Narratives are currently in beta

Key Takeaways

- Strategic divestments and focus on developed markets aim to enhance earnings quality and optimize capital allocation.

- Demand for 5G, hybrid IT, and AI infrastructure is set to fuel double-digit revenue growth and margin expansion.

- Sale of ATC India and FX risks in Latin America and Africa may impact growth and revenue stability, with challenges in interest rates and 5G adoption.

Catalysts

About American Tower- American Tower, one of the largest global REITs, is a leading independent owner, operator and developer of multitenant communications real estate with a portfolio of over 224,000 communications sites and a highly interconnected footprint of U.S.

- The expansion of 5G networks, particularly the densification phase in developed markets like the U.S. and Europe, is expected to drive strong demand for American Tower's assets, supporting revenue growth.

- The sale of the India business and a strategic focus on developed markets are initiatives aimed at improving earnings quality and net margins by reallocating capital to higher-performing markets.

- Accelerating demand for hybrid IT and AI infrastructure in the data center segment points to increased long-term earnings potential, with record-breaking leasing expected to continue driving double-digit revenue growth.

- Operational efficiencies and cost management strategies are expected to support margin expansion and drive high-quality earnings growth, positively impacting net earnings.

- Increased capital allocation to CoreSite developments underlines opportunities for significant incremental revenue and long-term return on investment, contributing to overall earnings growth through value-added services and increased data center capacity.

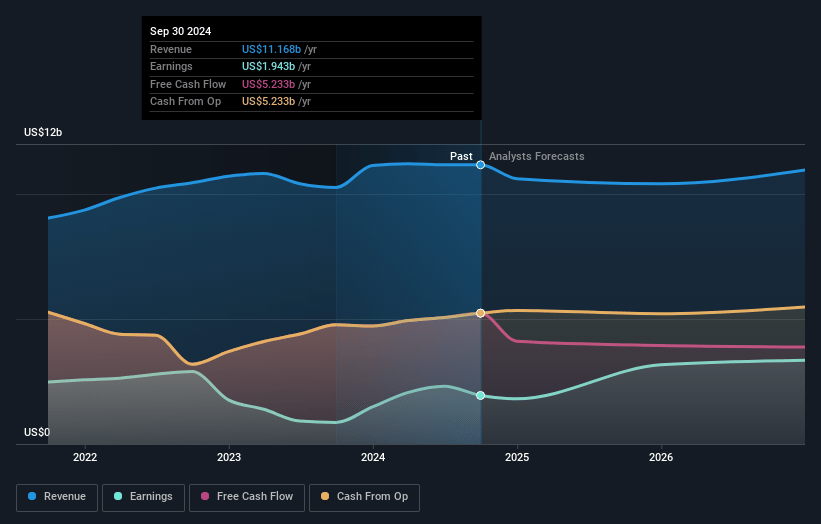

American Tower Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming American Tower's revenue will grow by 1.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.4% today to 30.3% in 3 years time.

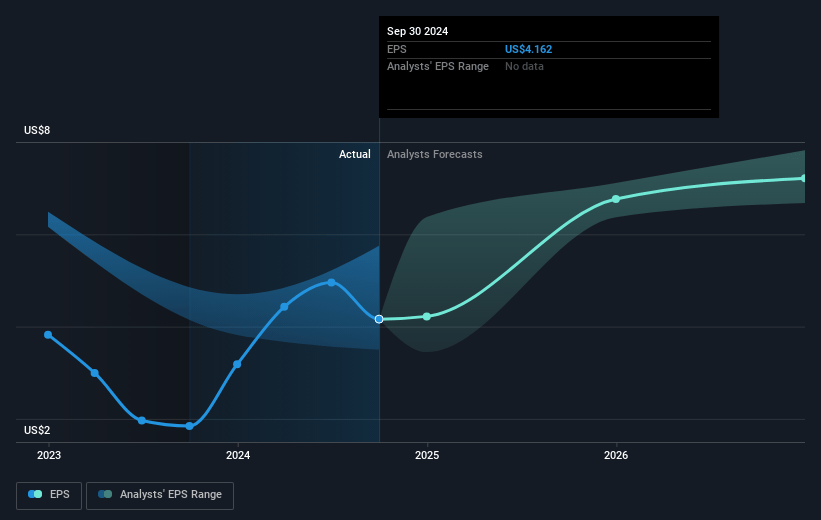

- Analysts expect earnings to reach $3.5 billion (and earnings per share of $7.51) by about November 2027, up from $1.9 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $3.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 38.8x on those 2027 earnings, down from 46.9x today. This future PE is greater than the current PE for the US Specialized REITs industry at 27.8x.

- Analysts expect the number of shares outstanding to grow by 0.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.5%, as per the Simply Wall St company report.

American Tower Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The sale of ATC India and the resulting discontinued operations may impact American Tower's growth potential in a major market, affecting future revenues and possibly hindering international expansion efforts.

- Exposure to currency fluctuations in Latin America and Africa, which together contribute 25% of attributable AFFO, poses a risk to revenue stability and earnings due to potential FX headwinds.

- Continued interest rate headwinds could hinder American Tower's growth in net margins, affecting the company's ability to maintain financial flexibility and invest further in core developments.

- Slower-than-expected adoption and implementation of 5G stand-alone infrastructure and mobile edge computing could delay anticipated revenue streams from these technological advancements, impacting future earnings growth projections.

- Risks related to customer financial health, as highlighted by provisions taken regarding WOM Colombia’s bankruptcy, could impact revenue stability and increase bad debt expenses.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $241.32 for American Tower based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $11.6 billion, earnings will come to $3.5 billion, and it would be trading on a PE ratio of 38.8x, assuming you use a discount rate of 6.5%.

- Given the current share price of $195.16, the analyst's price target of $241.32 is 19.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives