Narratives are currently in beta

Key Takeaways

- Expansion into third-party management and joint ventures is intended to diversify and increase future revenue streams.

- Investments in technology and strategic partnerships aim to enhance customer satisfaction and drive revenue through improved services and offerings.

- Increased competition and supply pressures in key markets may reduce rental pricing and revenue growth, while climate and financial risks threaten profitability.

Catalysts

About Invitation Homes- Invitation Homes, an S&P 500 company, is the nation's premier single-family home leasing and management company, meeting changing lifestyle demands by providing access to high-quality, updated homes with valued features such as close proximity to jobs and access to good schools.

- Invitation Homes plans to expand its third-party management business and joint ventures, which covers over 25,000 homes, potentially increasing its revenue streams in the coming years.

- The company is focusing on external growth initiatives and investing in technological advancements to enhance the leasing experience, which could lead to higher overall customer satisfaction and, consequently, revenue growth.

- Strategic relationships with homebuilders and the expansion of value-add services like smart home technology and bundled Internet are expected to drive more than $60 million in gross revenue this year, presenting a potential area of revenue enhancement.

- With BTR (Build-to-Rent) supply pressures expected to be temporary due to anticipated reductions in new starts, there is potential for future rent growth once the market stabilizes, positively impacting the revenue side.

- The demographic catalysts, like the expected growth in renter households and an increasing number of people reaching 35 years old, imply a long-term increase in demand for rental homes, which could drive increases in occupancy, revenue, and earnings.

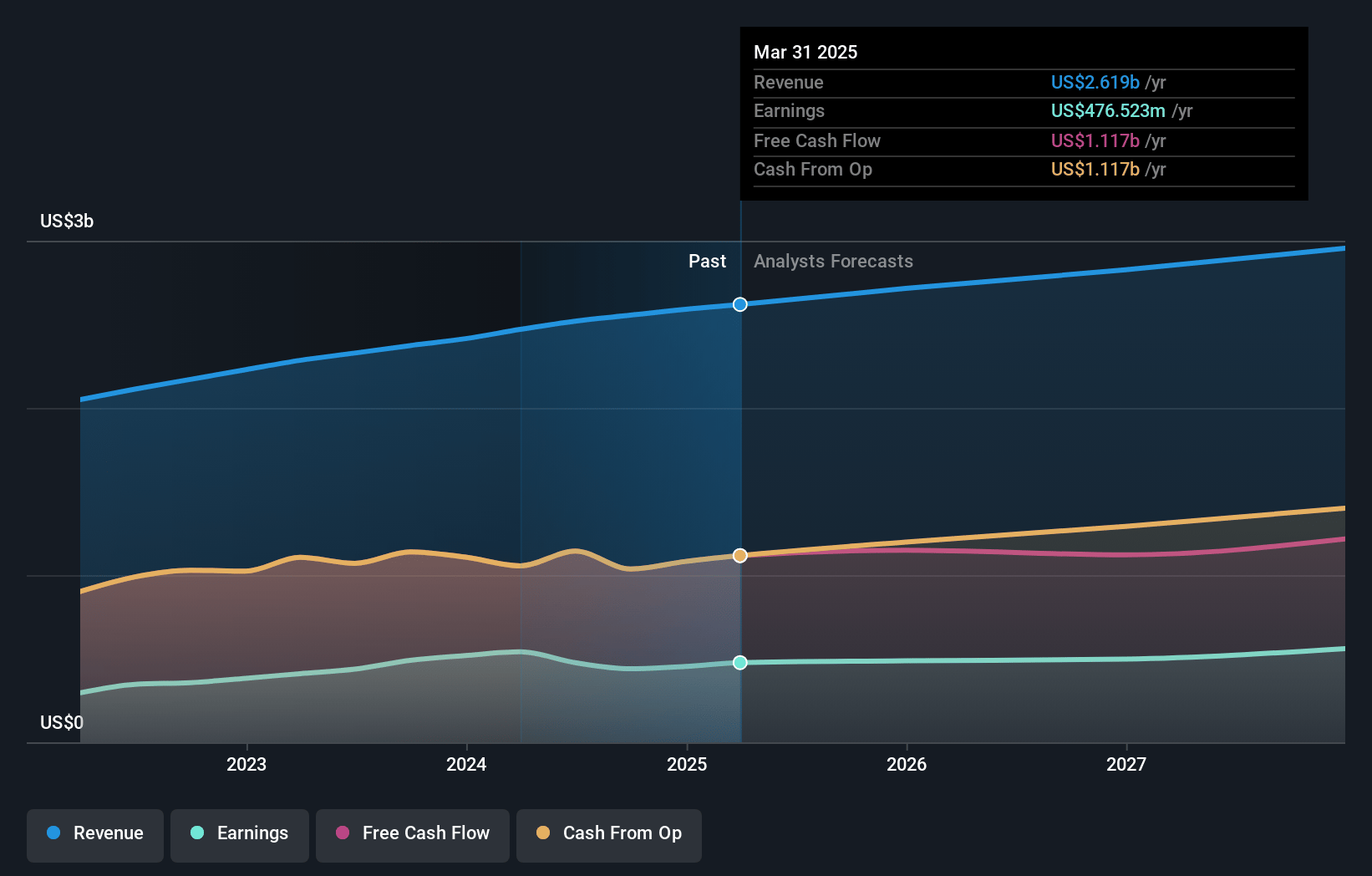

Invitation Homes Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Invitation Homes's revenue will grow by 6.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 17.2% today to 16.5% in 3 years time.

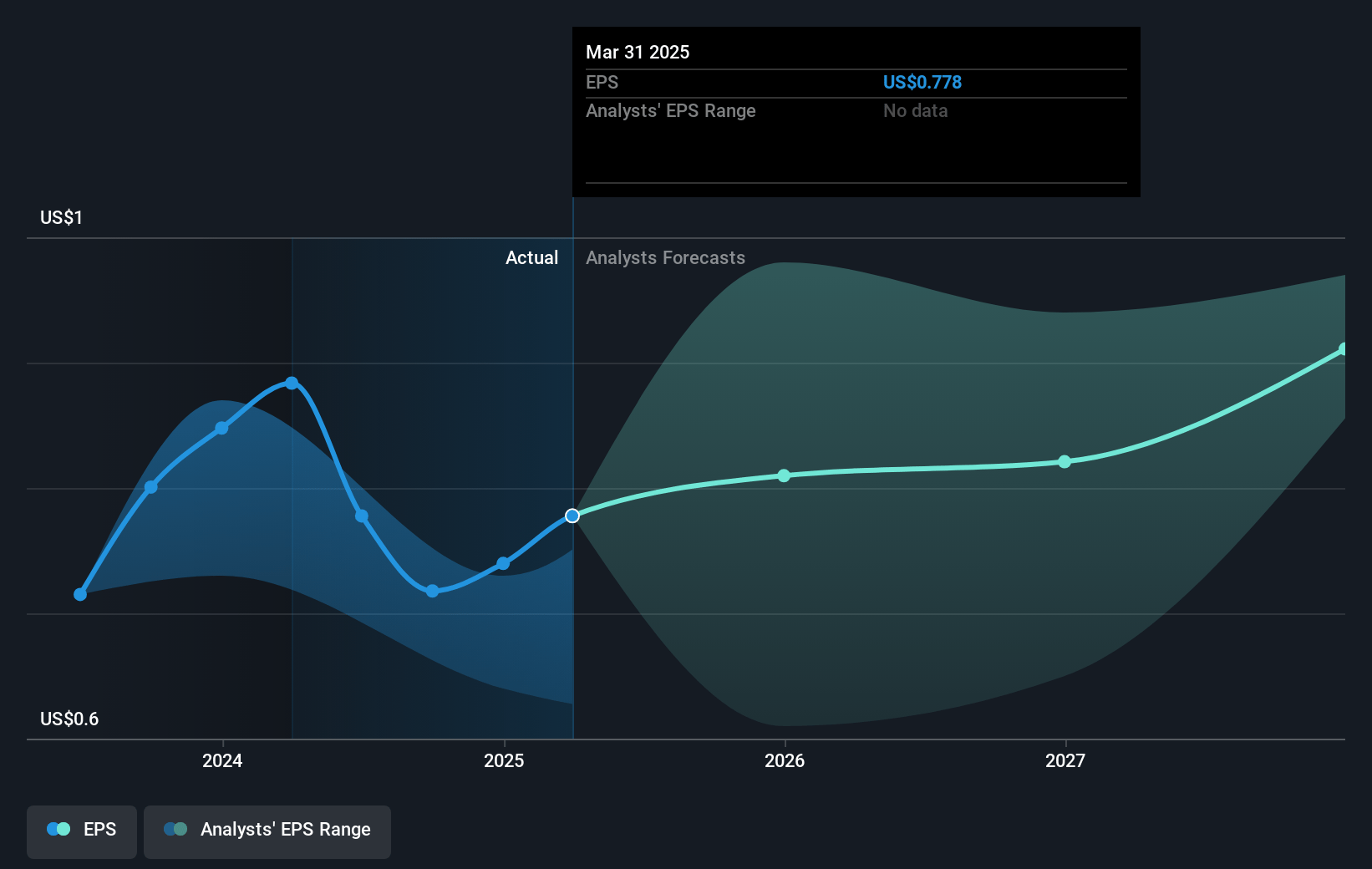

- Analysts expect earnings to reach $507.3 million (and earnings per share of $0.82) by about November 2027, up from $439.6 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $405 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 55.9x on those 2027 earnings, up from 47.3x today. This future PE is greater than the current PE for the US Residential REITs industry at 38.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.69%, as per the Simply Wall St company report.

Invitation Homes Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising supply pressures, especially from new build-to-rent (BTR) listings in key markets such as Phoenix, Tampa, Orlando, and Dallas, could lead to increased competition and downward pressure on rental pricing, adversely affecting revenue growth.

- The company's ability to negotiate its renewal rents is under pressure due to increased supply in certain markets, potentially impacting occupancy rates and revenue stability.

- Weather-related risks, such as frequent hurricanes, present ongoing costs and uncertainties in operational and property maintenance, which might negatively influence net margins.

- Future interest rate volatility and associated capital market risks could impact Invitation Homes’ financial flexibility and ability to finance growth initiatives, thereby affecting earnings.

- The concentration of investments and potential dislocations in markets like Florida may pose longer-term financial risks due to changing climate patterns and associated costs, potentially impacting overall profitability and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $37.95 for Invitation Homes based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $41.0, and the most bearish reporting a price target of just $33.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $3.1 billion, earnings will come to $507.3 million, and it would be trading on a PE ratio of 55.9x, assuming you use a discount rate of 6.7%.

- Given the current share price of $33.91, the analyst's price target of $37.95 is 10.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives