Narratives are currently in beta

Key Takeaways

- RIDEA structure aims to enhance growth and revenue through active management, though it may initially increase costs affecting net margins.

- Deleveraging and improved liquidity position LTC for strategic investments, offering an optimistic outlook for future revenue growth.

- Strong financial position, increased liquidity, and potential RIDEA structure implementation position LTC Properties for growth and improved earnings through new investment opportunities.

Catalysts

About LTC Properties- LTC is a real estate investment trust (REIT) investing in seniors housing and health care properties primarily through sale-leasebacks, mortgage financing, joint-ventures and structured finance solutions including preferred equity and mezzanine lending.

- The company's focus on the RIDEA structure, which involves actively managing operations directly or in partnership, is anticipated to drive internal growth and external investment, potentially impacting future revenue positively.

- The potential conversion of $150 to $200 million of current triple net leases to RIDEA structures by the second quarter of next year is seen as a catalyst for growth in 2025, which may enhance earnings if executed efficiently.

- While RIDEA is expected to open up new investment opportunities, the platform's expansion could result in increased costs and overhead, potentially impacting net margins until the benefits of the transition are fully realized.

- The active pursuit of external growth through RIDEA structures could lead to competitive acquisition opportunities, which, if explored successfully, may improve the company's revenue trajectory.

- The substantial deleveraging and increased liquidity prepare LTC to capitalize on new investments, suggesting an optimistic outlook for future revenue growth via new strategic investments.

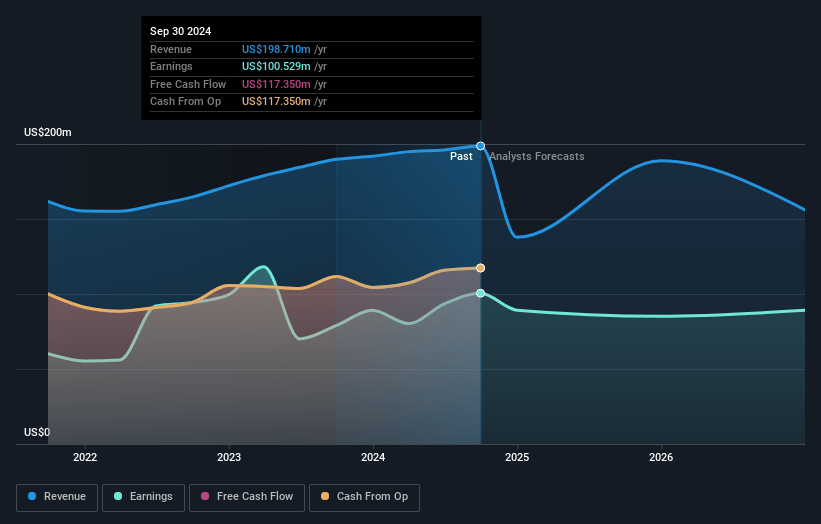

LTC Properties Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming LTC Properties's revenue will decrease by -7.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 50.6% today to 53.3% in 3 years time.

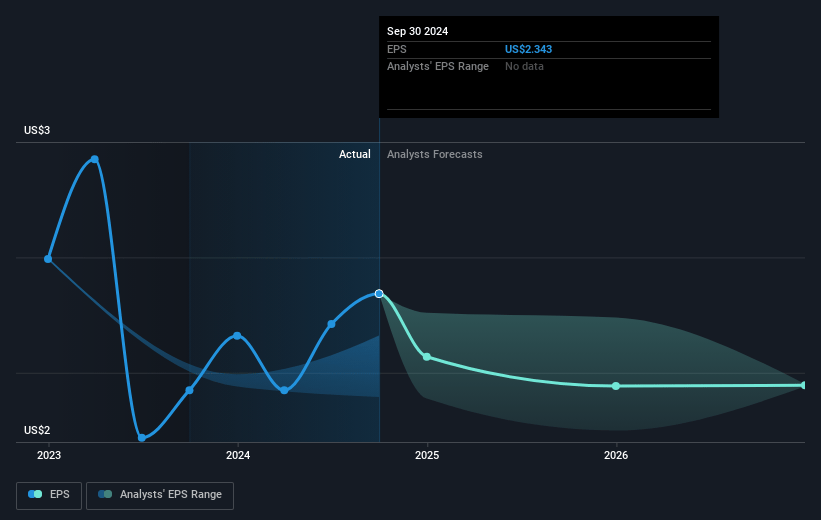

- Analysts expect earnings to reach $82.9 million (and earnings per share of $1.93) by about November 2027, down from $100.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.7x on those 2027 earnings, up from 17.4x today. This future PE is lower than the current PE for the US Health Care REITs industry at 45.6x.

- Analysts expect the number of shares outstanding to decline by 1.68% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.37%, as per the Simply Wall St company report.

LTC Properties Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company has successfully deleveraged its balance sheet, reducing its debt to EBITDA ratio and increasing its fixed charge coverage ratio, which positions it well to capitalize on new investment opportunities. This financial stability could positively impact earnings and net margins.

- LTC Properties has increased its liquidity to approximately $286 million, which provides significant flexibility to invest in growth opportunities. This strong liquidity position is likely to benefit revenue and earnings.

- The company is actively considering using the RIDEA structure, which could catalyze growth by increasing investment opportunities. Successful implementation of RIDEA could enhance revenue and net margins by capturing upside potential in operator performance.

- The company has received significant loan repayments and paydowns, resulting in increased cash available for redeployment into potentially accretive transactions. This could lead to higher earnings and an improved financial position.

- LTC's operators showed resilience during recent hurricanes, maintaining service levels and facing minimal property damage. This operational reliability supports stable revenue and earning prospects.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $36.83 for LTC Properties based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $42.0, and the most bearish reporting a price target of just $34.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $155.4 million, earnings will come to $82.9 million, and it would be trading on a PE ratio of 23.7x, assuming you use a discount rate of 7.4%.

- Given the current share price of $38.6, the analyst's price target of $36.83 is 4.8% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives