Key Takeaways

- New partnerships and casino developments, particularly with Red Rock Resorts, are projected to significantly enhance future revenue and earnings potential.

- Strategic refinancing and increased liquidity improve financial stability, while elevated cash flow expectations suggest promising growth in earnings and dividends.

- Expansion into tribal gaming presents substantial execution risks, and macroeconomic pressures could impact revenue and financial stability.

Catalysts

About VICI Properties- An S&P 500 experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality and entertainment destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, three of the most iconic entertainment facilities on the Las Vegas Strip.

- VICI Properties has established a new relationship with Red Rock Resorts, involving a significant development on tribal land. This relationship, along with the anticipated casino resort completion, is expected to boost future revenue streams.

- The completion of North Fork Mono Casino Resort in partnership with Red Rock Resorts, featuring multiple gaming and entertainment attractions, presents a substantial opportunity for future earnings growth.

- Recent refinancing activities, including a $400 million bond offering and increased liquidity to $3.2 billion, improve financial stability and lower cost of capital, positively impacting net margins and earnings.

- Continued growth in Las Vegas due to diverse demand drivers and substantial capital investments in regional gaming by partners, like Caesars, may result in increased revenue and improved property performance.

- An increase in full-year AFFO guidance highlights optimistic expectations for growth in operational cash flows and shareholder returns, supporting a positive outlook for earnings and dividends.

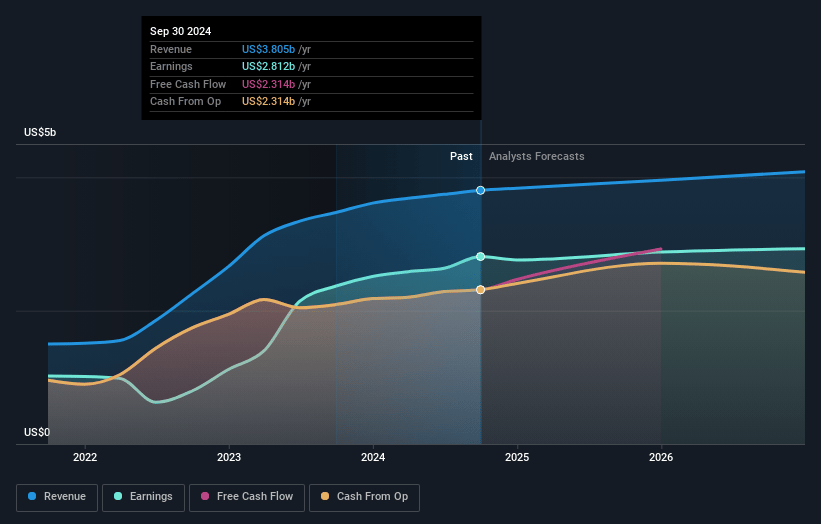

VICI Properties Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming VICI Properties's revenue will grow by 2.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 67.8% today to 67.9% in 3 years time.

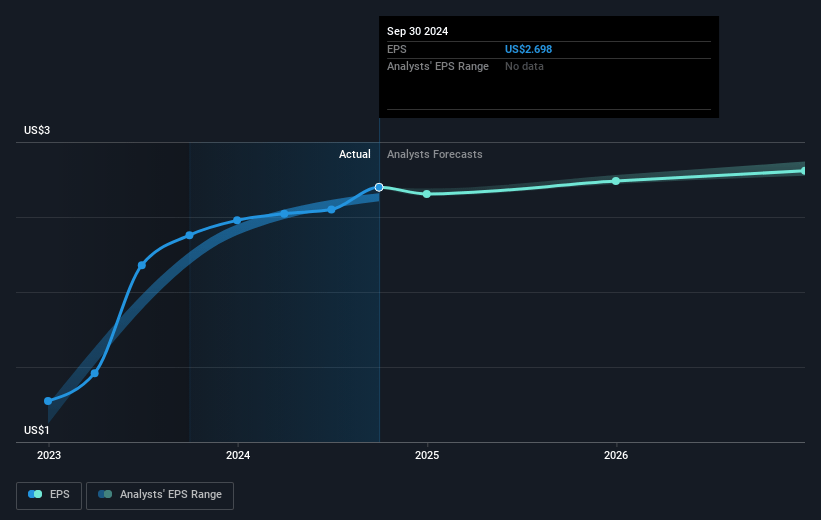

- Analysts expect earnings to reach $2.9 billion (and earnings per share of $2.89) by about May 2028, up from $2.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $3.2 billion in earnings, and the most bearish expecting $2.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.1x on those 2028 earnings, up from 12.7x today. This future PE is lower than the current PE for the US Specialized REITs industry at 29.5x.

- Analysts expect the number of shares outstanding to grow by 1.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.28%, as per the Simply Wall St company report.

VICI Properties Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- There is a significant amount of execution risk associated with VICI's expansion into tribal gaming through partnerships with operators like Red Rock Resorts, which could impact the company's earnings if these projects do not perform as expected.

- The burgeoning relationship with Red Rock Resorts involves some uncertainties, especially regarding the collateral and operational rights on tribal land, which may pose risks to the future revenue stream if the casinos do not perform well.

- Volatility in construction costs and potential tariffs could impact the drawdown schedules and final costs of casino development projects, potentially affecting the profit margins and returns on investment for VICI's new developments.

- While VICI's balance sheet currently demonstrates no debt maturities until 2026, continued macroeconomic uncertainty could affect borrowing costs or refinancing terms in the future, potentially impacting net margins and long-term financial stability.

- The heavy reliance on continued success and growth in the Las Vegas market, amidst potential international travel slowdowns and other economic pressures, may pose risks to future revenue if demand softens unexpectedly.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $36.207 for VICI Properties based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $43.0, and the most bearish reporting a price target of just $32.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.2 billion, earnings will come to $2.9 billion, and it would be trading on a PE ratio of 17.1x, assuming you use a discount rate of 7.3%.

- Given the current share price of $31.54, the analyst price target of $36.21 is 12.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.