Key Takeaways

- Strong leasing activity and increased rental rates are expected to drive future revenue growth as new and existing tenants contribute more financially.

- Suspending dividends to fund long-term growth and favorable refinancing efforts are anticipated to enhance net margins and earnings stability.

- Macroeconomic uncertainties and capital needs could strain liquidity, affect revenues, and impact financial stability, challenging growth and investor sentiment.

Catalysts

About Piedmont Office Realty Trust- Piedmont Office Realty Trust, Inc. (also referred to herein as "Piedmont" or the "Company") (NYSE: PDM) is an owner, manager, developer, redeveloper and operator of high-quality, Class A office properties located primarily in major U.S.

- Strong leasing activity with 363,000 square feet completed in Q1 2025 and ongoing demand, particularly in markets like Dallas, Atlanta, and Minneapolis, is expected to drive future revenue growth as new tenants commence and existing tenants renew at higher rates.

- Increased rental rate roll-ups observed, with double-digit increases on cash and GAAP basis, indicate potential for enhanced revenue and earnings growth as new leases start contributing financially.

- A substantial leasing backlog, with $67 million of annualized revenue from leases yet to commence, promises significant future cash flow and earnings once these leases activate.

- The decision to suspend dividends aims to retain earnings to fund accretive long-term growth, which is projected to result in higher earnings as these strategic investments mature.

- Favorable refinancing and lease commencements, like the Travel + Leisure lease in Orlando, are anticipated to improve balance sheet metrics and reduce interest expenses, thereby enhancing net margins and long-term earnings stability.

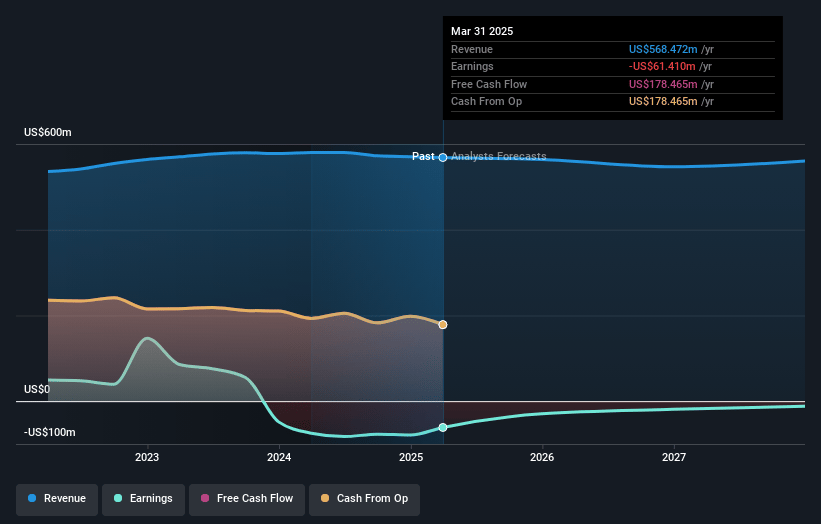

Piedmont Office Realty Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Piedmont Office Realty Trust's revenue will decrease by 0.1% annually over the next 3 years.

- Analysts are not forecasting that Piedmont Office Realty Trust will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Piedmont Office Realty Trust's profit margin will increase from -10.8% to the average US Office REITs industry of 8.6% in 3 years.

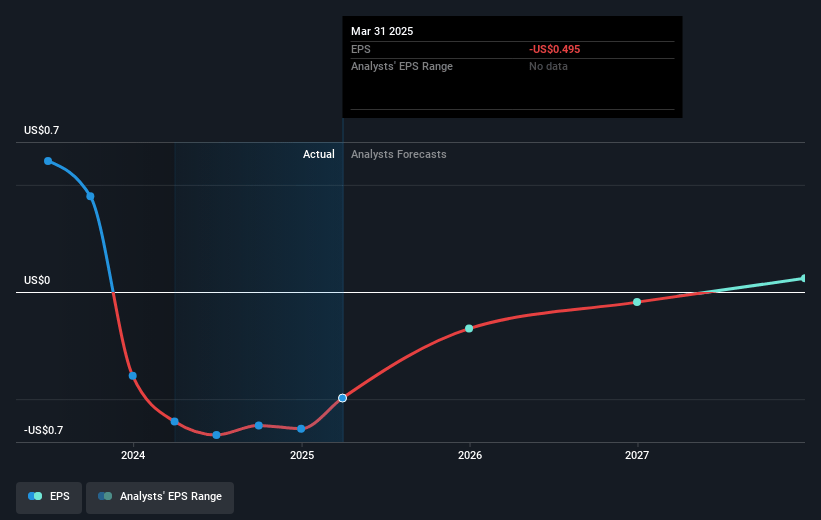

- If Piedmont Office Realty Trust's profit margin were to converge on the industry average, you could expect earnings to reach $49.1 million (and earnings per share of $0.39) by about May 2028, up from $-61.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 31.1x on those 2028 earnings, up from -11.6x today. This future PE is lower than the current PE for the US Office REITs industry at 64.8x.

- Analysts expect the number of shares outstanding to grow by 0.42% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.45%, as per the Simply Wall St company report.

Piedmont Office Realty Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The macroeconomic uncertainty mentioned during the call could slow down leasing activity and negatively impact future revenues and operating income.

- Net absorption turned negative again, and federal lease terminations may continue, particularly affecting the D.C. Metro market, which could influence occupancy rates and leasing revenues.

- The need for significant capital outlay to fund tenant improvements and leasing commissions, with a sizable percentage of the portfolio not paying cash rents, could strain liquidity and impede growth in earnings if not adequately managed.

- The company’s decision to suspend the dividend to fund growth reflects challenges in maintaining cash flow and leverage, which could affect investor sentiment and the company's overall financial stability.

- Broader economic uncertainties could delay or complicate asset dispositions, impacting the company's ability to generate revenue from non-core property sales and affecting net margins and financial flexibility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $9.333 for Piedmont Office Realty Trust based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $570.2 million, earnings will come to $49.1 million, and it would be trading on a PE ratio of 31.1x, assuming you use a discount rate of 9.4%.

- Given the current share price of $5.75, the analyst price target of $9.33 is 38.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.