Key Takeaways

- Strategic brand additions and category expansion are boosting foot traffic and sales, promising revenue and NOI growth.

- Acquisitions and digital optimization are enhancing traffic and sales, aiming to improve future earnings and net margins.

- Execution risks from property transactions and occupancy fluctuations may affect short-term financial metrics, despite potential long-term benefits from strategic re-tenanting.

Catalysts

About Tanger- Tanger Inc. (NYSE: SKT) is a leading owner and operator of outlet and open-air retail shopping destinations, with over 44 years of expertise in the retail and outlet shopping industries.

- Tanger's strategic remerchandising efforts, including adding high-demand brands like LEGO and Marc Jacobs, are fostering greater foot traffic and sales per square foot, which is likely to drive revenue growth.

- Renewal and new leasing activity are strong, with positive rent spreads contributing to increased rental income, which should bolster revenue and same-center NOI growth going forward.

- The expansion into new categories and the introduction of brands that appeal to a broader demographic are expected to increase frequency of visits and spending, enhancing future revenue potential.

- Tanger's external growth strategy, exemplified by acquisitions like Pinecrest and The Promenade at Chenal, alongside tailored marketing initiatives, is aimed at amplifying traffic and sales, thereby enhancing future earnings.

- Optimization of digital capabilities and customer insights enable targeted promotions that drive traffic and enhance sales performance, potentially boosting net margins through enhanced operational efficiency.

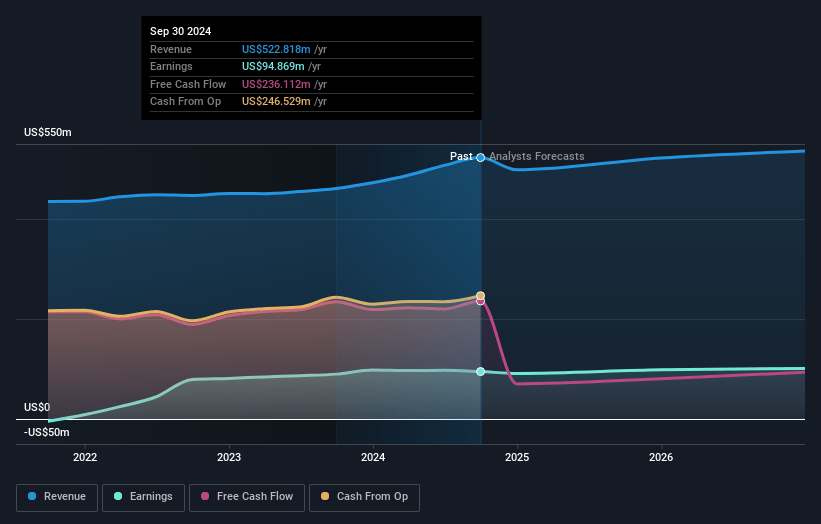

Tanger Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tanger's revenue will grow by 2.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.2% today to 19.9% in 3 years time.

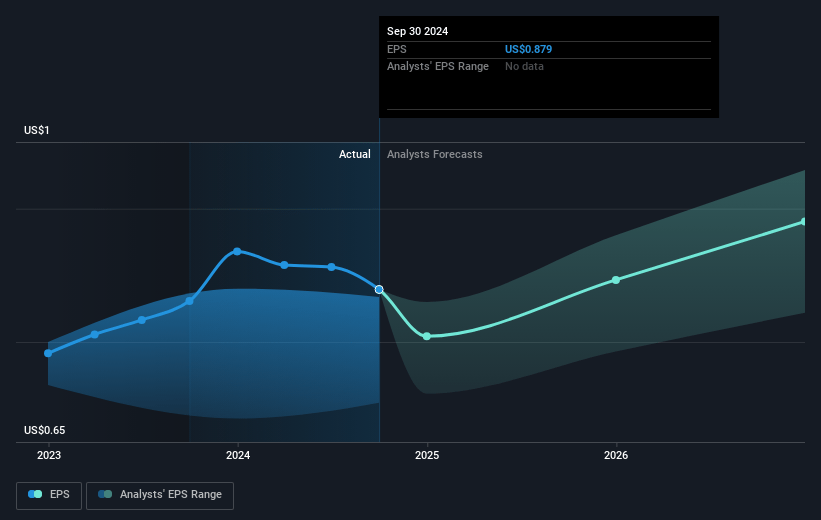

- Analysts expect earnings to reach $118.1 million (and earnings per share of $1.12) by about May 2028, up from $94.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 50.8x on those 2028 earnings, up from 35.5x today. This future PE is greater than the current PE for the US Retail REITs industry at 28.4x.

- Analysts expect the number of shares outstanding to grow by 3.49% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.26%, as per the Simply Wall St company report.

Tanger Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Tanger's occupancy rate declined due to timing between tenants and remerchandising efforts, which could result in lower near-term revenue and impact NOI growth negatively.

- The acquisition of new properties and sale of underperforming centers involve execution risks and non-cash impairment charges, which could temporarily lower net margins and core FFO.

- Temporary vacancies and re-tenanting strategies, although potentially beneficial in the long term, may lead to short-term reductions in occupancy rates and revenues.

- Dependence on seasonal sales and shifting promotional strategies might create uncertainty in revenue timing and stability, impacting short-term earnings projections.

- Broader macroeconomic uncertainties and potential future inventory problems for retail tenants could affect overall tenant sales and, consequently, Tanger's rental income and NOI growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $37.444 for Tanger based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $42.0, and the most bearish reporting a price target of just $32.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $593.0 million, earnings will come to $118.1 million, and it would be trading on a PE ratio of 50.8x, assuming you use a discount rate of 7.3%.

- Given the current share price of $29.68, the analyst price target of $37.44 is 20.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.