Narratives are currently in beta

Key Takeaways

- Getty Realty's continued investment in sale-leaseback transactions and redevelopment opportunities is expected to drive revenue growth with favorable lease terms and enhanced property utilization.

- Strong capital raising positions Getty Realty to fund investments and refinance debt, ensuring future earnings growth and long-term financial stability.

- Reliance on direct sale-leaseback and competitive pressures may impact Getty Realty's revenue growth, transaction volumes, and financial stability amid rising interest rates and market competition.

Catalysts

About Getty Realty- A publicly traded, net lease REIT specializing in the acquisition, financing and development of convenience, automotive and other single tenant retail real estate.

- Getty Realty's investment activity in direct sale-leaseback transactions within the convenience and automotive retail sectors is expected to continue, driving revenue growth and potentially improving earnings through favorable lease terms with new and existing tenants.

- The company's ability to identify redevelopment opportunities within its portfolio and sign new leases with automotive service tenants such as Take 5 Oil indicates potential revenue growth through increased rent commencement and enhanced property utilization.

- With the recent successful capital raising of over $245 million, including common equity and unsecured notes, Getty Realty is positioned to fund its investment pipeline and refinance near-term debt maturities, supporting future earnings growth and financial stability.

- The extension of material unitary leases and increased weighted average lease terms to over 10 years signal strong tenant commitment and provide long-term revenue stability, which can have a positive impact on net margins by reducing tenant turnover and associated risks.

- The company’s strategic focus on essential use assets in growing and fragmented convenience and automotive retail sectors, coupled with its expertise and strong tenant relationships, positions it well for capturing future acquisition opportunities and enhancing overall financial performance through diversified and resilient revenue streams.

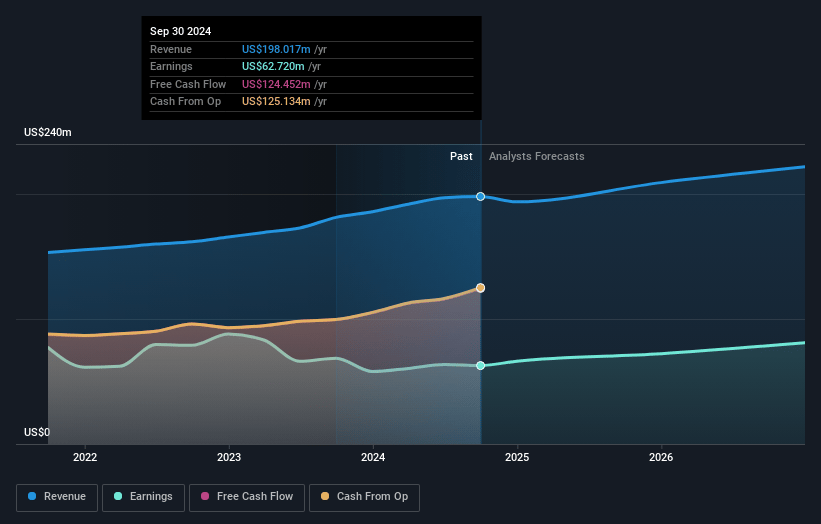

Getty Realty Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Getty Realty's revenue will grow by 5.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 31.7% today to 37.8% in 3 years time.

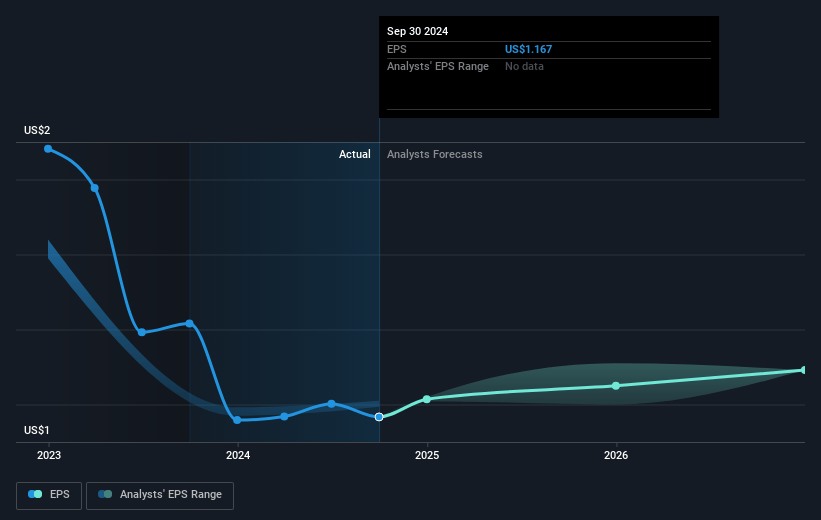

- Analysts expect earnings to reach $87.3 million (and earnings per share of $1.34) by about November 2027, up from $62.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 31.2x on those 2027 earnings, up from 28.8x today. This future PE is lower than the current PE for the US Retail REITs industry at 34.7x.

- Analysts expect the number of shares outstanding to grow by 5.88% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.65%, as per the Simply Wall St company report.

Getty Realty Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Getty Realty's reliance on a direct sale-leaseback model may expose it to uneven transaction terms and the competitive pricing environment, impacting potential revenue expansion and acquisition costs.

- The company faces a disconnect between buyers and sellers in the real estate market, with lingering material bid-ask spreads that could affect future transaction volumes and cap rate stability, potentially influencing revenue growth and investment returns.

- Potential rising interest rates and macroeconomic uncertainties, such as lingering economic volatility and upcoming elections, may impact the company's capital costs and the ability to maintain favorable debt financing, thereby affecting net margins.

- Competition from other investors and public companies entering the convenience and automotive retail sectors could erode Getty Realty's market share and pricing power, thereby threatening revenue streams and future investment opportunities.

- The timing of redeveloping properties and the associated costs, such as anticipated demolition expenses, could introduce variability into Getty Realty’s operating expenses, potentially affecting net earnings and financial performance stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $33.6 for Getty Realty based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $230.8 million, earnings will come to $87.3 million, and it would be trading on a PE ratio of 31.2x, assuming you use a discount rate of 7.6%.

- Given the current share price of $32.81, the analyst's price target of $33.6 is 2.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives