Key Takeaways

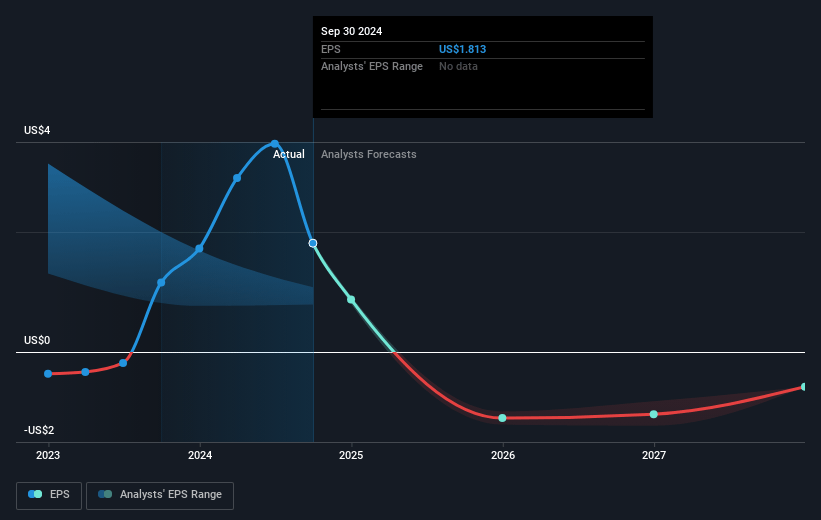

- Share repurchases and interest rate swaps are expected to enhance earnings stability and future earnings per share.

- Strategic asset management and property upgrades aim to drive revenue growth and improve rental demand and pricing power.

- NexPoint Residential Trust faces potential earnings pressure due to declining same-store rent, occupancy issues, and heightened competition impacting margins and asset profitability.

Catalysts

About NexPoint Residential Trust- NexPoint Residential Trust is a publicly traded REIT, with its shares listed on the New York Stock Exchange under the symbol "NXRT," primarily focused on acquiring, owning and operating well-located middle-income multifamily properties with "value-add" potential in large cities and suburban submarkets of large cities, primarily in the Southeastern and Southwestern United States.

- NexPoint Residential Trust is aggressively repurchasing shares, buying back 223,109 shares at an average price significantly below their estimated NAV midpoint, indicating potential for a higher future earnings per share due to reduced share count.

- The company is implementing additional interest rate swaps to lock in favorable rates, which should improve net margins and enhance earnings stability amid the volatile interest rate environment.

- Strategic capital recycling through potential asset dispositions and reinvestment in value-add properties positions NXRT to drive internal growth, potentially boosting future revenue and cash flow.

- Accelerated interior renovations and upgrades are resulting in notable rent increases with substantial ROI, likely to contribute to revenue growth across the portfolio as upgraded units achieve higher rents.

- Expected future decline in new supply across key submarkets where NXRT operates is anticipated to boost rental demand and pricing power, potentially enhancing net operating income and rental revenue growth.

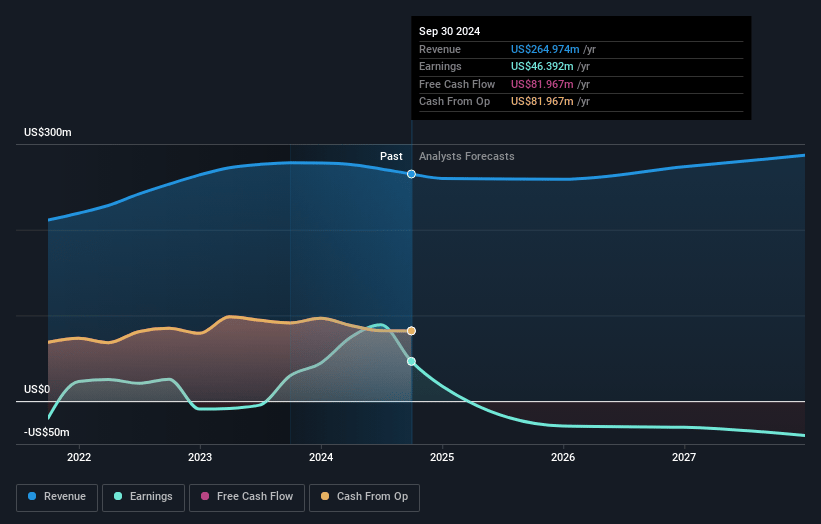

NexPoint Residential Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NexPoint Residential Trust's revenue will grow by 3.8% annually over the next 3 years.

- Analysts are not forecasting that NexPoint Residential Trust will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate NexPoint Residential Trust's profit margin will increase from -12.6% to the average US Residential REITs industry of 15.6% in 3 years.

- If NexPoint Residential Trust's profit margin were to converge on the industry average, you could expect earnings to reach $44.5 million (and earnings per share of $1.78) by about May 2028, up from $-32.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.4x on those 2028 earnings, up from -29.8x today. This future PE is lower than the current PE for the US Residential REITs industry at 40.3x.

- Analysts expect the number of shares outstanding to decline by 0.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.4%, as per the Simply Wall St company report.

NexPoint Residential Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- NexPoint Residential Trust has experienced a net loss of $6.9 million for Q1 2025, compared to a net income of $26.4 million for the same period in 2024, which might signal potential pressure on future earnings if this trend continues.

- Same-store rent and occupancy both decreased, resulting in a same-store NOI decline of 3.8% as compared to Q1 2024, primarily impacting the company's revenue generation from existing assets.

- Despite some regions showing strong occupancy, new supply delivers in certain key markets like Atlanta and DFW, possibly pressuring net margins and revenue growth as increased competition affects rental increases.

- The midpoint of the 2025 earnings guidance suggests a continued earnings loss and potentially points to challenges in managing costs, interest expenses, and asset profitability, which could weigh heavily on net margins.

- Some markets like Atlanta and DFW are experiencing weaker cap rates, which might affect the company’s ability to realize attractive net asset value (NAV) returns on asset sales, thereby impacting overall earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $42.429 for NexPoint Residential Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $50.0, and the most bearish reporting a price target of just $35.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $285.8 million, earnings will come to $44.5 million, and it would be trading on a PE ratio of 30.4x, assuming you use a discount rate of 8.4%.

- Given the current share price of $37.39, the analyst price target of $42.43 is 11.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.