Narratives are currently in beta

Key Takeaways

- FCPT's decreased cost of capital and significant equity raise bolster acquisition and earnings growth potential while maintaining low leverage.

- Strong portfolio metrics and diversification enhance revenue stability and resilience, with active acquisitions supporting further revenue and earnings growth.

- Rising borrowing costs and tenant concentration risk could strain FCPT's financial stability and acquisition capabilities, impacting future earnings and revenue growth.

Catalysts

About Four Corners Property Trust- FCPT, headquartered in Mill Valley, CA, is a real estate investment trust primarily engaged in the ownership, acquisition and leasing of restaurant and retail properties.

- The company's cost of capital has recently decreased, allowing FCPT to resume its acquisition activities more aggressively, which is expected to drive future revenue growth.

- FCPT has raised significant capital, including $224 million in equity, positioning them for future acquisitions and supporting earnings growth through expansion while maintaining low leverage.

- The company's in-place portfolio shows strong rent collections and high occupancy rates of 99.6%, suggesting stable revenue and margin performance going forward.

- Diversification efforts have progressed, with FCPT reaching a milestone of 156 brands within the portfolio, which should contribute to more resilient earnings.

- The acquisition pipeline is active, leveraging improved market conditions and an extensive network for sourcing high-quality deals, which should have a favorable impact on revenue and earnings growth.

Four Corners Property Trust Future Earnings and Revenue Growth

Assumptions

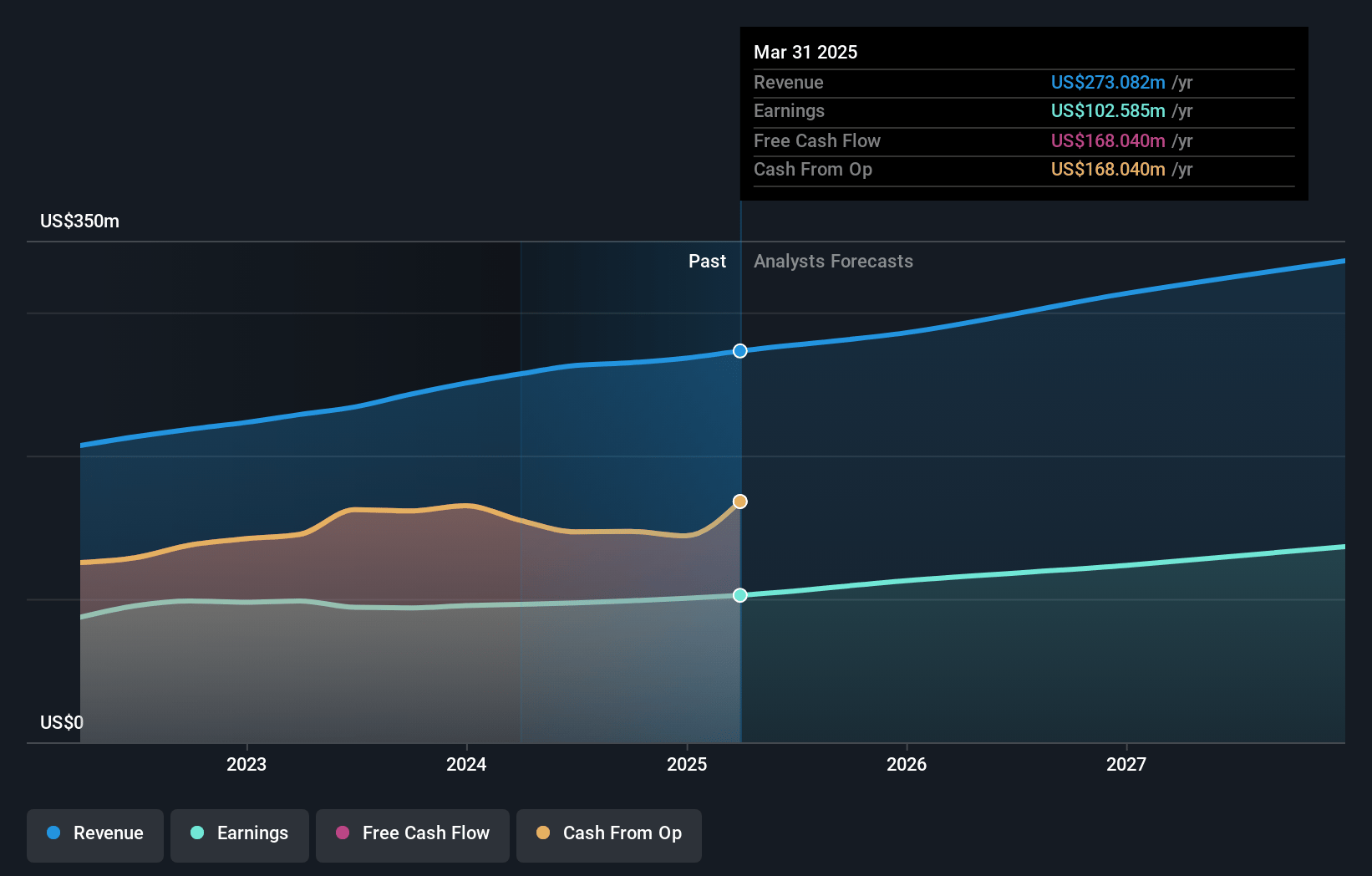

How have these above catalysts been quantified?- Analysts are assuming Four Corners Property Trust's revenue will grow by 6.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 37.3% today to 39.0% in 3 years time.

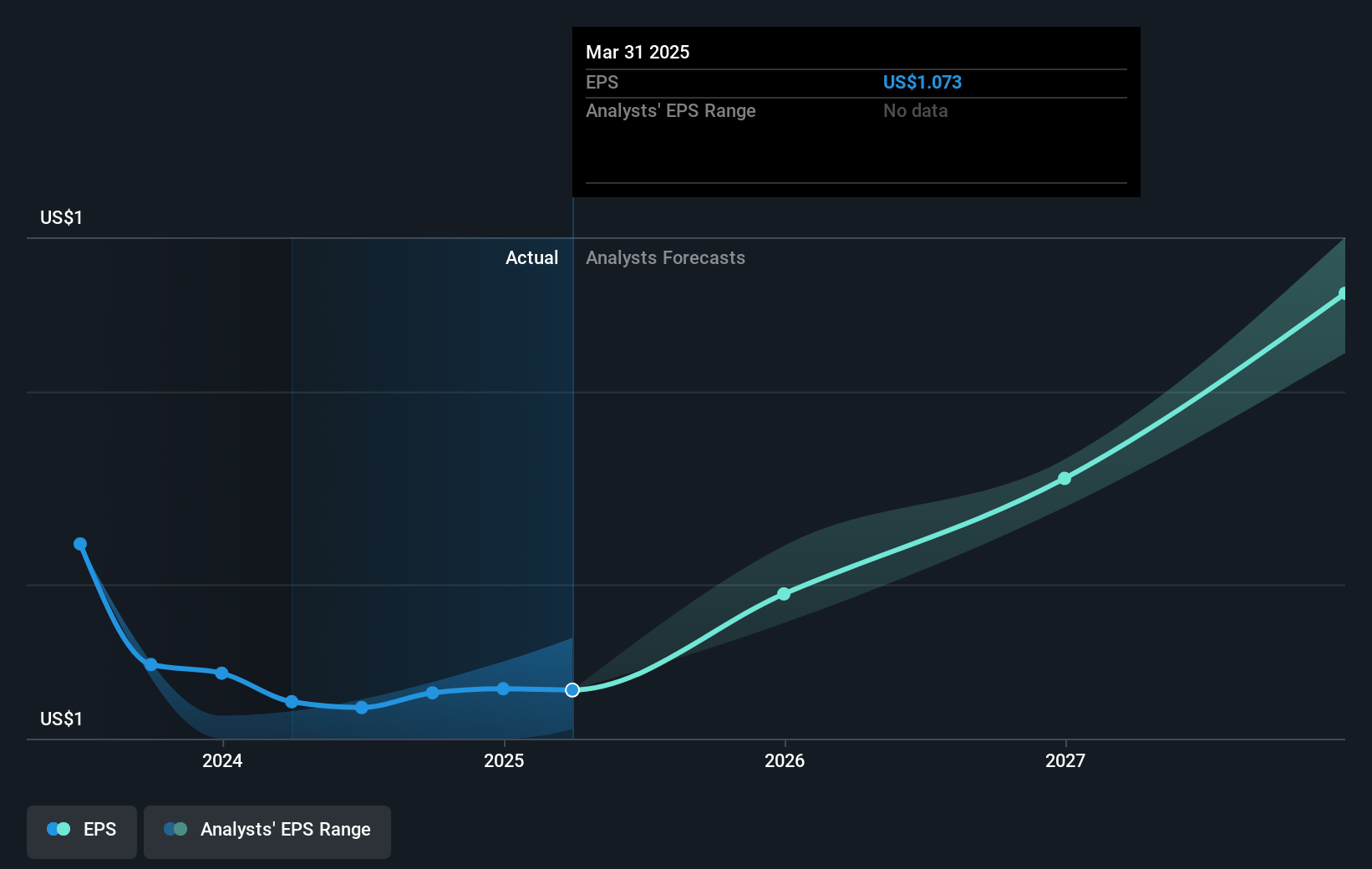

- Analysts expect earnings to reach $123.9 million (and earnings per share of $1.21) by about November 2027, up from $98.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.7x on those 2027 earnings, up from 27.3x today. This future PE is greater than the current PE for the US Specialized REITs industry at 27.8x.

- Analysts expect the number of shares outstanding to grow by 1.96% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

Four Corners Property Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising borrowing costs and uncertainties with debt maturities in 2025 could impact FCPT's acquisition capabilities and financial leverage, putting pressure on future earnings.

- Potential softening in consumer spending could negatively affect rental income from retail operators, impacting revenue and profitability.

- Heavy reliance on a few large tenants such as Darden and Brinker may pose concentration risk, potentially affecting revenue stability if these tenants face financial difficulties.

- Market competition in acquisitions, especially as liquidity improves, could constrain FCPT’s ability to secure high-return investments, impacting acquisition-driven revenue growth.

- Economic and market uncertainties, including political factors like elections and inflationary pressures, may affect the net lease market, potentially impacting FCPT's acquisition pipeline and financial margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $29.0 for Four Corners Property Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $32.0, and the most bearish reporting a price target of just $27.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $317.5 million, earnings will come to $123.9 million, and it would be trading on a PE ratio of 28.7x, assuming you use a discount rate of 6.4%.

- Given the current share price of $27.9, the analyst's price target of $29.0 is 3.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives