Narratives are currently in beta

Key Takeaways

- Mega campus strategy and life sciences industry growth drive higher occupancy, rental rates, and returns.

- Capital recycling and increased leasing demand from biotech IPOs enhance asset quality and future earnings.

- Economic challenges and competitive pressures could affect Alexandria's capital costs, tenant demand, occupancy rates, revenue, and cash flow stability.

Catalysts

About Alexandria Real Estate Equities- Alexandria Real Estate Equities, Inc. (NYSE: ARE), an S&P 500® company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world.

- Alexandria Real Estate Equities is expected to see future revenue growth driven by their mega campus strategy, focusing on premier locations with high occupancy and strong tenant retention, resulting in higher rental rates and returns on investment.

- The life sciences industry is projected to experience steady funding growth, which could positively influence Alexandria's occupancy rates and rental income as it meets the space demand for biotech and pharmaceutical companies.

- The company anticipates continued NOI growth from their pipeline of development and redevelopment projects, which are projected to generate an additional $510 million over the next few years, supporting top-line revenue and earnings expansion.

- The ongoing capital recycling program allows Alexandria to sell non-core assets and reinvest in higher-yielding developments, improving asset quality and potentially enhancing net margins through cost efficiencies.

- As the IPO market shows signs of reopening for well-positioned biotech companies, Alexandria could benefit from increased leasing demand, which might boost leasing volume and strengthen future earnings.

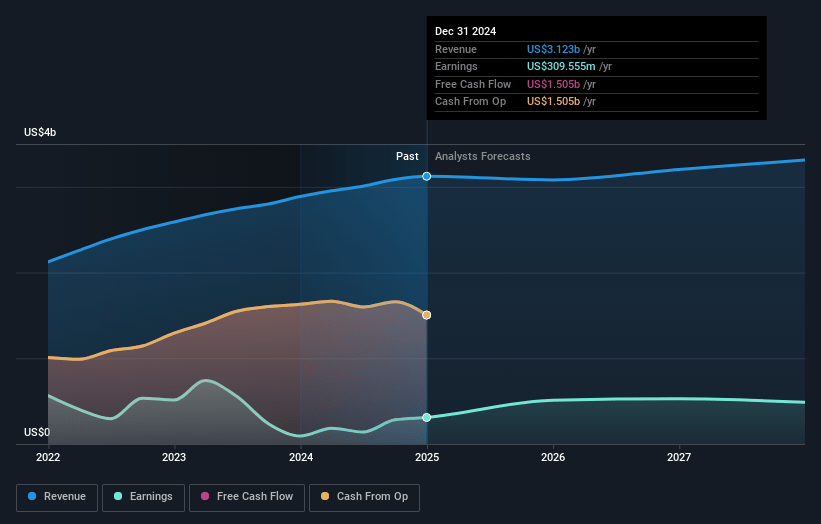

Alexandria Real Estate Equities Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Alexandria Real Estate Equities's revenue will grow by 5.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.2% today to 18.7% in 3 years time.

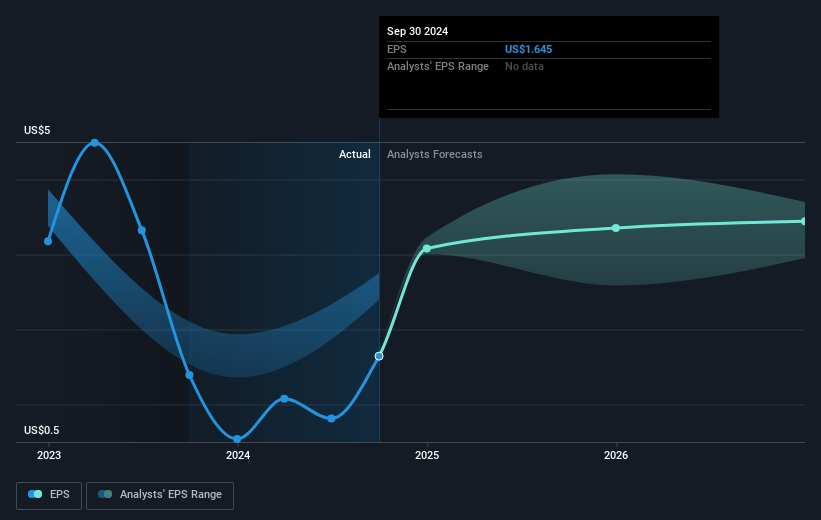

- Analysts expect earnings to reach $670.1 million (and earnings per share of $4.0) by about November 2027, up from $282.6 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $397.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 40.5x on those 2027 earnings, down from 64.6x today. This future PE is lower than the current PE for the US Health Care REITs industry at 45.2x.

- Analysts expect the number of shares outstanding to decline by 1.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.94%, as per the Simply Wall St company report.

Alexandria Real Estate Equities Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The stubborn economic environment, driven by high federal deficits and sticky inflation, presents a risk for Alexandria Real Estate Equities as it could lead to continued high costs of capital, which may impact net margins and earnings.

- The previous over-reliance on free-flowing capital within the biotech sector, which is a significant tenant base for Alexandria, could result in reduced demand for leasing as the funding environment becomes more disciplined, affecting future revenue growth.

- The high volume of competitive supply expected to be delivered in key markets like Greater Boston and San Francisco could affect Alexandria's ability to maintain high occupancy rates and rental growth, thereby impacting revenue and net operating income.

- The focus on asset recycling and sales to fund development might indicate a reliance on non-recurring capital sources, which could potentially strain consistent revenue streams and earnings growth if the transaction market slows or yields do not meet expectations.

- Shifts in leasing activity, driven by broader economic pressures or changing financing conditions, could result in leasing cycles becoming prolonged, affecting cash flow stability and potentially increasing tenant improvement and leasing commission costs, thus impacting net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $129.23 for Alexandria Real Estate Equities based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $186.0, and the most bearish reporting a price target of just $112.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $3.6 billion, earnings will come to $670.1 million, and it would be trading on a PE ratio of 40.5x, assuming you use a discount rate of 7.9%.

- Given the current share price of $104.49, the analyst's price target of $129.23 is 19.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives