Last Update01 May 25Fair value Increased 0.11%

AnalystConsensusTarget made no meaningful changes to valuation assumptions.

Read more...Key Takeaways

- Strategic initiatives like the Board review and Resident Services launch aim to boost revenue, operational efficiency, and shareholder value.

- Washington Metro's robust leasing environment and renovation ROI drive strong occupancy and revenue growth.

- Strategic review uncertainty and discounted share value raise concerns about Elme's strategy and asset valuation, potentially impacting investor confidence, occupancy rates, and profitability.

Catalysts

About Elme Communities- Elme Communities is committed to elevating what home can be for middle-income renters by providing a higher level of quality, service, and experience.

- The strategic review initiated by the Elme Board of Trustees could lead to potential value-maximizing transactions or strategic changes, potentially increasing revenue and shareholder value.

- The launch of Elme Resident Services and shared services department aims to streamline account management, collections, and renewal processes, improving operational efficiency and net margins.

- The managed Wi-Fi initiative is expected to ramp up throughout 2025, with projected additional NOI capturing between $300,000 to $600,000 in 2025 and up to $1 million to $1.5 million per year starting mid-2026, potentially increasing revenue.

- The Washington Metro area's favorable supply-demand dynamics and limited high-quality, affordable housing support a strong leasing environment, expected to sustain occupancy and revenue growth.

- The company's renovation program targeting a 17% ROI on completed renovations is designed to drive outsized rent growth and optimize earnings from property enhancements.

Elme Communities Future Earnings and Revenue Growth

Assumptions

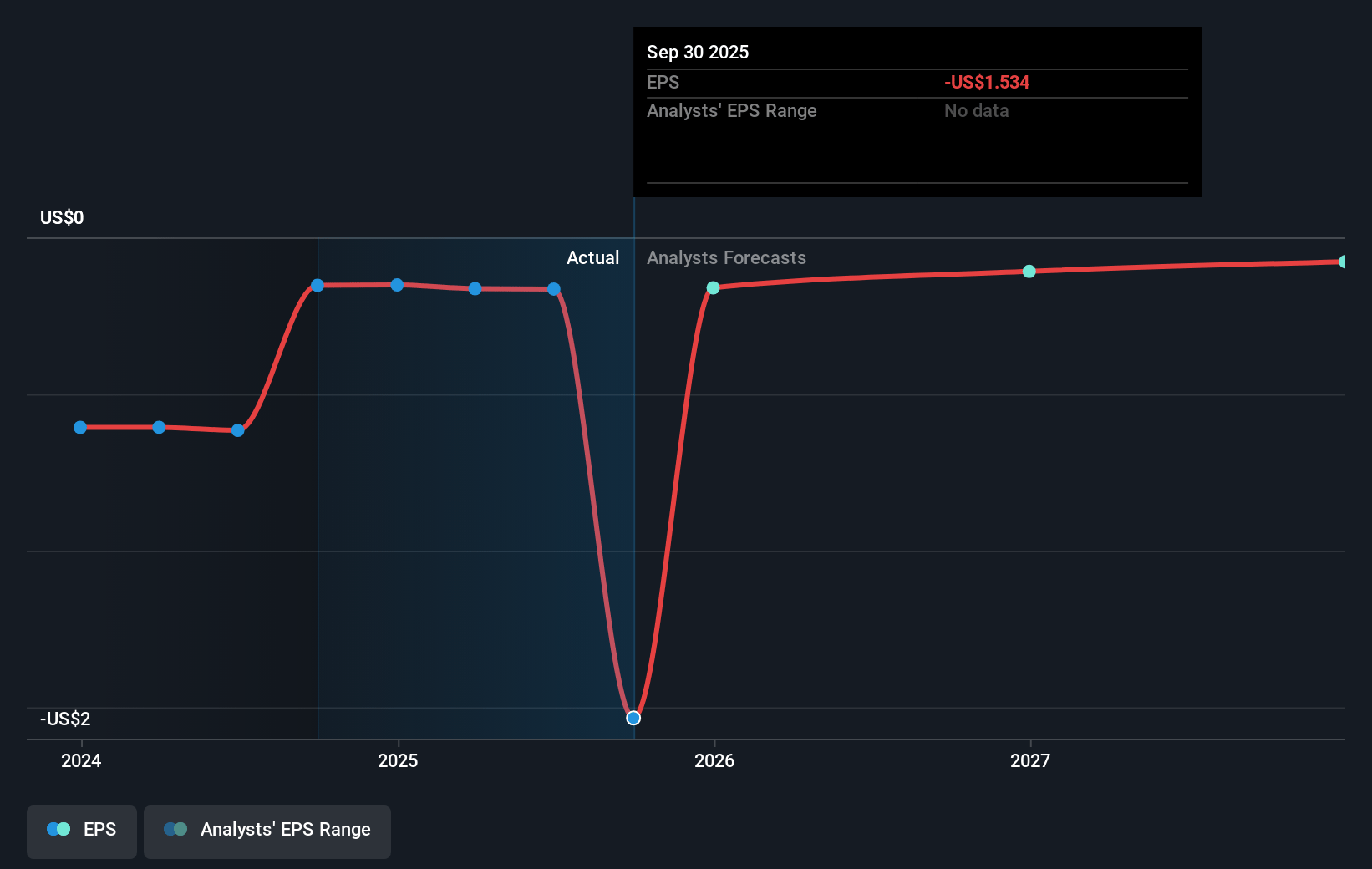

How have these above catalysts been quantified?- Analysts are assuming Elme Communities's revenue will grow by 2.7% annually over the next 3 years.

- Analysts are not forecasting that Elme Communities will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Elme Communities's profit margin will increase from -5.5% to the average US Residential REITs industry of 15.6% in 3 years.

- If Elme Communities's profit margin were to converge on the industry average, you could expect earnings to reach $40.9 million (and earnings per share of $0.46) by about May 2028, up from $-13.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 49.9x on those 2028 earnings, up from -101.5x today. This future PE is greater than the current PE for the US Residential REITs industry at 40.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.83%, as per the Simply Wall St company report.

Elme Communities Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The strategic review of Elme, which aims to evaluate strategic alternatives to maximize shareholder value, introduces uncertainty regarding the company's future direction. This uncertainty could impact investor confidence and influence the share price if the market perceives the review as a sign of underlying issues or lack of clear strategy, potentially affecting revenue and earnings.

- Shares of Elme are trading at a discount to the company's estimated private market value, indicating that investors may have concerns about the value proposition of the company's assets or its ability to generate returns, impacting the overall market perception and future revenue growth.

- The initiation of a formal review with no guarantee of a transaction or specific outcome may lead to prolonged periods of uncertainty, affecting strategic decisions and potentially delaying growth initiatives, which could impact future earnings.

- Exposure to potential changes in government employment due to a new administration's focus could alter demand for housing in key Elme markets like Washington D.C. If federal job dynamics change significantly, this could affect occupancy rates and rental income, impacting revenue.

- Operating issues, such as increased technology expenses, deterioration in occupancy, and higher non-controllable expenses like utilities, could squeeze net margins and affect the company’s ability to improve profitability and earnings outlook.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $19.0 for Elme Communities based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $262.3 million, earnings will come to $40.9 million, and it would be trading on a PE ratio of 49.9x, assuming you use a discount rate of 6.8%.

- Given the current share price of $15.41, the analyst price target of $19.0 is 18.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.