Narratives are currently in beta

Key Takeaways

- Temporary weather disruptions and economic uncertainty may impact costs, margins, demand, earnings, and revenue growth negatively for AMH in the near term.

- Acquisition integration challenges and rising property expenses could pressure net income and profitability, while tenant retention focus might limit revenue growth.

- AMH's focus on resident experience, cost control, and property management amid strong rental demand supports stable revenue growth and improved profitability.

Catalysts

About American Homes 4 Rent- AMH (NYSE: AMH) is a leading large-scale integrated owner, operator and developer of single-family rental homes.

- AMH is facing temporary disruptions from weather events, with significant hurricane damages that are expected to continue affecting the portfolio into the fourth quarter. This could impact costs and ultimately net margins as recovery efforts continue into 2025.

- The company has acknowledged operating in an uncertain environment due to economic conditions and the upcoming election. This uncertainty could result in fluctuating demand and impact earnings and revenue growth negatively in the near term.

- AMH's acquisition of a 1,700-home portfolio involves transitioning the properties to the AMH platform. If this process does not go smoothly or costs more than expected, it could affect net operating income growth projections and margins.

- The increase in property taxes and expenses, despite improved assessment outcomes, suggests potential pressure on net income and overall profitability if these costs continue to exceed expectations.

- The increased focus on managing occupancy rates may result in prioritizing tenant retention over rent growth, potentially impacting revenue growth if rental rate increases do not meet expectations.

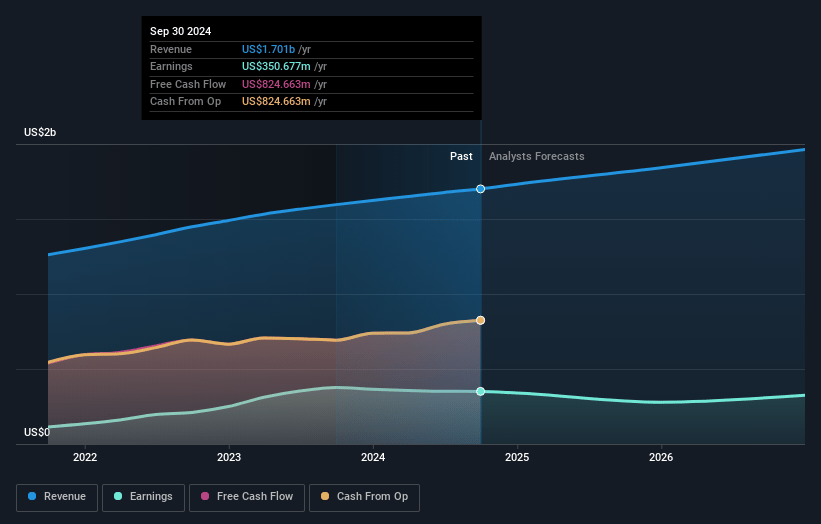

American Homes 4 Rent Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming American Homes 4 Rent's revenue will grow by 5.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 20.6% today to 16.0% in 3 years time.

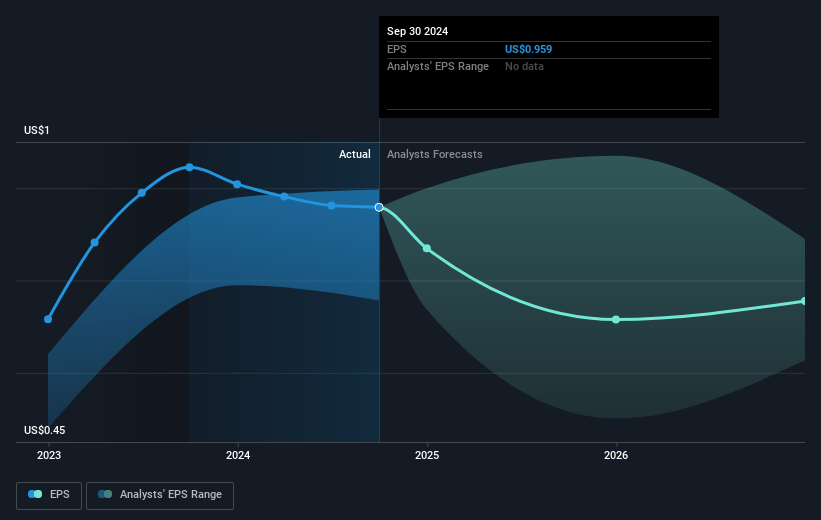

- Analysts expect earnings to reach $322.1 million (and earnings per share of $0.83) by about November 2027, down from $350.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $521.8 million in earnings, and the most bearish expecting $269 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 59.7x on those 2027 earnings, up from 40.0x today. This future PE is greater than the current PE for the US Residential REITs industry at 38.2x.

- Analysts expect the number of shares outstanding to decline by 2.81% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.45%, as per the Simply Wall St company report.

American Homes 4 Rent Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- AMH's focus on creating a strong resident experience and high occupancy rates could drive stable or increasing revenues as satisfied tenants are likely to renew leases and recommend the company, enhancing long-term revenue growth.

- The company's strategic approach to controlling costs and expenses, particularly during high move-out seasons, could improve net margins by lowering operating costs and increasing profitability.

- AMH's successful acquisition and integration of new properties into its existing portfolio, including controlling 1,700 homes, could contribute to incremental revenue growth and strengthened earnings over time due to improved occupancy and efficient management.

- The robust demand for single-family rentals, especially against the backdrop of a national housing shortage, positions AMH to leverage its development pipeline and newly acquired properties, potentially stabilizing or increasing its earnings and revenue.

- Improved property tax assessments and expense management, along with disciplined growth strategies, are likely to help reduce operational costs significantly, thus supporting improved net margins and overall financial health.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $41.32 for American Homes 4 Rent based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $2.0 billion, earnings will come to $322.1 million, and it would be trading on a PE ratio of 59.7x, assuming you use a discount rate of 6.4%.

- Given the current share price of $37.96, the analyst's price target of $41.32 is 8.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives