Key Takeaways

- Strong tenant demand and increased leasing volumes indicate potential revenue and earnings growth from high occupancy and rent rates.

- Strategic expansions, including redevelopment projects and acquisitions, aim to enhance income streams and drive long-term growth.

- Regulatory changes, competitive acquisition pressures, rising interest rates, and tenant risks could impact Federal Realty's revenue growth, net margins, and financial stability.

Catalysts

About Federal Realty Investment Trust- Federal Realty is a recognized leader in the ownership, operation and redevelopment of high-quality retail-based properties located primarily in major coastal markets from Washington, D.C.

- Federal Realty has achieved record leasing volumes with significant rent increases, indicating strong tenant demand that could drive revenue growth in 2025 and beyond.

- The company's occupancy rates have improved significantly, with expectations of further increases in 2025, suggesting potential for higher revenue and earnings from stabilized assets.

- Federal Realty is seeing increased interest and leasing activity in its office components, such as Santana West and 915 Meeting Street, which may contribute to revenue growth starting in 2026 as leases commence.

- The company has a robust pipeline of redevelopment and expansion projects, like those at Bala Cynwyd, Hoboken, and Andorra Shopping Center, expected to yield high returns and enhance future income streams.

- Federal Realty's strategic acquisitions, like the upcoming purchase of a shopping center in Northern California, are poised to complement its portfolio and drive earnings growth by adding high-quality, under-managed assets.

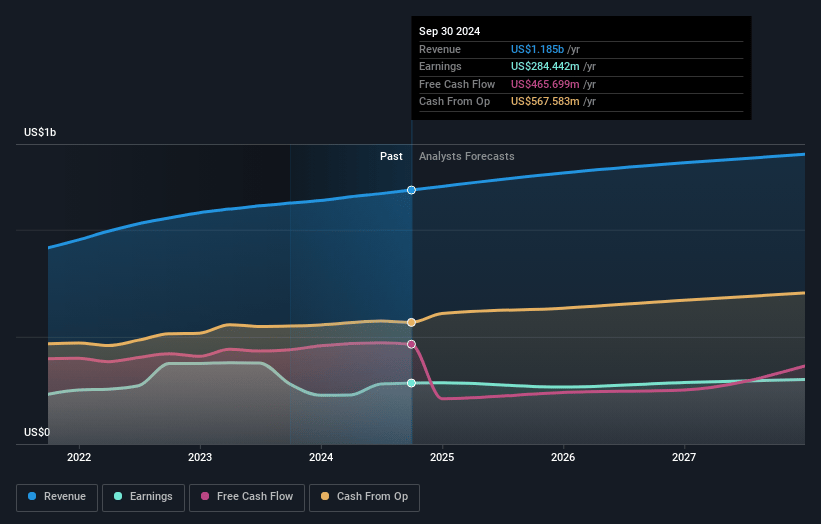

Federal Realty Investment Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Federal Realty Investment Trust's revenue will grow by 5.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 23.7% today to 21.2% in 3 years time.

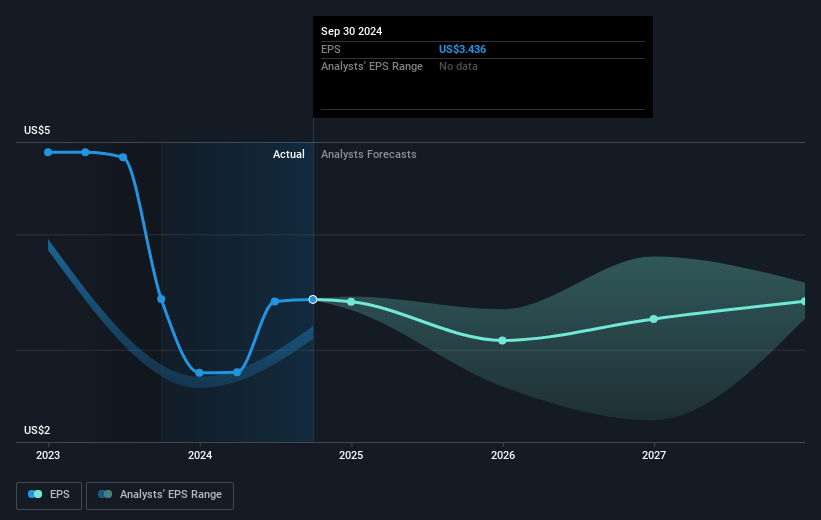

- Analysts expect earnings to reach $296.9 million (and earnings per share of $3.44) by about March 2028, up from $285.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 48.6x on those 2028 earnings, up from 29.2x today. This future PE is greater than the current PE for the US Retail REITs industry at 32.4x.

- Analysts expect the number of shares outstanding to grow by 3.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.1%, as per the Simply Wall St company report.

Federal Realty Investment Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Uncertainty surrounding a new administration in Washington could bring about changes in regulatory and economic policies, potentially impacting Federal Realty's future revenue growth and net margins.

- Competition in the acquisition market is intensifying, which may lead to higher prices for desirable assets and could pressure the company's ability to achieve targeted returns on investment, affecting its earnings.

- Increasing interest rates have led to higher interest expenses, which, if they continue to rise, could compress net margins and adversely affect overall financial performance.

- The reliance on large-format acquisitions in competitive markets might pose execution risks, potentially affecting revenue stability if anticipated growth or value creation from these acquisitions does not materialize.

- Potential exposure to tenant bankruptcies and retail sector volatility, despite minimal current impact, could introduce credit risk and uncertainty, possibly affecting future revenue and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $120.353 for Federal Realty Investment Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $142.0, and the most bearish reporting a price target of just $105.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $296.9 million, and it would be trading on a PE ratio of 48.6x, assuming you use a discount rate of 8.1%.

- Given the current share price of $97.28, the analyst price target of $120.35 is 19.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.