Key Takeaways

- Strategic acquisitions and reduced supply pressures could enhance revenue growth and support stable net margins.

- Efficient capital management, including a joint venture, aligns with growth strategies and earnings accretion.

- Potential headwinds include declining same-store NOI, increased operating expenses, and macroeconomic uncertainties, all potentially impacting revenue growth and financial flexibility.

Catalysts

About CubeSmart- A self-administered and self-managed real estate investment trust.

- CubeSmart's fourth quarter may have marked an inflection point in decelerating same-store revenue growth, with improvements seen in year-over-year same-store occupancy and rental rates. Continued positive trends in these metrics could drive future revenue growth.

- CubeSmart executed an accretive joint venture transaction, acquiring their partner's interest in a portfolio of properties mainly located in Tier 1 markets. This move could enhance earnings by bringing stable, income-generating assets fully onto CubeSmart's balance sheet.

- With new supply impacting fewer stores in 2025 compared to previous years, down from a peak of 50% in 2019 to 24% projected this year, CubeSmart may experience less competition-driven occupancy and rate pressure, potentially supporting net margins and revenue stabilization.

- CubeSmart raised equity capital at attractive valuations in anticipation of growth opportunities, such as the aforementioned joint venture transaction. This prudent capital management could support strategic acquisitions and contribute to earnings accretion.

- The company's strategic focus on acquiring lease-up stores and transitioning them fully onto its balance sheet may position CubeSmart for incremental growth in net operating income (NOI) as these assets fully stabilize, supporting long-term earnings growth.

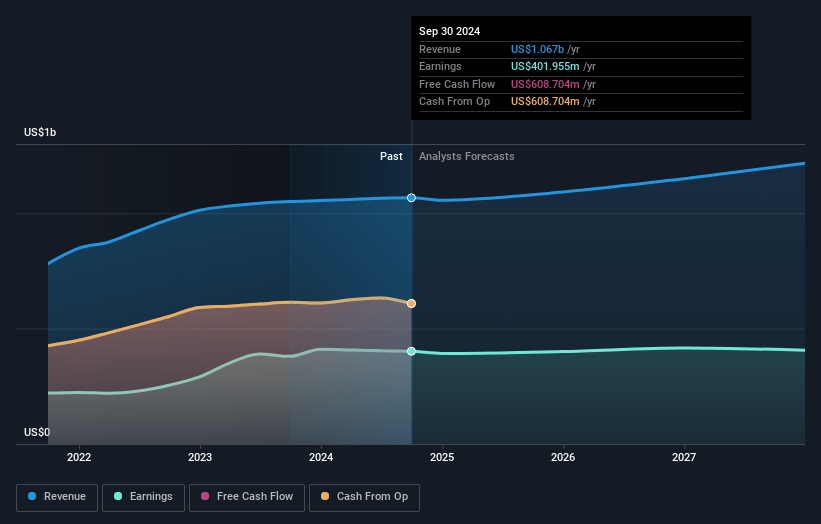

CubeSmart Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CubeSmart's revenue will grow by 5.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 36.6% today to 34.1% in 3 years time.

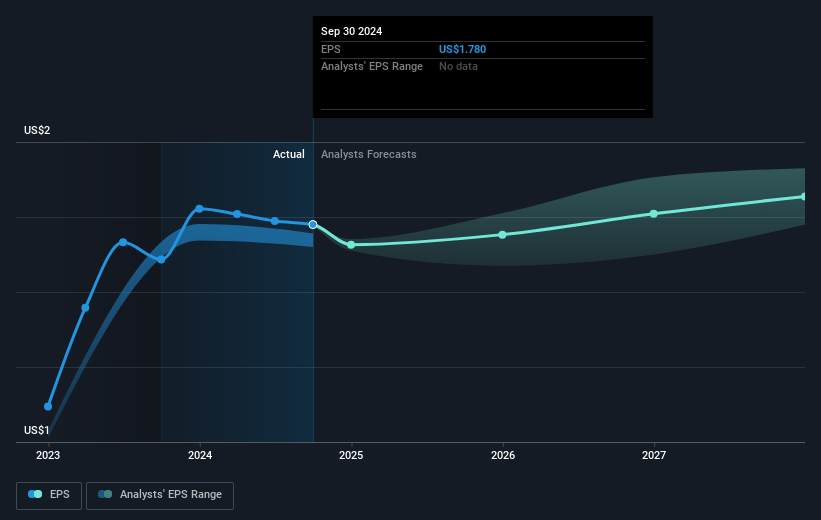

- Analysts expect earnings to reach $423.9 million (and earnings per share of $1.85) by about March 2028, up from $391.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.4x on those 2028 earnings, up from 25.0x today. This future PE is greater than the current PE for the US Specialized REITs industry at 29.4x.

- Analysts expect the number of shares outstanding to grow by 1.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.66%, as per the Simply Wall St company report.

CubeSmart Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The fourth quarter saw a same-store NOI decline of 3.7%, driven by a 1.6% decrease in same-store revenue and a 4.7% increase in expenses, largely due to real estate taxes. This trend indicates potential pressure on earnings if revenue does not recover as expected.

- Despite improvements, same-store occupancy and rental rates are still below last year's levels, which could impact revenue growth if these metrics do not continue strengthening.

- Continued pressure on property insurance and unpredictable real estate taxes could further increase operating expenses, negatively affecting net margins.

- The failure of anticipated catalysts, such as improvements in the housing market, to materialize could hinder the expected reacceleration of organic growth, putting revenue growth forecasts at risk.

- Uncertainties in the macroeconomic and geopolitical environment, including potential interest rate increases and their impact on refinancing costs, could negatively affect net earnings and financial flexibility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $47.533 for CubeSmart based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $53.0, and the most bearish reporting a price target of just $44.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $423.9 million, and it would be trading on a PE ratio of 32.4x, assuming you use a discount rate of 6.7%.

- Given the current share price of $42.95, the analyst price target of $47.53 is 9.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives