Narratives are currently in beta

Key Takeaways

- Increased liquidity and financial flexibility through equity offerings and credit facility expansion are expected to boost growth and earnings via strategic acquisitions.

- Strategic focus on high-demand Sun Belt markets and strong occupancy rates is projected to drive revenue and net margins growth.

- Economic shifts, interest rate changes, and geographic concentration risk could affect InvenTrust's revenues, earnings, refinancing, and market transactions.

Catalysts

About InvenTrust Properties- InvenTrust Properties Corp. (the "Company," "IVT," or "InvenTrust") is a premier Sun Belt, multi-tenant essential retail REIT that owns, leases, redevelops, acquires and manages grocery-anchored neighborhood and community centers as well as high-quality power centers that often have a grocery component.

- InvenTrust has raised approximately $250 million through a follow-on equity offering, boosting liquidity and providing capital for accretive investments, which is expected to positively impact future earnings.

- The company has expanded its unsecured credit facility by $150 million and extended its maturity, further enhancing liquidity and financial flexibility, which could lead to growth in revenues through strategic acquisitions.

- InvenTrust's focus on high-demand Sun Belt markets, combined with a near 100% occupancy rate for anchor tenants and increased leasing spreads, is projected to drive revenue growth.

- The company's strategy to acquire assets in high-growth markets, such as the recent purchases in Phoenix and Richmond, is expected to contribute positively to net margins through increased property net operating income.

- Robust demand in the strip center and Sun Belt retail space, alongside an occupancy rate of 97% and rising rent levels, positions InvenTrust for continued strong same-property NOI and FFO growth, enhancing earnings potential.

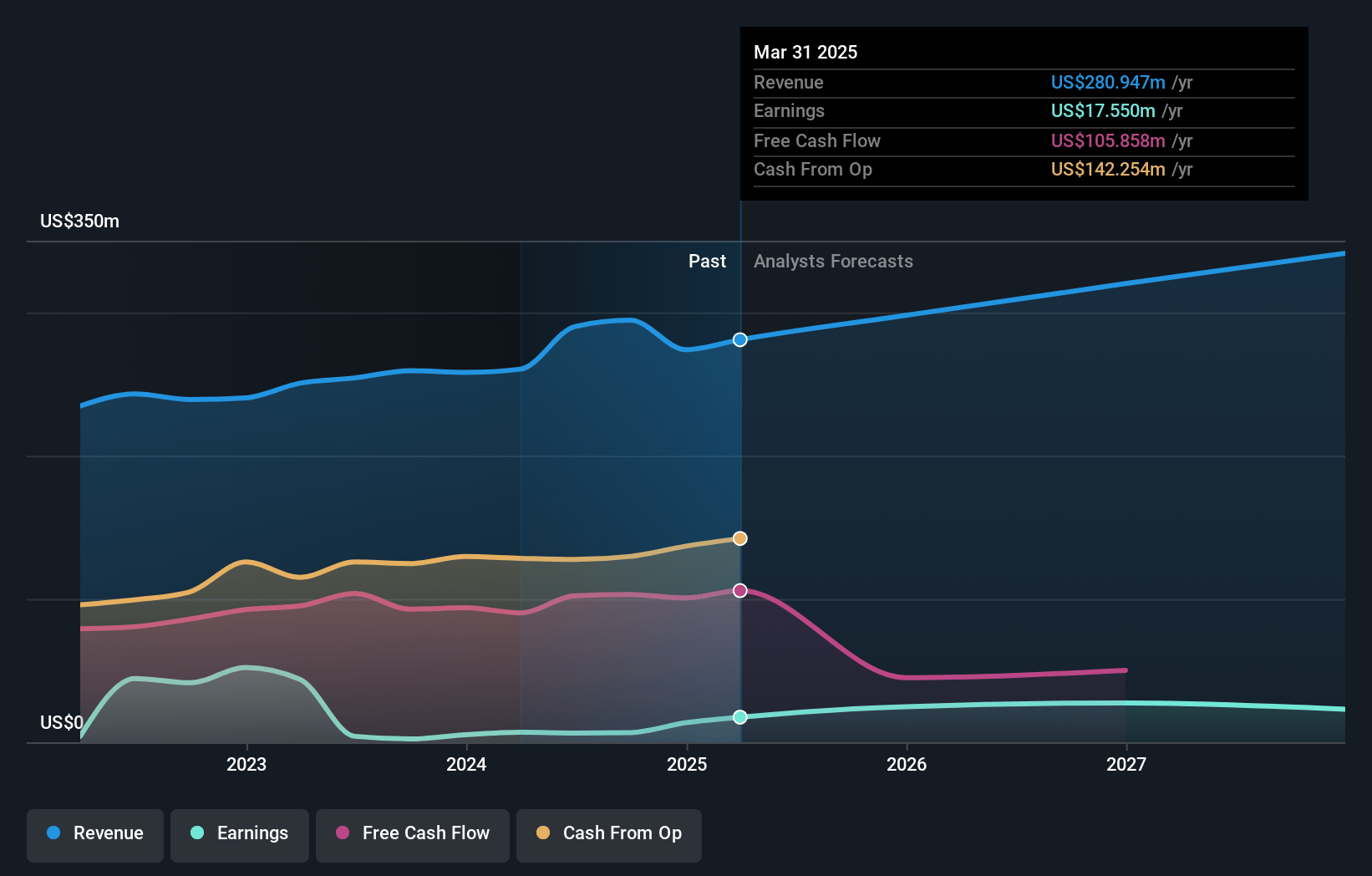

InvenTrust Properties Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming InvenTrust Properties's revenue will grow by 3.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.2% today to 8.2% in 3 years time.

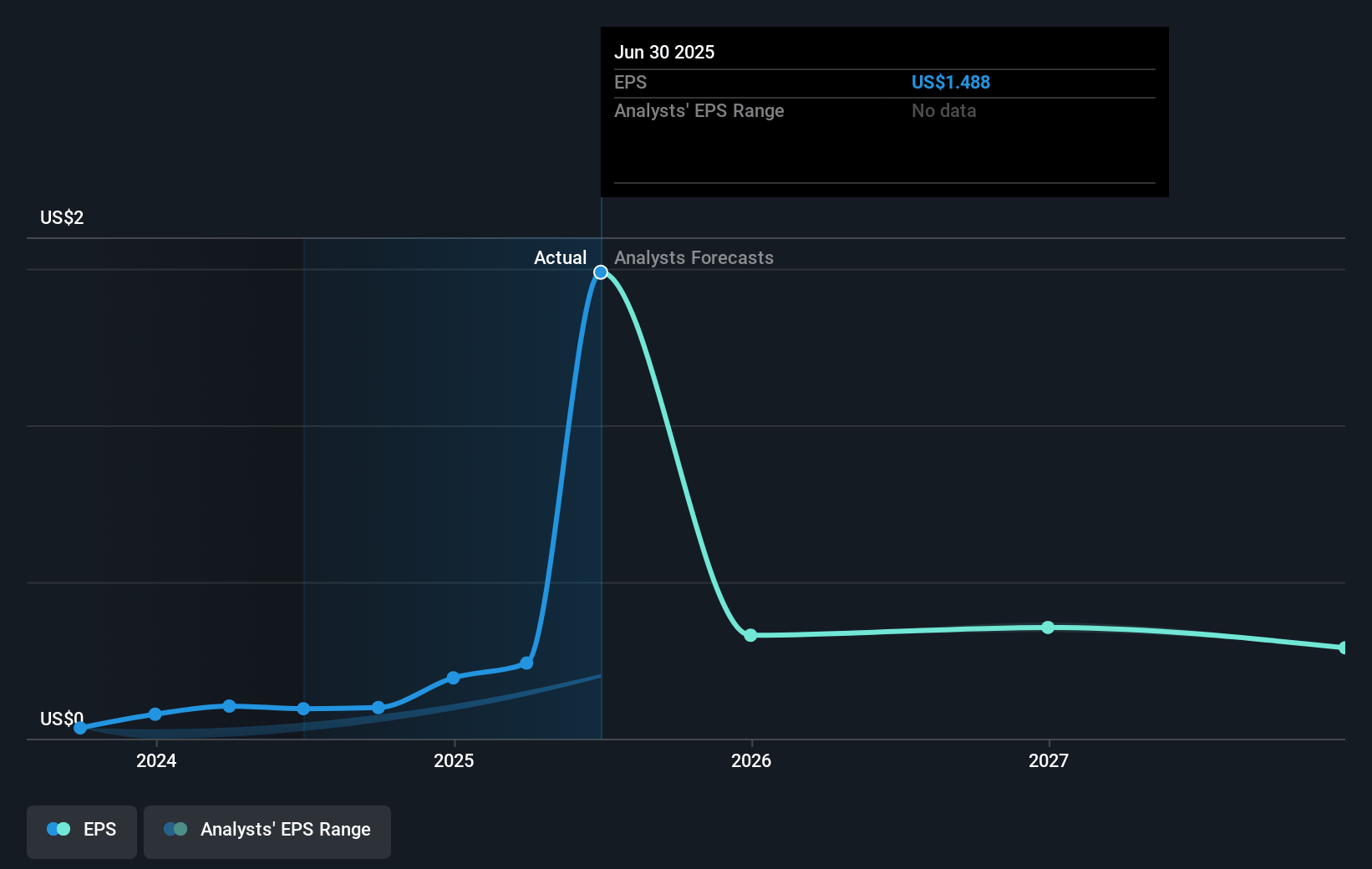

- Analysts expect earnings to reach $26.2 million (and earnings per share of $0.24) by about October 2027, up from $6.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 161.0x on those 2027 earnings, down from 351.1x today. This future PE is greater than the current PE for the US Retail REITs industry at 34.0x.

- Analysts expect the number of shares outstanding to grow by 12.23% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 7.23%, as per the Simply Wall St company report.

InvenTrust Properties Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reversal of interest rates could potentially dampen external opportunities, impacting the company's ability to engage in acquisitions and grow its portfolio, which could affect future revenue and earnings growth.

- While current tenant demand remains strong, potential changes in consumer behavior affecting discretionary spending could result in lower occupancy or rental income in sectors such as home goods and restaurants, impacting revenue.

- The reliance on Sun Belt markets, while beneficial in boom conditions, poses geographic concentration risk which could affect revenue if economic conditions shift unfavorably in that region.

- While interest rates are presently stable, a dependency on fixed rate debt with a weighted average rate of 4% and maturity of 3.6 years could expose InvenTrust to future refinancing risks or increase interest expenses, affecting net margins and earnings.

- External factors such as potential election uncertainties could impact market conditions and investor sentiment, potentially affecting company transactions and valuations, impacting earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $31.33 for InvenTrust Properties based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $318.8 million, earnings will come to $26.2 million, and it would be trading on a PE ratio of 161.0x, assuming you use a discount rate of 7.2%.

- Given the current share price of $29.43, the analyst's price target of $31.33 is 6.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives