Narratives are currently in beta

Key Takeaways

- A landlord's market in Manhattan, with rising rents and limited vacancies, supports Vornado's revenue growth and increased rental income.

- Strategic limited dividend payouts aim to boost balance sheet strength and maintain financial flexibility, affecting short-term net margins.

- Strong demand in key markets, successful leasing, and robust liquidity position are set to enhance Vornado Realty Trust's financial stability and growth prospects.

Catalysts

About Vornado Realty Trust- A fully - integrated equity real estate investment trust.

- The Manhattan office leasing market is described as being in a landlord's market phase, with increasing rents, limited vacancies, and no major new supply projected. This optimistic outlook may be contributing to expectations of higher revenues and earnings as demand remains robust.

- Vornado's plan to complete significant leasing activity, particularly at PENN 1 and PENN 2, suggests anticipated growth in occupancy and rental income. This could increase revenue and flow through to higher net operating income and earnings over time.

- The strategy of limited dividend payouts, focusing on a single annual dividend to conserve cash, indicates a focus on balance sheet strength and financial flexibility in the near term, which may affect net margins as it temporarily limits cash outflows.

- The lack of new office supply in the Manhattan market, combined with active leasing, suggests potential growth in rental rates and revenue. This scarcity in high-quality office space is likely to enhance occupancy and future revenue potential as Vornado capitalizes on market conditions.

- Rising rents in redeveloped properties like PENN 1 and PENN 2, along with ongoing redesign and redevelopment efforts, indicate a strategy to drive earnings growth through enhanced asset quality and increased market rents, supporting future revenue growth and improved net margins.

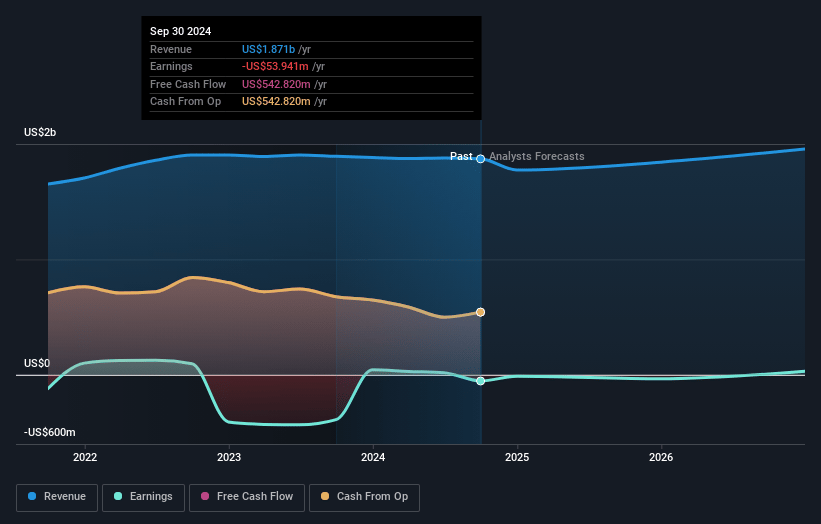

Vornado Realty Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Vornado Realty Trust's revenue will grow by 1.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -2.9% today to 1.5% in 3 years time.

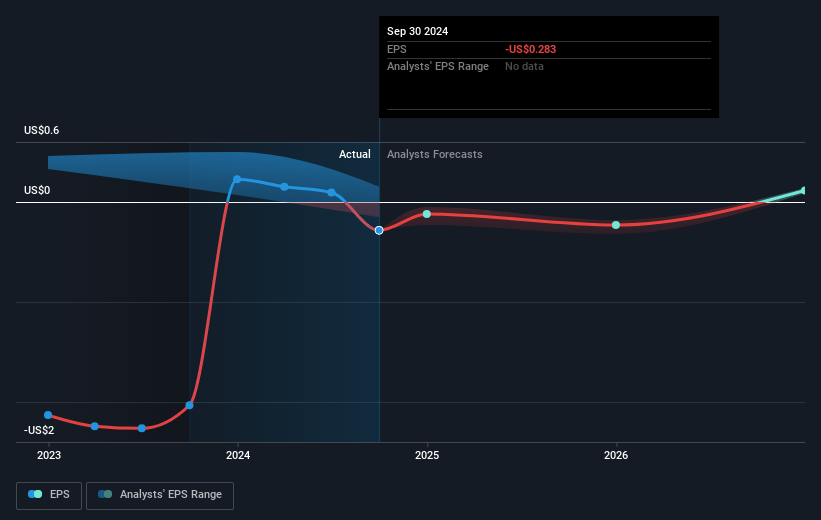

- Analysts expect earnings to reach $30.0 million (and earnings per share of $0.15) by about November 2027, up from $-53.9 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $36.4 million in earnings, and the most bearish expecting $17 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 300.2x on those 2027 earnings, up from -155.5x today. This future PE is greater than the current PE for the US Office REITs industry at 43.9x.

- Analysts expect the number of shares outstanding to decline by 0.92% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.44%, as per the Simply Wall St company report.

Vornado Realty Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The strong demand and rapidly decreasing vacancies in the Manhattan Class A office market may lead to increased rent revenues for Vornado Realty Trust, especially in landlord-favorable markets such as Park and Sixth Avenues where vacancy rates are as low as 7% to 9%.

- The successful leasing and expected closing of a substantial master lease deal with NYU at 770 Broadway, which includes a significant upfront rent payment, can potentially improve their financial position by paying off existing debt, thus positively impacting earnings.

- The continued strong leasing activity and high occupancy rates at their trophy properties like 555 California Street in San Francisco, with performance outpacing the market, could stabilize and potentially increase revenue and net operating income for Vornado.

- The strategic focus on leasing in the PENN district has the potential to enhance rental income significantly as the neighborhood transforms and commands higher rents, impacting future revenue positively.

- Vornado's robust liquidity position, with over $2.6 billion in liquidity, including significant cash reserves, provides a strong foundation to manage debt maturities, fund capital requirements for leasing, and potentially finance new opportunistic acquisitions, which can favorably affect financial metrics such as net income and cash flow from operations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $36.16 for Vornado Realty Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $49.0, and the most bearish reporting a price target of just $23.75.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.9 billion, earnings will come to $30.0 million, and it would be trading on a PE ratio of 300.2x, assuming you use a discount rate of 7.4%.

- Given the current share price of $43.99, the analyst's price target of $36.16 is 21.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives