Key Takeaways

- Growth in digital billboard and automated advertising suggests potential for higher future revenues amid expanding digital capabilities and technology investments.

- Reducing leverage and strategic investments in transit and AFFO growth indicate improved margins and financial stability.

- Heavy reliance on the New York MTA contract, leadership transition uncertainties, and high CAPEX needs could pressure margins, revenue growth, and investor confidence.

Catalysts

About OUTFRONT Media- OUTFRONT leverages the power of technology, location, and creativity to connect brands with consumers outside of their homes through one of the largest and most diverse sets of billboard, transit, and mobile assets in North America.

- OUTFRONT Media's continued growth in digital billboard revenues, driven by automated sales platforms which have increased their share from 14% to 20% of digital billboard revenues in 2024, suggests potential for higher future revenues as the digital and automated advertising trend continues to grow.

- The rebound in transit revenues, notably led by the New York MTA which grew nearly 12%, indicates potential for improved net margins and earnings as transit adjusted OIBDA has returned to positive territory, improving by nearly $20 million.

- The company's ongoing strategy to reduce leverage, having utilized proceeds from the sale of its Canadian business to decrease its leverage ratio from 5.4x to 4.7x, suggests improved future net margins and financial stability.

- Expanding digital capabilities with only 4.9% of total billboard inventory digitized provides further revenue growth opportunities as the company plans continued conversions of static to digital billboards.

- Expected mid-single-digit AFFO growth driven by OIBDA improvements in 2025 indicates potential earnings growth, supported by strategic investments in technology and a focus on capital expenditures for screen replacements and digital upgrades.

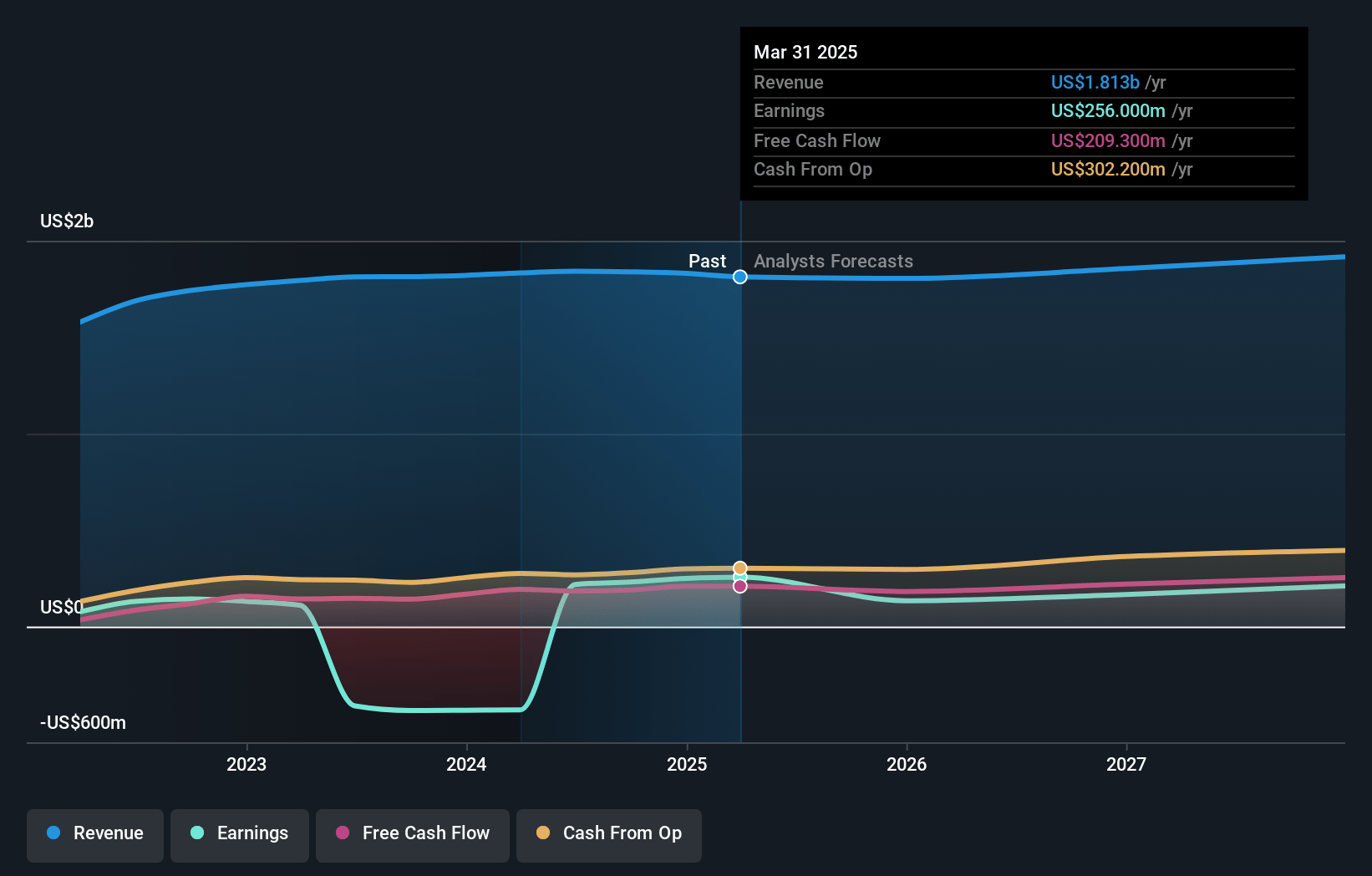

OUTFRONT Media Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming OUTFRONT Media's revenue will grow by 2.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 13.6% today to 8.6% in 3 years time.

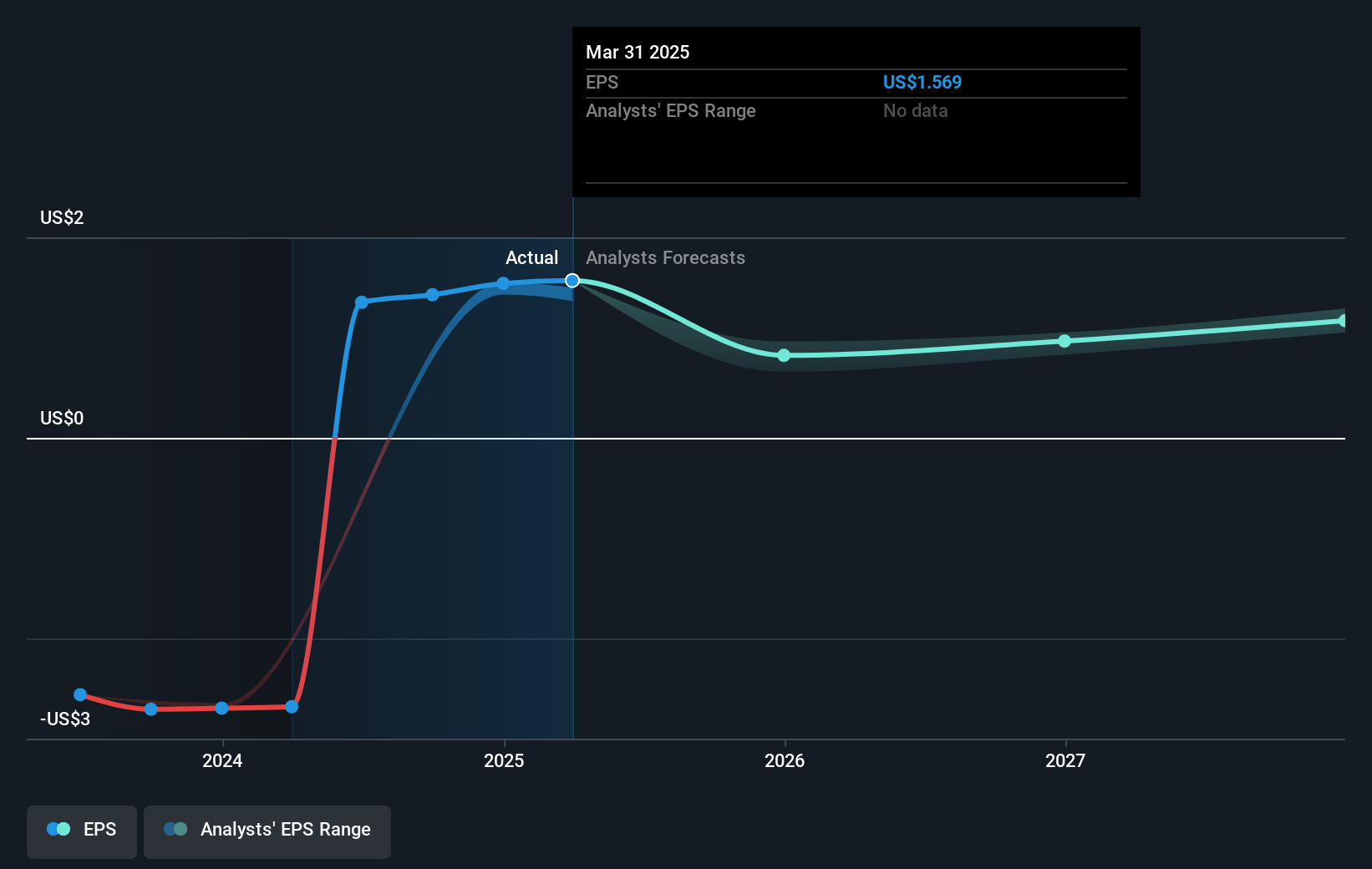

- Analysts expect earnings to reach $167.4 million (and earnings per share of $0.97) by about April 2028, down from $249.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.7x on those 2028 earnings, up from 10.3x today. This future PE is about the same as the current PE for the US Specialized REITs industry at 27.7x.

- Analysts expect the number of shares outstanding to grow by 3.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.82%, as per the Simply Wall St company report.

OUTFRONT Media Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's significant reliance on the New York MTA contract, which includes planned MAG payments that are increasing, could pressure net margins and OIBDA if expected revenues from this segment do not materialize as anticipated.

- Potential macroeconomic uncertainties, such as those affecting local ad growth and the soft ad growth in the CPG, health, medical, and alcohol sectors, could adversely impact revenue growth and earnings.

- The transition in leadership, with the retirement of long-time CEO Jeremy Male and the ongoing search for a permanent CEO, could potentially lead to strategic uncertainties, affecting overall earnings stability and investor confidence.

- The portfolio remains vulnerable to changes in ridership levels and potential disruptions in major transit markets like New York, which could impact transit revenue projections and consequently affect OIBDA and net earnings.

- The CAPEX requirements for replacing aging digital billboards and screens, including those from the MTA network, indicate a significant and ongoing capital expenditure expectation, which could constrain free cash flow and impact net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $19.667 for OUTFRONT Media based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $22.0, and the most bearish reporting a price target of just $17.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.0 billion, earnings will come to $167.4 million, and it would be trading on a PE ratio of 27.7x, assuming you use a discount rate of 8.8%.

- Given the current share price of $15.37, the analyst price target of $19.67 is 21.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.