markets in the country: Phoenix, Austin, Dallas-Fort Worth, Houston and San Antonio.

- Whitestone REIT aims for 11% growth in core FFO per share in 2024 through operational improvements, which is expected to drive future earnings.

- The company's strategy of remerchandising and utilizing shorter leases has led to strong leasing spreads and increased occupancy, which should positively impact revenue growth.

- Enhanced tenant selection and leveraging technology by the leasing team are expected to streamline operations and improve tenant success, likely benefiting net margins.

- Increasing same-store net operating income targets and maintaining a high occupancy rate suggest continued revenue growth momentum.

- The ongoing asset recycling program aims to strategically position the portfolio for better returns, which could improve earnings and leverage ratios.

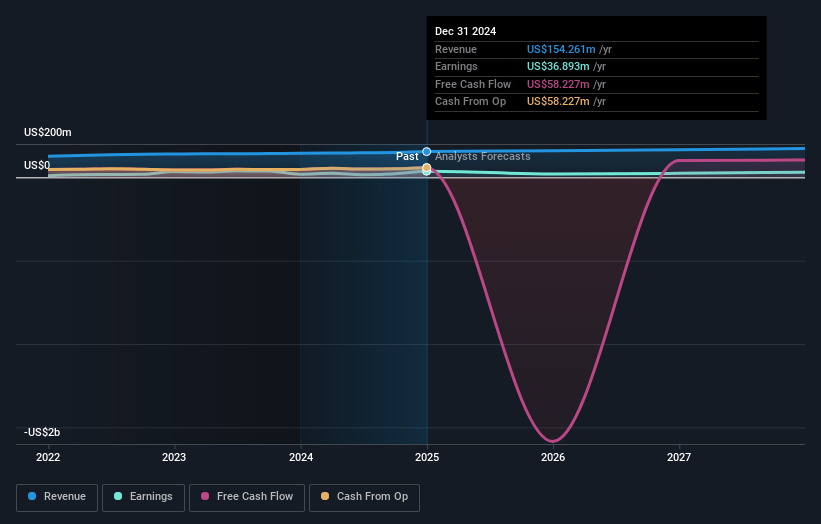

Whitestone REIT Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Whitestone REIT's revenue will grow by 5.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.1% today to 18.8% in 3 years time.

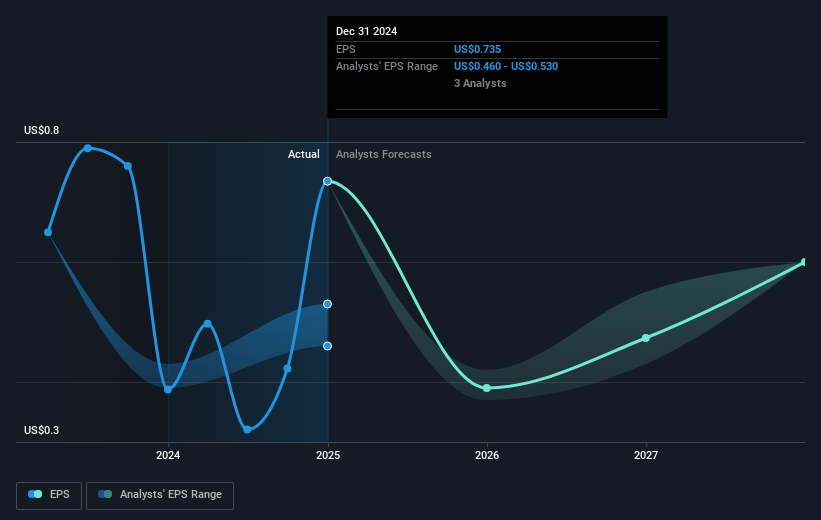

- Analysts expect earnings to reach $32.6 million (and earnings per share of $0.63) by about November 2027, up from $21.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.2x on those 2027 earnings, down from 35.0x today. This future PE is lower than the current PE for the US Retail REITs industry at 34.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.45%, as per the Simply Wall St company report.

Whitestone REIT Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Whitestone's reliance on improving occupancy and leasing spreads could struggle if there is a downturn in demand, potentially impacting their future revenue and same-store net operating income growth.

- The company's leverage, although improving, remains relatively high and subject to market conditions, and any inability to continue deleveraging may affect net margins and financial stability.

- Exposure to the restaurant sector, which comprises about a third of their rents and could be vulnerable to consumer pullback, poses a risk to revenue consistency.

- The increased cost of real estate taxes in Harris County could impact margins if it continues to rise and becomes a sustained trend not immediately compensated by rent hikes.

- Selling and recycling assets, while often beneficial for capital allocation, may lead to underestimating future performance if new acquisitions do not generate expected earnings and returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $16.14 for Whitestone REIT based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $173.3 million, earnings will come to $32.6 million, and it would be trading on a PE ratio of 32.2x, assuming you use a discount rate of 8.4%.

- Given the current share price of $14.59, the analyst's price target of $16.14 is 9.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives