Narratives are currently in beta

Key Takeaways

- Declines in new developments and expirations of key leases could hinder future revenue and rental rate increases, creating uncertainty in occupancy and net margins.

- Development delays and limited transactional activities could constrain revenue growth, with regulatory changes impacting long-term growth in attractive markets.

- Strategic management and solid operating metrics suggest First Industrial Realty Trust is well-positioned for sustained revenue and earnings growth with reduced financial risks.

Catalysts

About First Industrial Realty Trust- First Industrial Realty Trust, Inc. (NYSE: FR) is a leading U.S.-only owner, operator, developer and acquirer of logistics properties.

- The decline in new industrial development starts and completions, alongside the absorption of existing supply, could lead to reduced future revenue growth in key markets, impacting long-term rental rate increases.

- The expiration of key leases and reliance on a subletting strategy, as seen with boohoo, could create uncertainty in occupancy rates and impact net margins due to potential disruptions in consistent rental income.

- Lagging leasing activity in the development portfolio, with expectations for fourth quarter completions to delay into 2025, could negatively impact 2025 revenue contributions from new developments.

- With a focus on dispositions of lower-growth properties and potential shifts in acquisition strategy amid current market conditions, revenue growth could be constrained if transactional activities remain limited.

- The implementation of California's AB 98 law could restrict future development supply and, while potentially benefitting existing property values, could limit the company's long-term growth in attractive markets by impacting future land acquisition strategies.

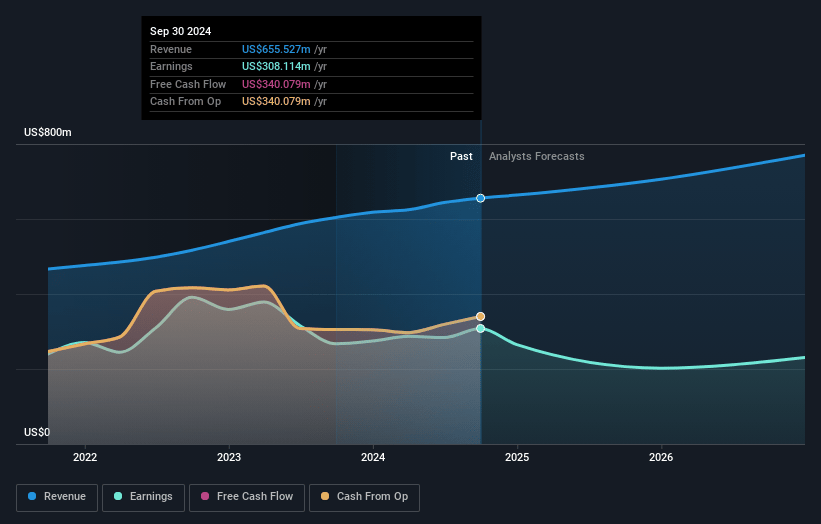

First Industrial Realty Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming First Industrial Realty Trust's revenue will grow by 8.6% annually over the next 3 years.

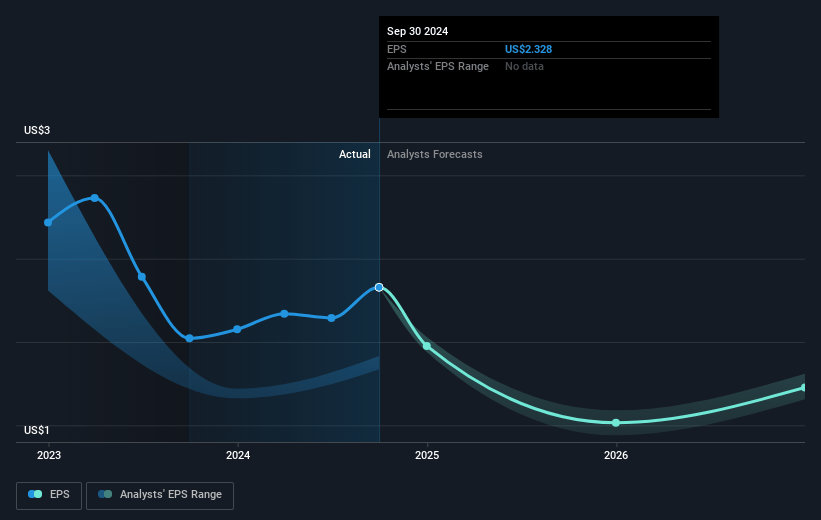

- Analysts assume that profit margins will shrink from 47.0% today to 30.8% in 3 years time.

- Analysts expect earnings to reach $258.7 million (and earnings per share of $1.93) by about October 2027, down from $308.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.7x on those 2027 earnings, up from 23.6x today. This future PE is lower than the current PE for the US Industrial REITs industry at 37.0x.

- Analysts expect the number of shares outstanding to decline by 0.44% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 6.75%, as per the Simply Wall St company report.

First Industrial Realty Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company demonstrated strong cash flow growth from contractual lease escalations and new leases, showing a healthy revenue pipeline that may suggest stability or growth in revenue moving forward.

- Their operating metrics remain solid, with high lease renewal rates and significant cash rental rate increases, indicating the potential for sustained high net margins.

- A disciplined approach to new project development and strategic acquisitions in attractive markets potentially positions First Industrial to enhance long-term earnings and asset value.

- The portfolio is well-managed with notable lease-up opportunities and high occupancy rates, which can support consistent revenue generation and reduce the downside risk to earnings.

- Strong balance sheet management, with no debt maturities until 2026, provides financial flexibility and reduces interest expense risk, supporting stable net margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $58.31 for First Industrial Realty Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $64.0, and the most bearish reporting a price target of just $42.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $840.7 million, earnings will come to $258.7 million, and it would be trading on a PE ratio of 36.7x, assuming you use a discount rate of 6.8%.

- Given the current share price of $55.0, the analyst's price target of $58.31 is 5.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives