Narratives are currently in beta

Key Takeaways

- Modernization of the Waldo sawmill is expected to significantly boost capacity, reduce costs, and enhance earnings.

- Expanding natural climate solutions and bioenergy initiatives aim to diversify revenue and improve net margins.

- Weak lumber markets, operational challenges, and external disruptions could pressure future revenue, while economic factors and carbon market volatility pose additional risks to earnings.

Catalysts

About PotlatchDeltic- PotlatchDeltic Corporation (Nasdaq: PCH) is a leading Real Estate Investment Trust (REIT) that owns nearly 2.2 million acres of timberlands in Alabama, Arkansas, Georgia, Idaho, Louisiana, Mississippi and South Carolina.

- The modernization and expansion project at the Waldo, Arkansas sawmill is expected to increase annual capacity by 85 million board feet and reduce cash processing costs by about 30%, potentially increasing EBITDDA by approximately $25 million annually once fully ramped up, improving earnings.

- Natural climate solutions, like solar development and lithium opportunities, are expanding, with solar option contracts potentially worth an NPV of $400 million. These are poised to impact future revenue streams positively.

- There is optimism about pricing and demand improvement in lumber markets based on long-term housing fundamentals and a possible easing of Federal Reserve policies, which could increase revenue.

- Forest carbon credit initiatives and other bioenergy and biofuel projects are being explored, which could enhance revenue streams and improve net margins.

- Share repurchase programs suggest management believes the company is undervalued, which could improve earnings per share and return value to shareholders.

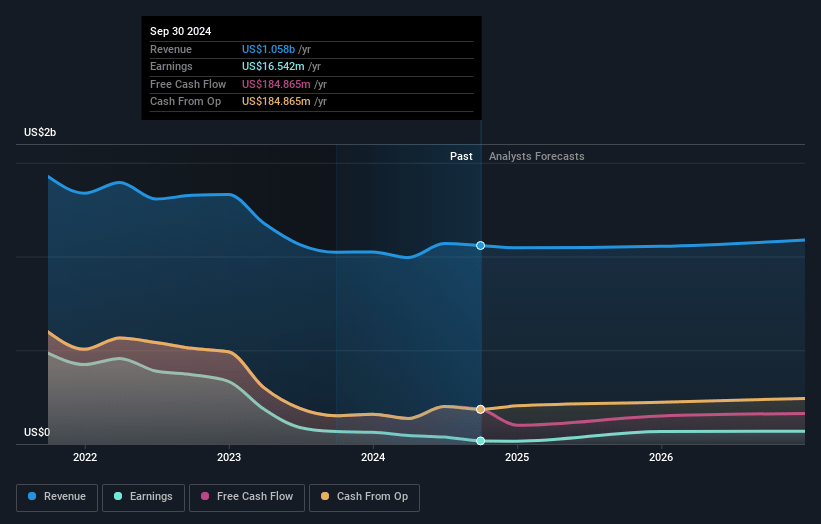

PotlatchDeltic Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming PotlatchDeltic's revenue will decrease by 0.7% annually over the next 3 years.

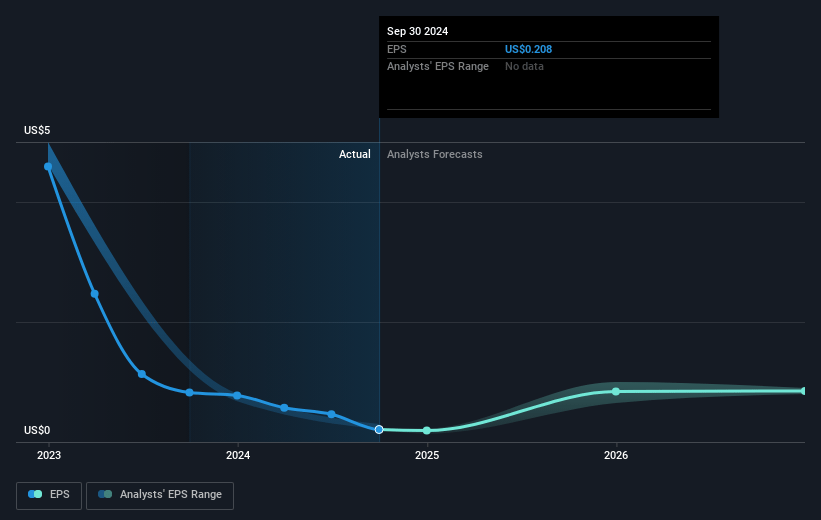

- Analysts assume that profit margins will increase from 1.6% today to 10.8% in 3 years time.

- Analysts expect earnings to reach $116.4 million (and earnings per share of $1.46) by about November 2027, up from $16.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 41.4x on those 2027 earnings, down from 197.6x today. This future PE is greater than the current PE for the US Specialized REITs industry at 27.8x.

- Analysts expect the number of shares outstanding to grow by 0.37% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.26%, as per the Simply Wall St company report.

PotlatchDeltic Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The continuing weakness in lumber markets, where supply has outpaced demand, negatively impacted the Wood Products segment, evidenced by a $10 million adjusted EBITDDA loss in the third quarter. This could further pressure future revenue and earnings.

- The start-up costs and downtime associated with the modernized Waldo sawmill reduced lumber production and increased expenses, with a P&L impact of $3 million. This may lead to short-term pressure on net margins until full operational efficiency is reached.

- Hurricane Helene caused damage to timberland which could lead to increased salvage operations and potential disruptions; while financial impact seems limited currently, it presents a risk to future operational stability and revenue.

- Elevated interest rates and economic uncertainty are posing challenges in the U.S. housing market, affecting homebuyer activity and potentially reducing demand for lumber, impacting revenue and growth prospects.

- The volatility in voluntary carbon credit markets and evolving project methodologies pose a risk to the potential revenue from carbon credit projects, potentially affecting future earnings and margins from Natural Climate Solutions initiatives.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $50.86 for PotlatchDeltic based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $55.0, and the most bearish reporting a price target of just $45.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.1 billion, earnings will come to $116.4 million, and it would be trading on a PE ratio of 41.4x, assuming you use a discount rate of 6.3%.

- Given the current share price of $41.5, the analyst's price target of $50.86 is 18.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives