Key Takeaways

- Strong transient room revenue growth driven by leisure demand, strategic acquisitions, and renovation projects enhance future revenue and earnings potential.

- Investment-grade balance sheet and excess liquidity enable flexibility for strategic investments and shareholder value creation through potential stock buybacks.

- Rising wage pressures and operational challenges, including from natural disasters and international travel imbalances, threaten Host Hotels & Resorts' net and EBITDA margins.

Catalysts

About Host Hotels & Resorts- An S&P 500 company and is the largest lodging real estate investment trust and one of the largest owners of luxury and upper-upscale hotels.

- Host Hotels & Resorts is experiencing strong transient room revenue growth, particularly driven by leisure demand in Maui and other key markets like New York and O'ahu. This trend is expected to positively impact future revenue growth as leisure demand continues to recover and exceed previous levels.

- The company has acquired $1.5 billion worth of iconic real estate in new markets, which are performing well according to underwriting expectations. These strategic acquisitions are likely to enhance revenue and earnings through increased market presence and adding high-quality assets to the portfolio.

- Host Hotels is investing significantly in renovations and expansion projects, such as the Hyatt Transformational Capital Program and the Four Seasons Resort Orlando condo development. These initiatives are projected to improve net margins and future earnings by attracting more guests and increasing ancillary revenues.

- The company is focused on group business recovery, with an increased definite group room nights on the books for 2025. This increase in group business and related banquet and catering revenue will likely bolster revenue and earnings through higher occupancy and out-of-room spend.

- Host Hotels maintains an investment-grade balance sheet and has excess liquidity, providing the flexibility to capitalize on future opportunities, including stock buybacks and strategic investments. This financial strength supports the potential for earnings growth and value creation for shareholders.

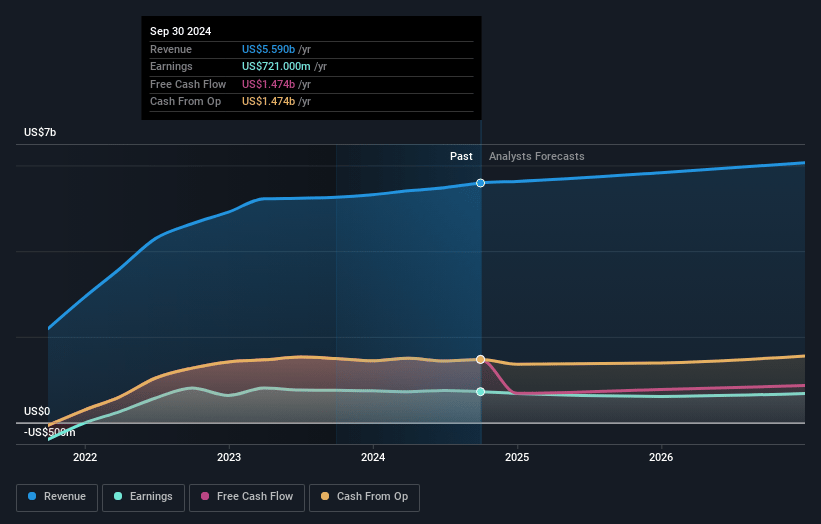

Host Hotels & Resorts Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Host Hotels & Resorts's revenue will grow by 3.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 12.2% today to 9.9% in 3 years time.

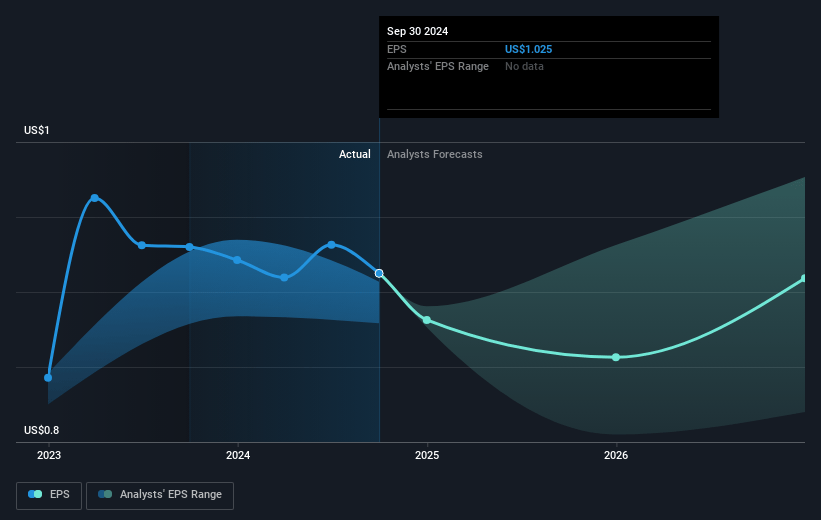

- Analysts expect earnings to reach $626.5 million (and earnings per share of $0.94) by about April 2028, down from $697.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $786 million in earnings, and the most bearish expecting $466.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.6x on those 2028 earnings, up from 14.1x today. This future PE is greater than the current PE for the US Hotel and Resort REITs industry at 19.1x.

- Analysts expect the number of shares outstanding to decline by 0.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.55%, as per the Simply Wall St company report.

Host Hotels & Resorts Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces operational risks due to increased wages and fixed expense pressures, which negatively impacted their hotel EBITDA margins, potentially affecting net margins.

- The recovery of operations in Maui is uncertain and is expected to pose a significant challenge, including a potential variable $15 million to $30 million in operational improvements, affecting revenues and earnings.

- The impact of hurricanes has caused substantial property damage and remediation costs, including at the Don CeSar, which impacts capital expenditures and future EBITDA margins due to business interruptions.

- The rising costs related to labor, with overall wage and benefit expenses expected to increase over 6%, are putting pressure on operating expenses and affecting net margins.

- The company anticipates some challenges due to the international travel imbalance, which might continue to weaken and affect group and business transient segment growth, potentially impacting revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $17.972 for Host Hotels & Resorts based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $21.5, and the most bearish reporting a price target of just $14.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.3 billion, earnings will come to $626.5 million, and it would be trading on a PE ratio of 24.6x, assuming you use a discount rate of 7.5%.

- Given the current share price of $14.03, the analyst price target of $17.97 is 21.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.