Narratives are currently in beta

Key Takeaways

- Successful RPT acquisition boosts operational synergies, enhancing future NOI and earnings growth.

- Strategic focus on larger-format properties and multifamily units supports revenue, NOI, and net margin improvements.

- Shifting focus from structured investments to ownership poses unforeseen risks that could affect revenue projections and financial outcomes amidst changing economic conditions.

Catalysts

About Kimco Realty- Kimco Realty (NYSE: KIM) is a real estate investment trust (REIT) and leading owner and operator of high-quality, open-air, grocery-anchored shopping centers and mixed-use properties in the United States.

- Kimco Realty's integration of the RPT acquisition has outperformed expectations, leading to enhanced operational synergies and higher than anticipated NOI projections, which can contribute to increased future NOI and earnings.

- The company's entitlement of 12,000 multifamily units ahead of schedule presents potential avenues for long-term growth through self-development, joint ventures, or sales, impacting revenues and net margins positively.

- The favorable supply and demand dynamics for high-quality retail locations portend strong leasing opportunities, potentially driving revenue growth and improving net margins as occupancy rates and lease spreads increase.

- Kimco's strategic shift towards acquiring larger-format properties with less competition can yield favorable pricing and returns, enhancing revenue and NOI growth from high-performing assets such as Waterford Lakes Town Center.

- The structured investment program provides a pipeline for potential fee ownership of high-quality assets, which could bolster earnings and NOI growth as these opportunities materialize and integrate into Kimco's portfolio.

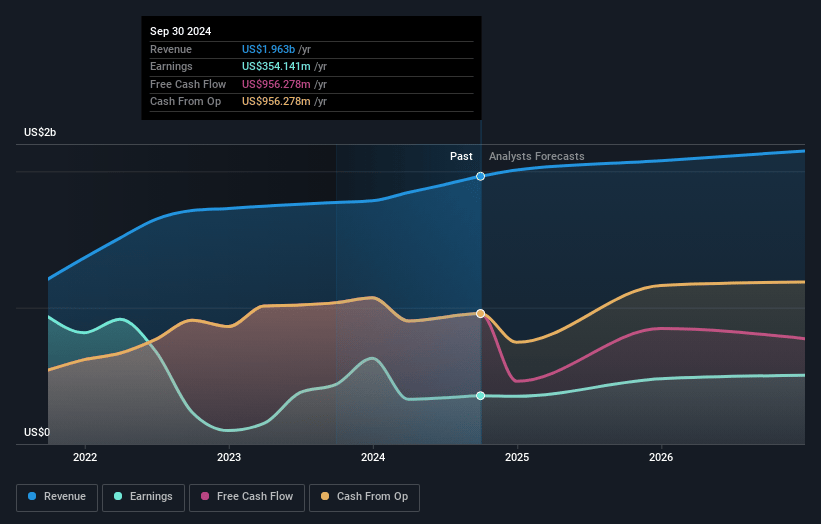

Kimco Realty Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kimco Realty's revenue will grow by 3.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 18.0% today to 22.3% in 3 years time.

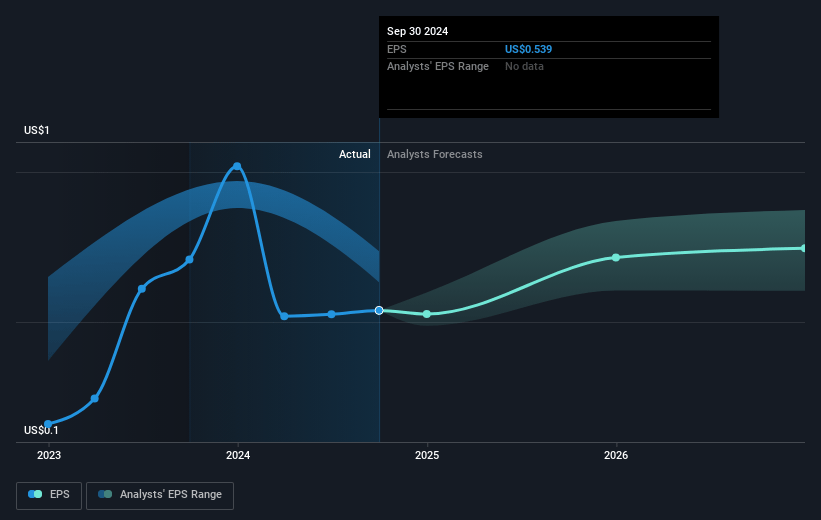

- Analysts expect earnings to reach $481.8 million (and earnings per share of $0.72) by about November 2027, up from $354.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $586.7 million in earnings, and the most bearish expecting $409.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 43.9x on those 2027 earnings, down from 47.7x today. This future PE is greater than the current PE for the US Retail REITs industry at 34.7x.

- Analysts expect the number of shares outstanding to decline by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.71%, as per the Simply Wall St company report.

Kimco Realty Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reliance on acquiring large-format properties, like Waterford Lakes, may bring execution risk and potential challenges in integrating and optimizing these assets, affecting NOI growth and return on investments.

- The expectation of a strong transaction environment with increased acquisition volumes may expose the company to potential overvaluation risks or adverse market conditions, impacting future revenue growth and FFO.

- The company's plan to shift focus from structured investments to ownership in the acquisition strategy could lead to unforeseen risks or mismatches in revenue projections, thereby impacting financial outcomes.

- Changes in the economic environment, such as potential inflationary pressures, may affect tenant operation costs and consumer behavior, possibly leading to higher tenant turnover and impacting rent spreads and occupancy levels.

- The possibility of fluctuations in interest rates and financial market conditions could impact the cost of debt and refinancing strategies, affecting net margins and overall liquidity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $25.35 for Kimco Realty based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $30.0, and the most bearish reporting a price target of just $20.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $2.2 billion, earnings will come to $481.8 million, and it would be trading on a PE ratio of 43.9x, assuming you use a discount rate of 7.7%.

- Given the current share price of $25.05, the analyst's price target of $25.35 is 1.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives