Key Takeaways

- Strategic focus on mixed-use, walkable urban properties in high-growth regions drives strong occupancy, rent growth, and resilience to shifting tenant demands.

- Active portfolio management and cost controls increase flexibility, allowing reinvestment and supporting sustained earnings consistency and risk-adjusted long-term growth.

- High leverage, reduced dividends, and sector headwinds across office and retail threaten long-term growth and income, while development activity slows amid macroeconomic uncertainty.

Catalysts

About Armada Hoffler Properties- Armada Hoffler (NYSE: AHH) is a vertically integrated, self-managed real estate investment trust with over four decades of experience developing, building, acquiring, and managing high-quality retail, office, and multifamily properties located primarily in the Mid-Atlantic and Southeastern United States.

- Armada Hoffler’s concentration in high-growth Sun Belt and Southeast urban markets is expected to support above-average occupancy and rent growth, particularly as population migration and ongoing urbanization drive long-term demand for mixed-use, retail, and multifamily assets; this benefits both property-level revenue and NOI growth.

- The company’s strategic focus on walkable, lifestyle-centered mixed-use properties—which continue to attract high-credit tenants and yield double-digit office and retail re-leasing spreads—positions Armada Hoffler to benefit from evolving tenant preferences favoring “live-work-play” environments, supporting revenue stability and future margin expansion.

- Robust leasing activity, high occupancy rates (~95%+ across all segments), and successful re-leasing of challenging retail spaces (often at higher rents and with better credit tenants) indicate operational resilience and the ability to maintain and even improve net margins despite sector headwinds.

- Armada Hoffler has a pipeline of internal redevelopment projects and is actively unlocking value through capital recycling and repositioning underutilized assets, which should drive incremental NOI and long-term AFFO growth by optimizing existing portfolio returns.

- A conscious reduction of G&A expenses (targeting a 13% year-over-year decrease) and a right-sized, fully covered dividend enhance balance sheet flexibility and enable greater reinvestment in high-yielding opportunities, likely translating into improved future earnings consistency and risk-adjusted growth.

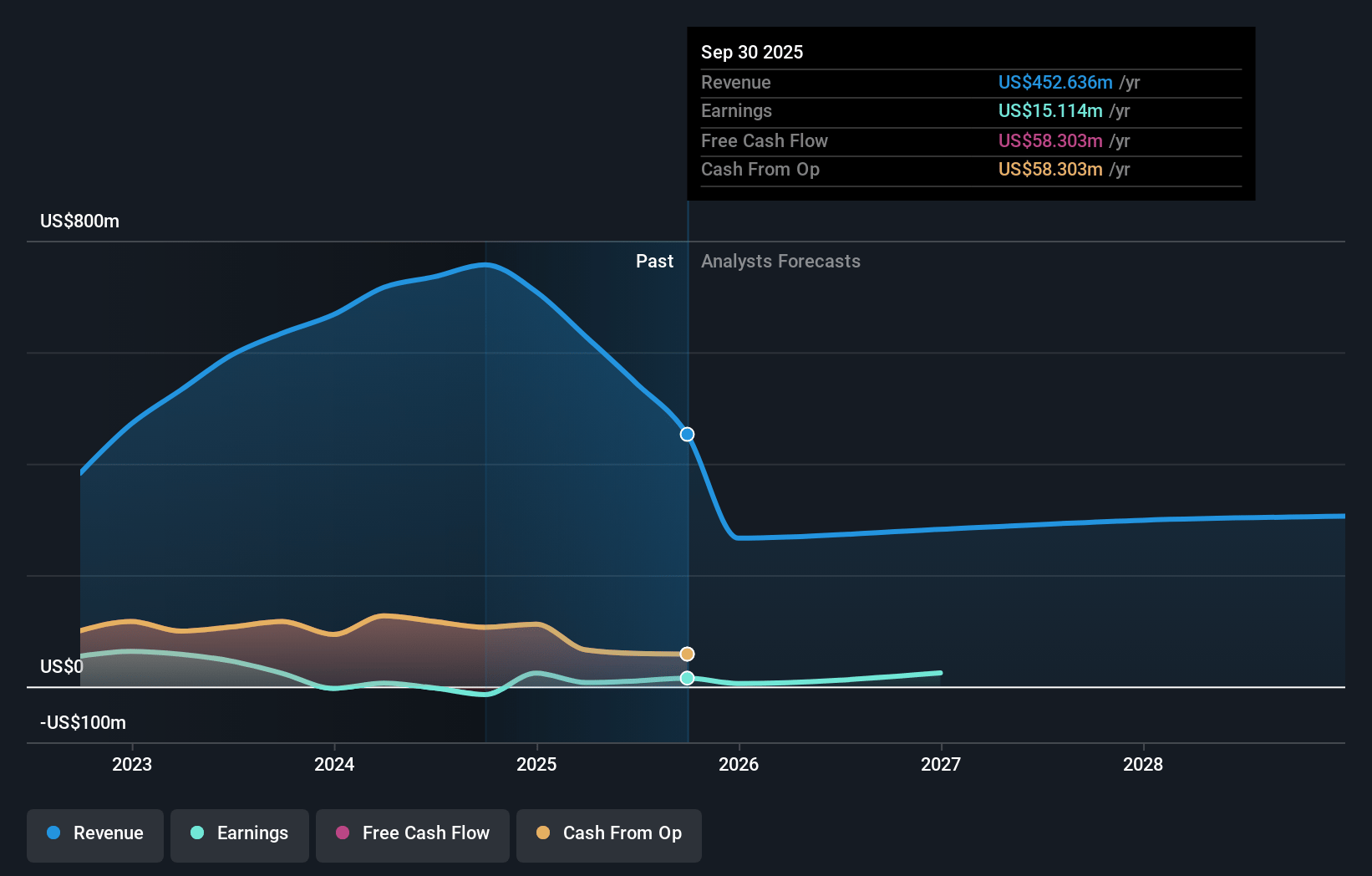

Armada Hoffler Properties Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Armada Hoffler Properties's revenue will decrease by 36.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 1.1% today to 0.8% in 3 years time.

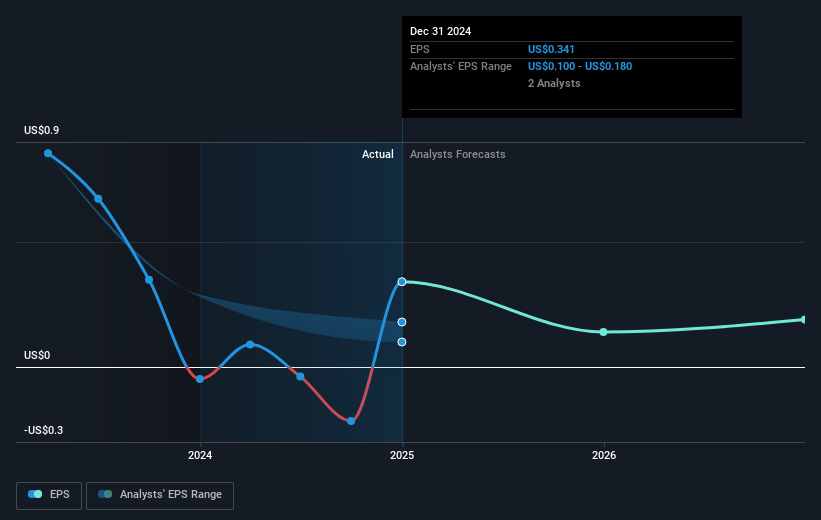

- Analysts expect earnings to reach $1.3 million (and earnings per share of $0.16) by about July 2028, down from $7.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 1090.5x on those 2028 earnings, up from 79.5x today. This future PE is greater than the current PE for the US REITs industry at 26.2x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.3%, as per the Simply Wall St company report.

Armada Hoffler Properties Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company reduced its dividend payout and justified it as necessary for long-term value creation, which signals recent cash flow pressure and may lower total shareholder returns if future earnings growth fails to rebound—impacting both near-term net income and longer-term dividend-supported valuation.

- Net debt to adjusted EBITDA remains relatively high at 7.1x, and management expresses ongoing sensitivity around leverage and capital allocation, meaning that higher-for-longer interest rates or tightening credit conditions could materially raise interest expense and restrict growth investments, pressuring earnings and net margins.

- The company’s office portfolio is nearly fully leased and insulated from immediate rollover, but long-term secular trends toward remote and hybrid work threaten ongoing demand for office space—even in mixed-use environments—posing downside risk to future occupancy rates and rental income.

- The construction and development pipeline has slowed, with management removing some construction projects from guidance and acknowledging macroeconomic uncertainty, tariffs, and selective capital markets as constraints, implying that future revenue and AFFO growth may be limited if new project starts remain subdued.

- Despite recent success in backfilling vacated retail space, the company’s significant exposure to retail (especially big-box and necessity-based anchors) leaves it vulnerable to continued secular headwinds from e-commerce and potential tenant bankruptcies, which could result in elevated vacancies and lower rental revenue over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $8.5 for Armada Hoffler Properties based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.5, and the most bearish reporting a price target of just $7.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $161.6 million, earnings will come to $1.3 million, and it would be trading on a PE ratio of 1090.5x, assuming you use a discount rate of 9.3%.

- Given the current share price of $7.16, the analyst price target of $8.5 is 15.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.