Key Takeaways

- SL Green Realty's strategic debt activities and acquisitions are driving strong growth, with particular success in occupancy and future rental income enhancement.

- Their focus on Midtown development sites, alongside popular attractions like Summit One Vanderbilt, supports revenue growth despite international tourism risks.

- Macroeconomic and geopolitical risks, along with leasing vulnerabilities and tourism declines, may hinder SL Green's revenue growth and profitability.

Catalysts

About SL Green Realty- A privately owned real estate investment manager and fully integrated real estate investment trust, or REIT, that is focused primarily on acquiring, managing and maximizing value of Manhattan commercial properties.

- SL Green Realty expects to take advantage of an opportunity-rich commercial debt market through new debt originations, secondary market purchases, and distressed opportunities, driving strong revenue and earnings growth from their debt-related businesses.

- The company's acquisition and leasing activities seem robust, with the recent acquisition of 500 Park reaching 100% occupancy and plans to elevate finishes to increase future rental income, enhancing revenue and net margins as tenants renew and roll.

- Summit One Vanderbilt continues to be a popular attraction, capturing significant ticket presales and boosting revenue through high visitor demand, possibly mitigating risks from a reduction in international tourism and supporting earnings.

- The firm is considering office-to-residential conversions in certain Midtown locations, aiming to repurpose its portfolio to meet market demand better, potentially increasing asset values and future net operating income.

- SL Green's strategic focus on acquiring high-quality development sites in Midtown and its long-term confidence in the New York City market highlight potential future growth in revenue and earnings, driven by anticipated demand for Class A office space.

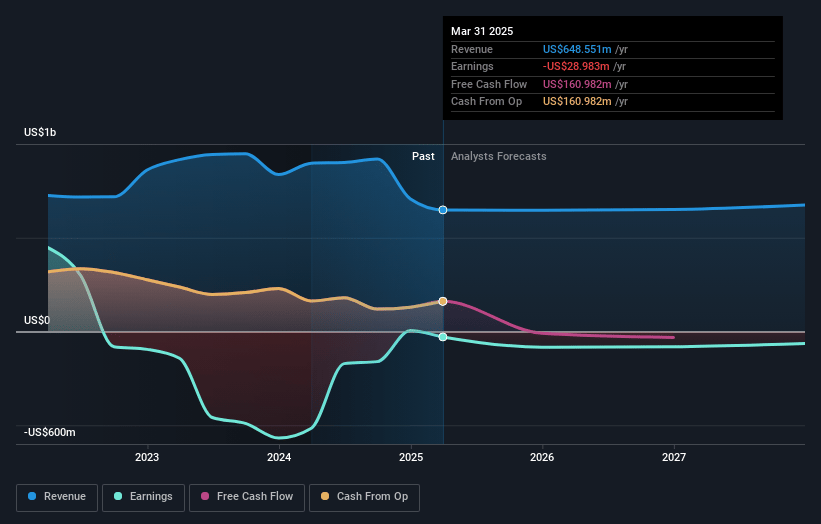

SL Green Realty Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SL Green Realty's revenue will grow by 3.7% annually over the next 3 years.

- Analysts are not forecasting that SL Green Realty will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate SL Green Realty's profit margin will increase from -4.5% to the average US Office REITs industry of 8.6% in 3 years.

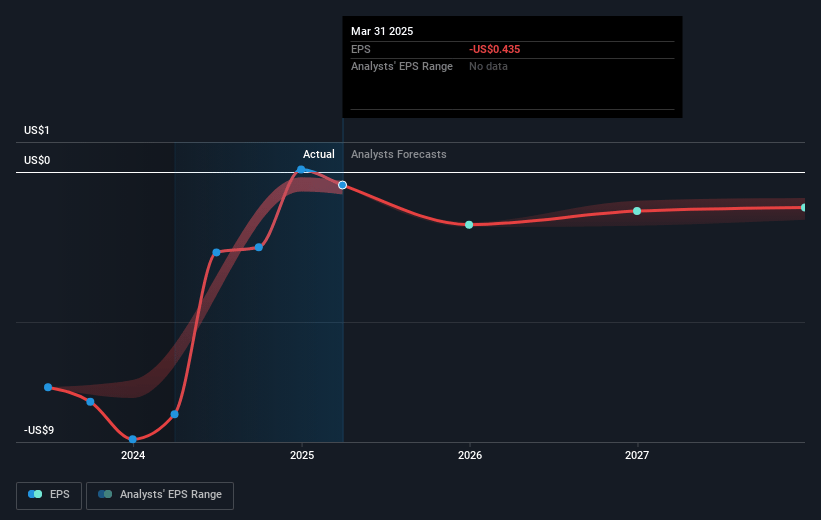

- If SL Green Realty's profit margin were to converge on the industry average, you could expect earnings to reach $62.3 million (and earnings per share of $0.68) by about May 2028, up from $-29.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 116.8x on those 2028 earnings, up from -129.5x today. This future PE is greater than the current PE for the US Office REITs industry at 64.8x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.02%, as per the Simply Wall St company report.

SL Green Realty Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The macroeconomic environment across the country may cause turbulence in credit markets, which could impact SL Green's New York City investments, potentially affecting future revenue growth and earnings.

- While the company has plans for significant new projects, reliance on macroeconomic stability poses a risk; unexpected interest rate hikes or geopolitical tensions could increase development costs and strain net margins.

- Concerns about leasing activity slowing due to stock market disruptions highlight vulnerabilities within their leasing pipeline, which could negatively affect occupancy rates and ultimately reduce revenue.

- Despite expectations of a strong CMBS market, uncertainties in the broader economic climate could hamper financing deals, possibly impacting SL Green’s ability to maintain a favorable debt position affecting net earnings.

- Potential impacts of reduced international tourism could affect revenues from Summit, one of SL Green's attractions, thereby affecting overall profitability if domestic attendance does not offset international visitor shortfalls.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $62.778 for SL Green Realty based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $87.0, and the most bearish reporting a price target of just $49.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $723.1 million, earnings will come to $62.3 million, and it would be trading on a PE ratio of 116.8x, assuming you use a discount rate of 8.0%.

- Given the current share price of $52.98, the analyst price target of $62.78 is 15.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.