Narratives are currently in beta

Key Takeaways

- Strategic acquisitions and geographic diversity stabilize future earnings, enhancing resilience and boosting net margins.

- Population migration trends and tightening markets allow for rent increases, positively impacting revenue growth and portfolio demand.

- Economic uncertainty, speculative expansions, and macroeconomic exposure could delay tenant decisions, impact leasing and occupancy, and affect revenue, margins, and strategic growth.

Catalysts

About EastGroup Properties- EastGroup Properties, Inc. (NYSE: EGP), a member of the S&P Mid-Cap 400 and Russell 1000 Indexes, is a self-administered equity real estate investment trust focused on the development, acquisition and operation of industrial properties in major Sunbelt markets throughout the United States with an emphasis in the states of Florida, Texas, Arizona, California and North Carolina.

- EastGroup Properties is focusing on pushing rents and maintaining high occupancy, which should help increase revenue and net margins as the market tightens.

- The company benefits from geographic and revenue diversity, which helps stabilize future earnings and provides resilience against economic fluctuations, potentially boosting earnings.

- They are undertaking strategic acquisitions of 100% leased buildings that are immediately accretive and aim to raise the long-term growth profile of the portfolio, impacting NAV per share positively.

- The planned reduction in the construction pipeline, which is already at its lowest since 2017, suggests a tightening future market, enabling potential rent increases and enhancing revenue growth.

- Favorable long-term trends such as population migration, near-shoring, and onshoring are expected to positively impact their portfolio, resulting in increased demand and rental income growth.

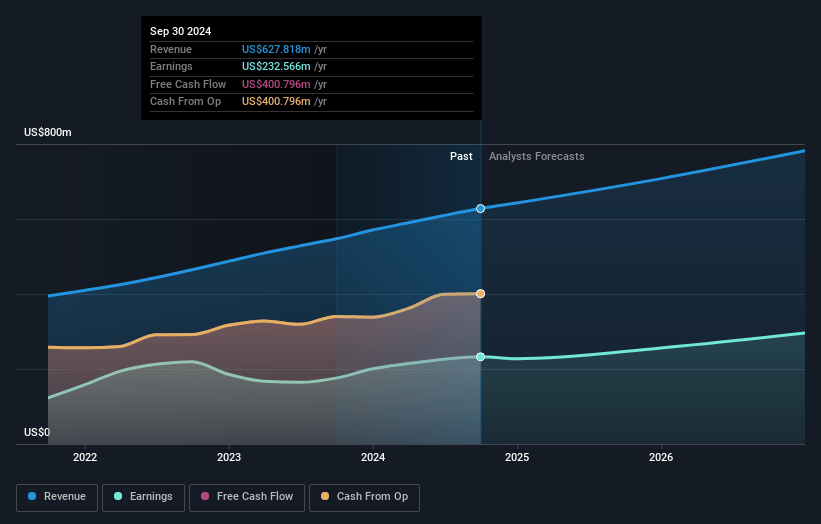

EastGroup Properties Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming EastGroup Properties's revenue will grow by 13.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 37.0% today to 35.2% in 3 years time.

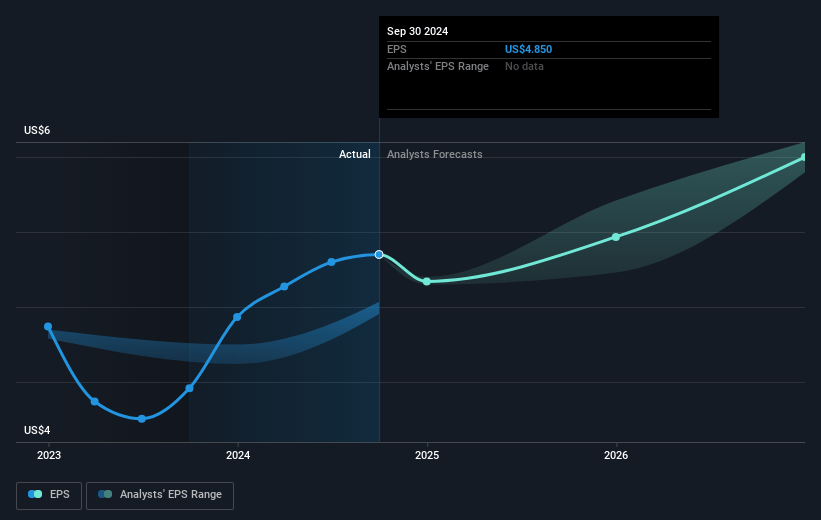

- Analysts expect earnings to reach $318.7 million (and earnings per share of $6.09) by about October 2027, up from $232.6 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $265 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 39.6x on those 2027 earnings, up from 37.0x today. This future PE is greater than the current PE for the US Industrial REITs industry at 36.4x.

- Analysts expect the number of shares outstanding to grow by 1.95% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 6.56%, as per the Simply Wall St company report.

EastGroup Properties Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Potential impacts from economic uncertainty, such as the upcoming elections and interest rate fluctuations, could delay tenant decision-making and negatively impact leasing activity. This may affect future revenue growth and occupancy rates.

- Increased bad debt levels, particularly in California, and challenges with certain tenants, like the Conn’s bankruptcy filing, could lead to higher reserves and affect net margins.

- The reliance on speculative geographic expansions and acquisitions in higher supply markets, such as Austin, may yield unpredictable financial returns and impact earnings.

- Slower development leasing and a cautious approach to new development starts could delay expected revenue from new projects, potentially impacting future earnings growth.

- Exposure to macroeconomic and financial market changes might result in acquisition challenges or cost of capital increases, impacting strategic growth and long-term net asset value creation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $200.61 for EastGroup Properties based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $220.0, and the most bearish reporting a price target of just $174.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $906.3 million, earnings will come to $318.7 million, and it would be trading on a PE ratio of 39.6x, assuming you use a discount rate of 6.6%.

- Given the current share price of $174.04, the analyst's price target of $200.61 is 13.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives