Key Takeaways

- Strategic renovations and urban market focus position the company to benefit from rising travel demand and shifting consumer preferences.

- Operational efficiencies, brand partnerships, and strong capital management enhance margin resilience and potential shareholder value.

- Weak demand, policy uncertainty, and limited investment constrain revenue growth and margins, while geographic concentration increases vulnerability to economic volatility in key markets.

Catalysts

About Summit Hotel Properties- A publicly traded real estate investment trust focused on owning premium-branded lodging facilities with efficient operating models primarily in the upscale segment of the lodging industry.

- Strong recent and ongoing portfolio investment—including high-return renovations in key leisure and Sunbelt markets—positions Summit to capture outsized future revenue growth and improved net margins as U.S. domestic travel demand and ‘experience-first’ consumer preferences continue to rise.

- Almost half of Summit’s rooms are in urban centers benefiting from the return and growth of group, business, and convention travel, supporting future occupancy and rate expansion as business and ‘bleisure’ travel trends accelerate, directly impacting top-line revenue.

- The company’s operational focus on contract labor reductions, improved employee retention, and lean cost controls enhance margin resilience, suggesting significant upside to net earnings as fixed expense leverage works in their favor when RevPAR growth returns to historical norms.

- Ongoing partnerships with major hotel brands and recent repositioning of flagship assets (e.g., Marriot Courtyard Oceanside) improve pricing power and loyalty-driven direct bookings, which reduces distribution costs and boosts long-term margins.

- Management’s ability to opportunistically deploy capital via hotel investments, measured CapEx reductions, and a newly launched share repurchase program—backed by a strong balance sheet and extended debt maturities—creates additional upside potential for earnings per share and shareholder returns.

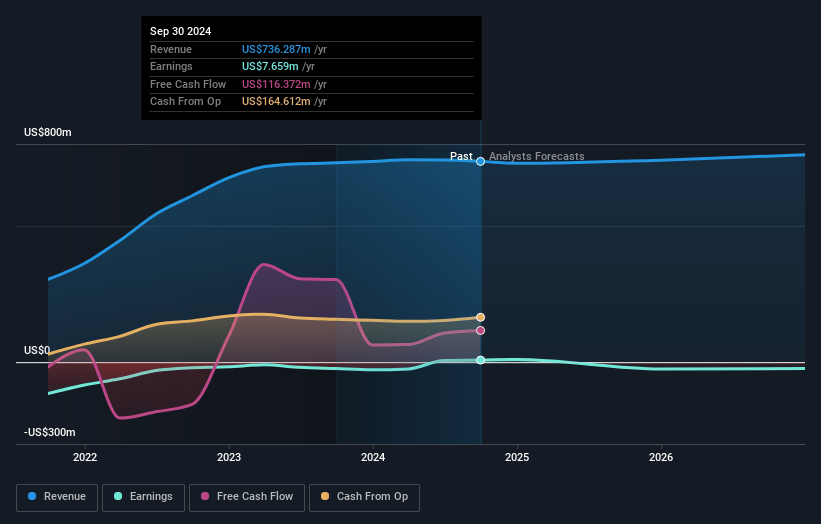

Summit Hotel Properties Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Summit Hotel Properties's revenue will grow by 3.1% annually over the next 3 years.

- Analysts are not forecasting that Summit Hotel Properties will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Summit Hotel Properties's profit margin will increase from 3.1% to the average US Hotel and Resort REITs industry of 3.4% in 3 years.

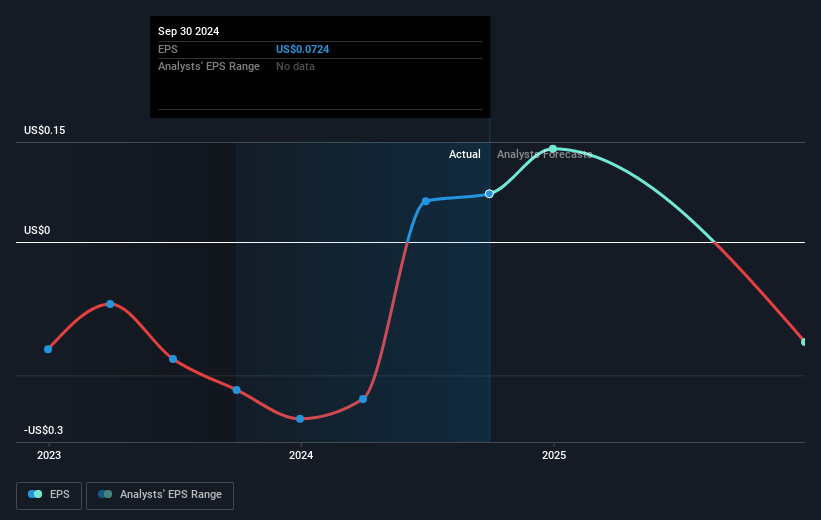

- If Summit Hotel Properties's profit margin were to converge on the industry average, you could expect earnings to reach $27.3 million (and earnings per share of $0.22) by about May 2028, up from $22.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 45.6x on those 2028 earnings, up from 21.8x today. This future PE is greater than the current PE for the US Hotel and Resort REITs industry at 25.0x.

- Analysts expect the number of shares outstanding to grow by 1.01% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Summit Hotel Properties Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Softening demand in government and international segments has materially reduced RevPAR in key markets, and future recovery in these segments is uncertain, impacting both revenue and earnings growth.

- Management notes a need to shift mix towards lower-rated and discount channels (including OTAs) due to weak demand in higher-yield segments, which puts sustained downward pressure on average daily rates and net margins.

- Persistent macroeconomic and policy uncertainty is leading to shorter booking windows, special event-driven volatility, and negative RevPAR guidance for Q2, implying limited near-term pricing power and sluggish top-line revenue growth.

- Continued reliance on cost controls and reduced CapEx (a 15% cut for 2025) may limit the company’s ability to fully invest in asset upgrades, potentially reducing future competitiveness and long-term asset value appreciation, impacting future revenue and margins.

- High geographic concentration in urban and Sunbelt/secondary markets exposes Summit to localized economic shocks and labor market volatility, which could exacerbate RevPAR swings and compress property-level earnings during downturns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $7.125 for Summit Hotel Properties based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $798.3 million, earnings will come to $27.3 million, and it would be trading on a PE ratio of 45.6x, assuming you use a discount rate of 11.4%.

- Given the current share price of $4.51, the analyst price target of $7.12 is 36.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.