Narratives are currently in beta

Key Takeaways

- Strategic acquisitions and enhanced regional density in senior housing improve economies of scale and net margins through operational synergies.

- Strong cash flow growth and a deleveraged balance sheet offer flexibility for accretive investments, boosting future earnings per share.

- Geopolitical tensions, construction cost inflation, and reliance on demographics pose risks to Welltower's revenue and growth in the senior housing market.

Catalysts

About Welltower- Welltower Inc. (NYSE:WELL), a real estate investment trust ("REIT") and S&P 500 company headquartered in Toledo, Ohio, is driving the transformation of health care infrastructure.

- Welltower's commitment to strengthening its operating platform, including a technology rollout, is expected to drive significant efficiency gains and improved revenue per occupied room (RevPOR), which should positively impact revenue growth and net margins.

- The company is in the early stages of benefiting from demographic tailwinds, such as the growing population of individuals aged 80 and older, which is expected to increase demand for senior housing, contributing to revenue growth.

- Welltower’s strategic focus on bolt-on acquisitions and enhancing regional density in senior housing sectors positions it to leverage economies of scale and achieve higher net margins through operational synergies.

- The limited new supply in the senior housing market, due to reduced construction starts and tighter financing conditions, provides a favorable environment for occupancy growth and potential RevPOR improvements, enhancing revenue and net margins.

- The combination of strong cash flow growth and a deleveraged balance sheet provides Welltower with the flexibility to pursue accretive investments, supporting future earnings per share growth.

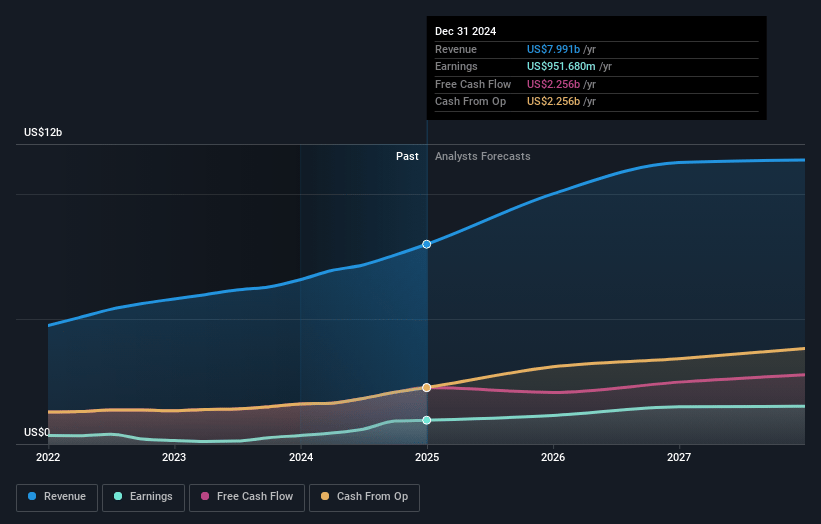

Welltower Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Welltower's revenue will grow by 11.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.1% today to 14.0% in 3 years time.

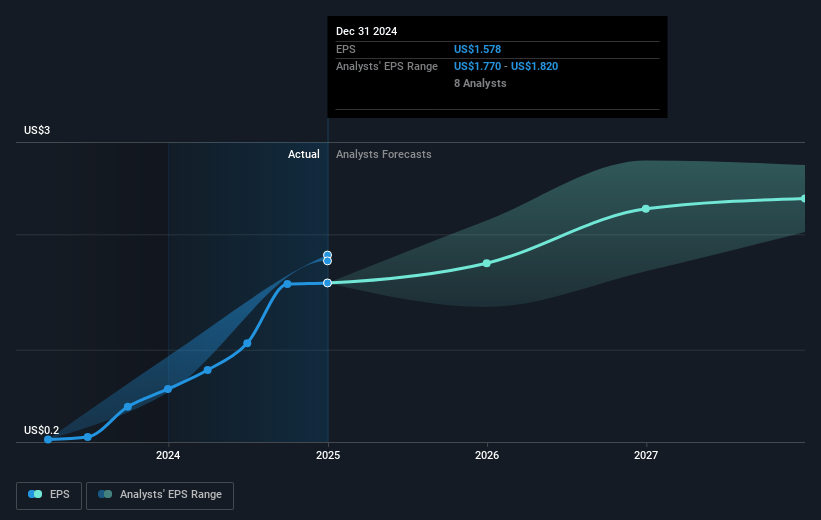

- Analysts expect earnings to reach $1.5 billion (and earnings per share of $2.63) by about January 2028, up from $915.6 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.7 billion in earnings, and the most bearish expecting $1.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 68.5x on those 2028 earnings, down from 93.3x today. This future PE is greater than the current PE for the US Health Care REITs industry at 41.4x.

- Analysts expect the number of shares outstanding to decline by 3.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.89%, as per the Simply Wall St company report.

Welltower Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Macroeconomic uncertainty and heightened geopolitical tensions could impact future revenues and margins as they create an unstable environment for investment and operations.

- The rising costs of construction and financing, coupled with banks winding down their senior housing loan exposure, could limit Welltower's ability to expand and affect its earnings growth.

- The company’s senior housing market heavily depends on demographic trends such as the silver tsunami, meaning any slowdown in this demographic shift or economic factors affecting seniors could impact revenue growth projections.

- Replacement cost considerations and potential interest rate fluctuations present risks to property valuation and investment returns, which could impact net margins if not properly managed.

- Competitive pressures in the senior housing sector and reliance on geographic market density strategies may limit Welltower’s revenue growth if competitors effectively challenge their regional positions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $147.79 for Welltower based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $221.0, and the most bearish reporting a price target of just $125.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $10.5 billion, earnings will come to $1.5 billion, and it would be trading on a PE ratio of 68.5x, assuming you use a discount rate of 6.9%.

- Given the current share price of $137.15, the analyst's price target of $147.79 is 7.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives