Key Takeaways

- Strategic shift to high-quality NYC assets and improved leasing momentum enhances revenue growth and boosts net margins.

- Dynamic pricing and improved visitation drive top-line growth in the Observatory segment, benefiting future earnings and cash flow.

- Macroeconomic factors, increased expenses, and limited liquidity could impede Empire State Realty Trust's revenue growth, earnings potential, and financial flexibility.

Catalysts

About Empire State Realty Trust- Empire State Realty Trust, Inc. (NYSE: ESRT) is a NYC-focused REIT that owns and operates a portfolio of modernized, amenitized, and well-located office, retail, and multifamily assets.

- ESRT's continued leasing momentum in its Manhattan office portfolio, which is expected to increase occupancy and rents, will likely enhance revenue and improve net margins as they reduce concessions.

- The Observatory's performance, specifically the introduction of a new dynamic pricing model and potential improvements in visitation levels, is expected to drive top-line growth and net operating income.

- ESRT's opportunistic approach to acquisitions, focusing on properties with better growth profiles and lower CapEx, especially in high-demand New York City areas, is anticipated to contribute to future earnings and cash flow growth.

- The proactive management of ESRT's balance sheet, with a well-laddered debt maturity schedule and low leverage, provides flexibility for future growth initiatives, enhancing financial stability and prospective earnings.

- The strategic shift from non-core suburban assets to high-quality New York City multifamily and retail assets is designed to provide lower CapEx and higher growth potential, improving revenue streams and net margins over time.

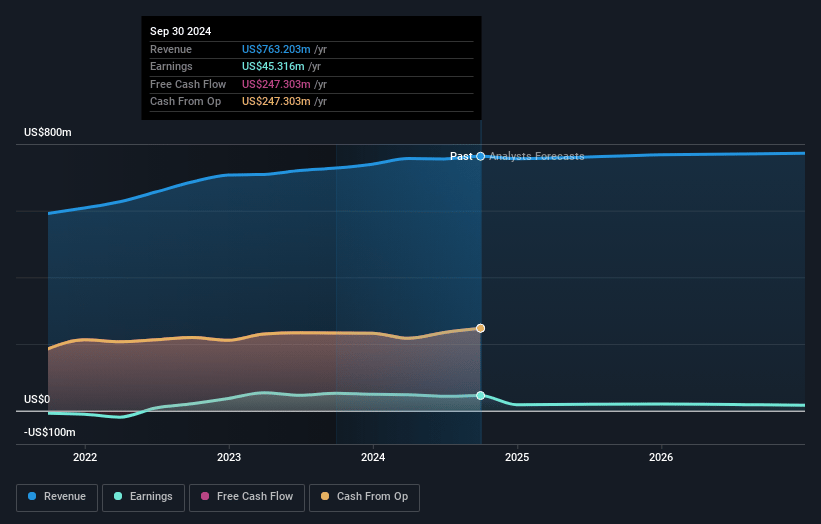

Empire State Realty Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Empire State Realty Trust's revenue will grow by 1.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 6.2% today to 2.3% in 3 years time.

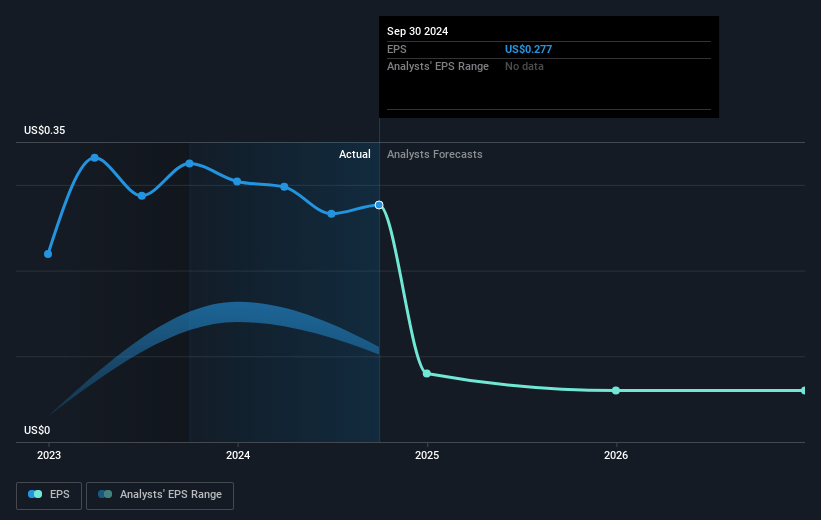

- Analysts expect earnings to reach $18.8 million (and earnings per share of $0.07) by about March 2028, down from $47.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 207.8x on those 2028 earnings, up from 29.3x today. This future PE is greater than the current PE for the US REITs industry at 30.0x.

- Analysts expect the number of shares outstanding to grow by 1.63% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.21%, as per the Simply Wall St company report.

Empire State Realty Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The presence of significant macroeconomic factors, such as dollar strength and limited airline seat capacity from China to New York City, could adversely impact tourism and, consequently, the Observatory's revenue potential.

- A stronger U.S. dollar and potential negative perception of America as a tourist destination may reduce international visitor numbers, affecting top-line revenue growth from the Observatory.

- Increased operating expenses in 2024, as highlighted by the 2% to 4% rise in property operating expenses, could negatively impact net operating income and net margins despite increased leasing activity.

- The prediction for core FFO to decrease from $0.91 in 2024 to between $0.86 and $0.89 in 2025 suggests potential downward pressure on earnings.

- The low interest income from using cash reserves for past acquisitions, coupled with scheduled debt repayments, could limit liquidity and financial flexibility, potentially impacting future earnings and investment opportunities.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $10.7 for Empire State Realty Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $13.0, and the most bearish reporting a price target of just $9.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $805.6 million, earnings will come to $18.8 million, and it would be trading on a PE ratio of 207.8x, assuming you use a discount rate of 8.2%.

- Given the current share price of $8.28, the analyst price target of $10.7 is 22.6% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives