Narratives are currently in beta

Key Takeaways

- Improvement in travel demand and strategic asset sales are boosting occupancy rates, RevPAR, and earnings, enhancing portfolio quality and net margins.

- Better capital markets and reduced corporate leverage allow for external growth via acquisitions, indicating potential for future revenue and earnings increases.

- Challenges include revenue stability risks from hurricanes, market challenges in urban areas, and dependency on special event demand affecting consistent earnings.

Catalysts

About Summit Hotel Properties- A publicly traded real estate investment trust focused on owning premium-branded lodging properties with efficient operating models primarily in the upscale segment of the lodging industry.

- The continued strength of group demand and improvement in business transient travel are expected to drive higher weekday occupancy and average rates in urban and suburban markets, leading to an increase in RevPAR and revenue growth.

- Summit Hotel Properties has completed strategic sales of lower-performing assets, reducing capital expenditure needs and improving the quality of the portfolio, which should enhance net margins and earnings.

- The company is benefiting from a moderation in labor cost growth and improved employee retention, which contributes to a more stable and efficient cost structure, facilitating better net margins and earnings growth.

- The identification of key markets with higher growth profiles where Summit has an advantageous position signals potential for above-average RevPAR and EBITDA growth, particularly in markets like New Orleans and San Jose, boosting future earnings.

- The improving capital markets conditions and reduction in corporate leverage enhance Summit's capacity for external growth through acquisitions, potentially increasing future revenue and earnings.

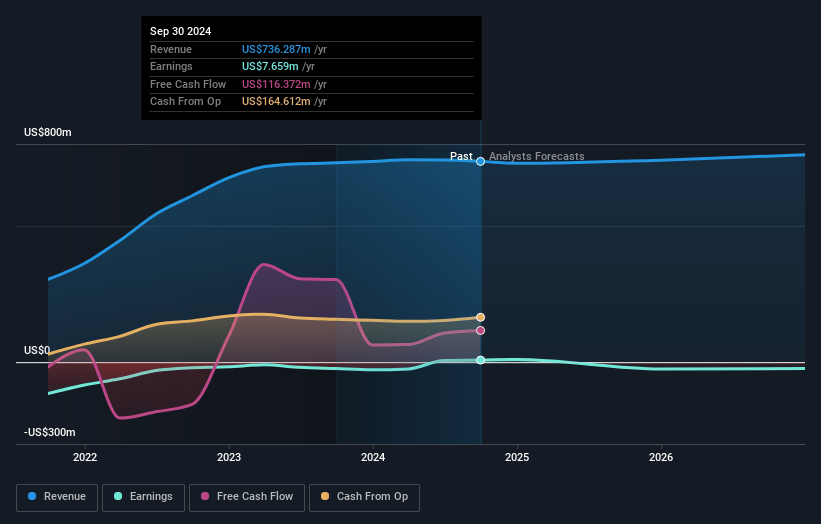

Summit Hotel Properties Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Summit Hotel Properties's revenue will grow by 1.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 1.0% today to 0.4% in 3 years time.

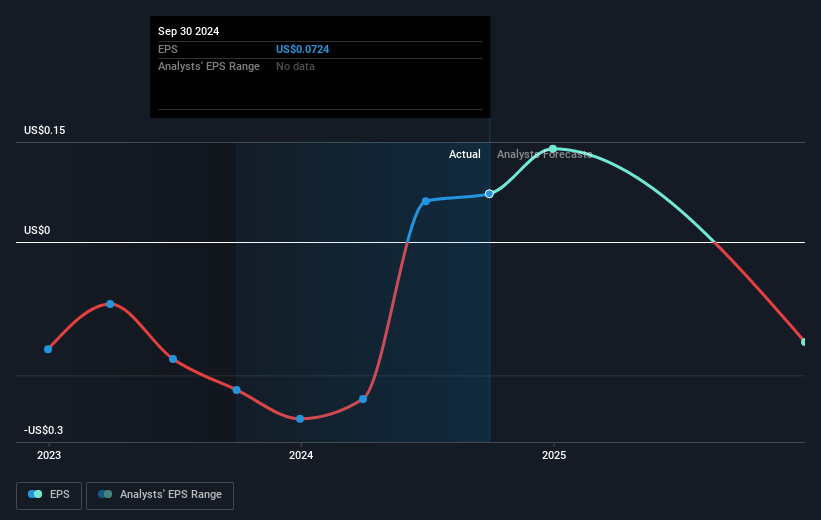

- Analysts expect earnings to reach $3.1 million (and earnings per share of $-0.07) by about November 2027, down from $7.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 405.4x on those 2027 earnings, up from 92.2x today. This future PE is greater than the current PE for the US Hotel and Resort REITs industry at 19.4x.

- Analysts expect the number of shares outstanding to grow by 0.66% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.2%, as per the Simply Wall St company report.

Summit Hotel Properties Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Recent hurricanes displaced revenue and reduced RevPAR growth, impacting third quarter EBITDA by approximately $300,000, which poses a risk to revenue stability and earnings.

- The sale of lower-performing hotels might have a positive impact on liquidity and average portfolio quality, but also reflects challenges in certain markets that may affect future revenues and net margins if not managed correctly.

- San Francisco's continued struggle with a weak convention calendar and lack of international travel highlights risks in specific urban markets, potentially affecting occupancy, RevPAR, and earnings.

- With third quarter EBITDA decreasing by 3% year-over-year due to occupancy contraction, the company faces challenges in maintaining revenue growth and managing future earnings consistency.

- Dependency on special event demand and fluctuating travel patterns creates an unstable revenue environment, posing a risk to achieving consistent earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $7.5 for Summit Hotel Properties based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $9.0, and the most bearish reporting a price target of just $6.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $765.8 million, earnings will come to $3.1 million, and it would be trading on a PE ratio of 405.4x, assuming you use a discount rate of 10.2%.

- Given the current share price of $6.51, the analyst's price target of $7.5 is 13.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives