Key Takeaways

- Strategic new developments in high-demand areas and acquisitions above market yields may enhance earnings and net margins.

- Proactive debt management and high occupancy rates position the company well for stable future growth and consistent cash flow.

- Trade uncertainties and geopolitical tensions may impact occupancy, leasing, and growth, potentially leading to financial pressures and missed targets.

Catalysts

About First Industrial Realty Trust- First Industrial Realty Trust, Inc. (NYSE: FR) is a leading U.S.-only owner, operator, developer and acquirer of logistics properties.

- First Industrial Realty Trust is targeting a 30% to 40% overall cash rental rate growth for 2025, which could drive significant revenue growth if achieved.

- The company plans new construction starts in areas with unmet demand, such as the 176,000 square foot facility in the Dallas submarket targeting an 8% cash yield, indicating potential for strong future earnings.

- First Industrial's recent acquisition of two fully leased developments in Phoenix at a 6.4% cash yield, above market caps, suggests potential enhancements to net margins and earnings as these investments stabilize.

- The company's proactive management of debt, including extended maturities and increased credit facilities, provides financial flexibility to support future growth initiatives.

- With 95.3% in-service occupancy and continued progress on 2025 rollovers, First Industrial is well-positioned to maintain stable occupancy levels and consistent cash flow, positively impacting future earnings.

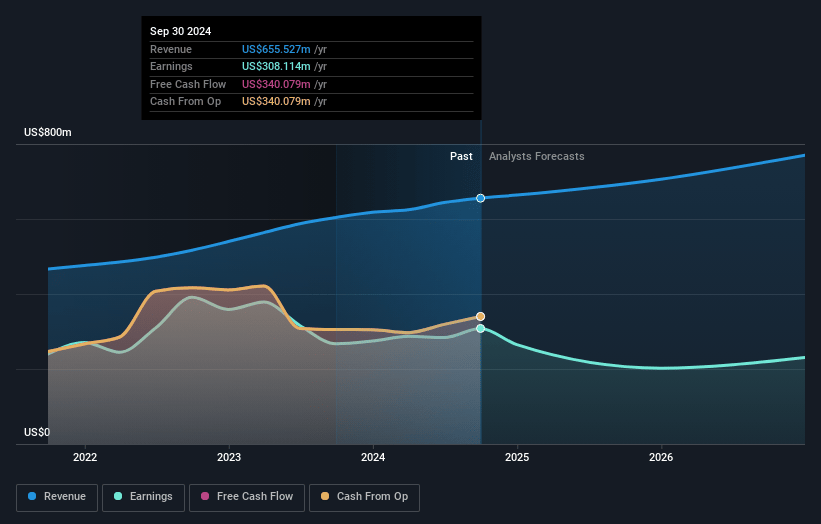

First Industrial Realty Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming First Industrial Realty Trust's revenue will grow by 7.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 38.9% today to 30.1% in 3 years time.

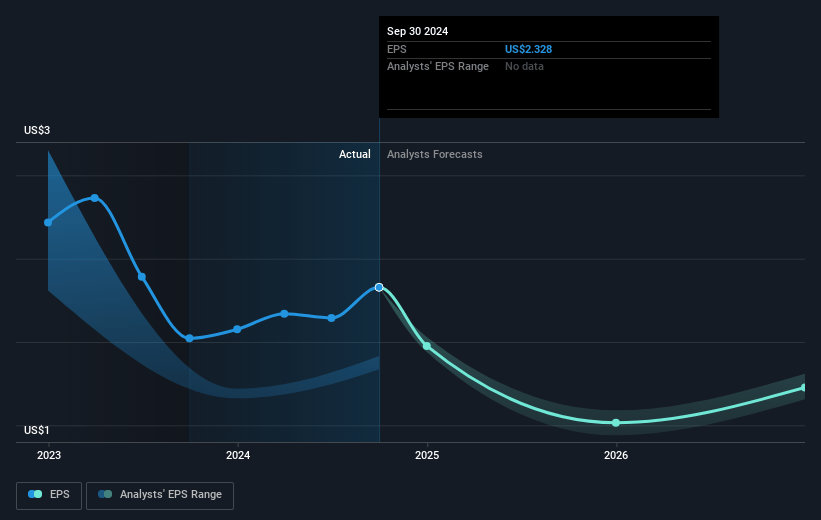

- Analysts expect earnings to reach $258.3 million (and earnings per share of $2.16) by about May 2028, down from $267.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $295 million in earnings, and the most bearish expecting $213.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.3x on those 2028 earnings, up from 24.1x today. This future PE is greater than the current PE for the US Industrial REITs industry at 25.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.71%, as per the Simply Wall St company report.

First Industrial Realty Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The evolving landscape surrounding tariffs poses a risk to business activity and the leasing market, potentially impacting revenue and earnings if it leads to slower decision-making on new investments and growth.

- Slow development and clarity around international trade negotiations may impact the operating environment, leading to uncertainties in leasing and growth, which could affect future revenue streams.

- Although new construction activity has decreased, vacancy rates in certain submarkets remain low, which could lead to an oversupply situation if demand expectations are overly optimistic, impacting net margins due to potential downward pressure on rental rates.

- Exposure to trade disruptions, particularly with Chinese 3PLs, while minimized, could still pose a risk to occupancy and rental income if geopolitical tensions impact tenant demand in affected markets.

- The expectation of significant development leasing in the fourth quarter suggests sensitivity to timing, which if delayed, could pressure short-term earning projections and financial target achievement.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $55.188 for First Industrial Realty Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $64.0, and the most bearish reporting a price target of just $50.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $858.2 million, earnings will come to $258.3 million, and it would be trading on a PE ratio of 36.3x, assuming you use a discount rate of 7.7%.

- Given the current share price of $48.57, the analyst price target of $55.19 is 12.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.