Key Takeaways

- Asset sales and reinvestments aim to enhance portfolio quality and growth, potentially boosting revenue and long-term earnings.

- Strategic hotel improvements and ROI projects focus on efficiency and increased value, likely driving higher net margins and shareholder returns.

- Renovations, debt challenges, labor issues, and economic uncertainties could adversely impact revenue growth, net margins, and earnings for Park Hotels & Resorts.

Catalysts

About Park Hotels & Resorts- Park is one of the largest publicly-traded lodging real estate investment trusts (“REIT”) with a diverse portfolio of iconic and market-leading hotels and resorts with significant underlying real estate value.

- Park Hotels & Resorts is aggressively pursuing the sale of $300 million to $400 million of non-core assets, which is expected to improve the overall quality of its portfolio and enhance long-term growth prospects, potentially impacting revenue positively.

- Strategic reinvestments into core portfolio properties like Bonnet Creek and Casa Marina, which are expected to produce upper single-digit RevPAR growth and double-digit EBITDA growth in 2025, suggest a positive impact on future earnings.

- The repositioning of Royal Palm Resort in South Beach with a $100 million investment aims to significantly enhance guest experience and increase ADR, potentially doubling the hotel's EBITDA once stabilized, thereby positively impacting future net margins and earnings.

- Operational improvements and operator changes at six hotels, including transitioning some to franchise models, are anticipated to drive efficiency and cost savings, potentially leading to higher net margins.

- Park Hotels & Resorts plans over $1 billion in ROI projects with an estimated value creation potential of over $300 million, indicating a strategic focus on unlocking long-term shareholder value through enhanced revenue and earnings growth.

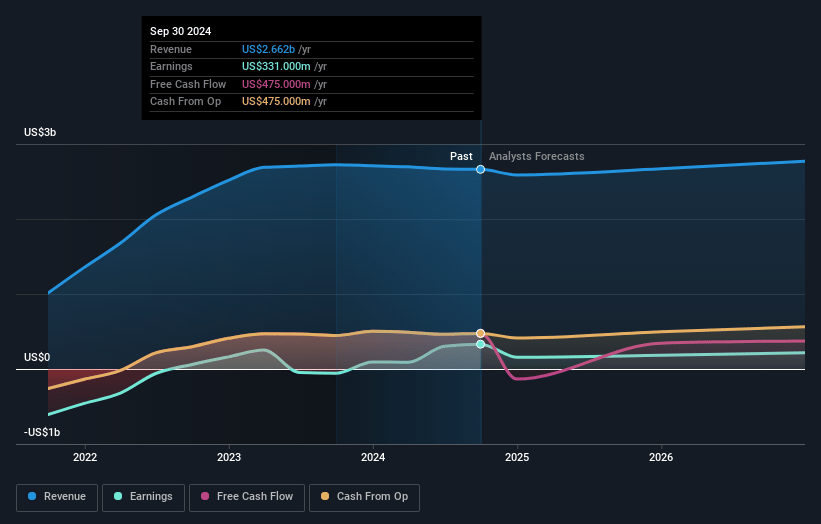

Park Hotels & Resorts Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Park Hotels & Resorts's revenue will grow by 2.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 8.1% today to 8.0% in 3 years time.

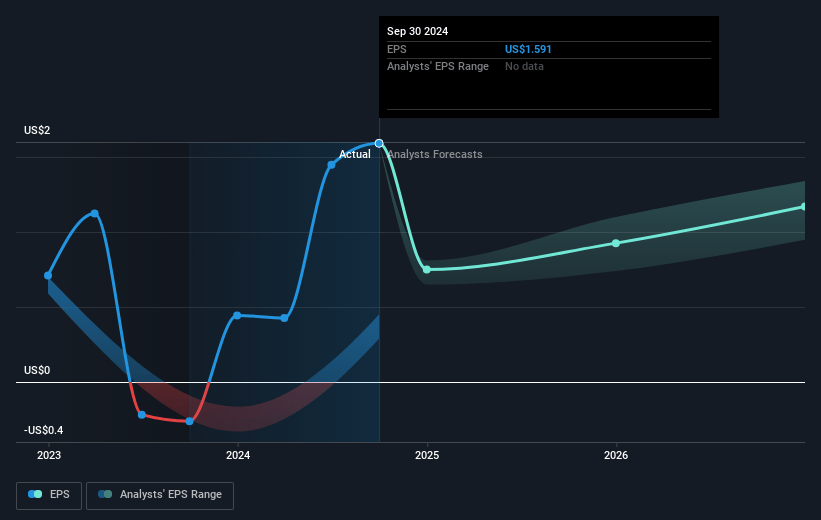

- Analysts expect earnings to reach $224.2 million (and earnings per share of $1.19) by about April 2028, up from $211.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $284 million in earnings, and the most bearish expecting $180.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.3x on those 2028 earnings, up from 9.5x today. This future PE is lower than the current PE for the US Hotel and Resort REITs industry at 19.1x.

- Analysts expect the number of shares outstanding to decline by 4.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.83%, as per the Simply Wall St company report.

Park Hotels & Resorts Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The planned closure and renovation of the Royal Palm Resort in South Beach, expected to disrupt operations until Q2 of 2026, could negatively impact 2025 earnings, contributing to an expected $17 million EBITDA displacement. This may result in reduced revenue during this period.

- The company has a significant amount of debt, particularly the $1.4 billion CMBS debt on the Hilton Hawaiian Village and Hyatt Regency Boston that matures in 2026. This could affect net margins if refinancing terms are unfavorable or if interest rates increase, impacting future earnings.

- Exposure to labor disruptions, such as the 45-day strike in Hawaii, previously caused a significant negative impact on revenue and EBITDA margins. Future labor issues could similarly affect financial performance and revenue growth.

- Park Hotels & Resorts plans to increase its disposition of non-core assets; however, if market conditions are unfavorable, or if asset sales take longer than expected, this could result in less cash available for debt reduction or reinvestment into ROI projects, potentially impacting net margins.

- The expectations of economic uncertainty, including fluctuating international travel patterns and tariffs impacting Canadian travelers, introduce risk to revenue and earnings projections, particularly in key markets like Florida and Hawaii that rely heavily on international visitors.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $14.179 for Park Hotels & Resorts based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $22.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.8 billion, earnings will come to $224.2 million, and it would be trading on a PE ratio of 15.3x, assuming you use a discount rate of 10.8%.

- Given the current share price of $9.9, the analyst price target of $14.18 is 30.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.