Key Takeaways

- Integration challenges with Turner & Townsend could delay synergies, pressuring earnings and SOP growth targets.

- Reliance on data center and industrial real estate markets poses concentration risk, affecting revenue growth if these sectors face downturns.

- Strategic acquisitions, organizational realignments, and capital deployment bolster CBRE's growth across infrastructure, energy, and real estate to drive long-term earnings expansion.

Catalysts

About CBRE Group- Operates as a commercial real estate services and investment company in the United States, the United Kingdom, and internationally.

- There is risk that the integration of CBRE's Project Management business with Turner & Townsend might face challenges, delaying expected synergies and resulting in below-trend SOP growth, which could pressure earnings targets.

- CBRE's ambitious real estate development projects and acquisitions, while promising long-term, could increase financial leverage and risk, especially if market conditions turn unfavorable, potentially impacting the company's net margins and earnings stability.

- Despite strong current performance, the company's reliance on data center and industrial real estate markets presents a concentration risk. A flattening or downturn in these sectors could slow revenue growth, as seen with flat industrial leasing revenue in recent quarters.

- The expectation of continued high M&A activity may not materialize, leading to potential capital allocation inefficiencies and lower-than-anticipated revenue and EPS growth, especially given the company's willingness to leverage up for the right opportunities.

- Macro-economic uncertainties, like currency headwinds or changes in interest rates, could adversely impact revenue and earnings. For instance, projected core EPS growth in 2025 is already tempered by a 1% to 2% expected currency translation headwind, potentially limiting upside and compressing net margins.

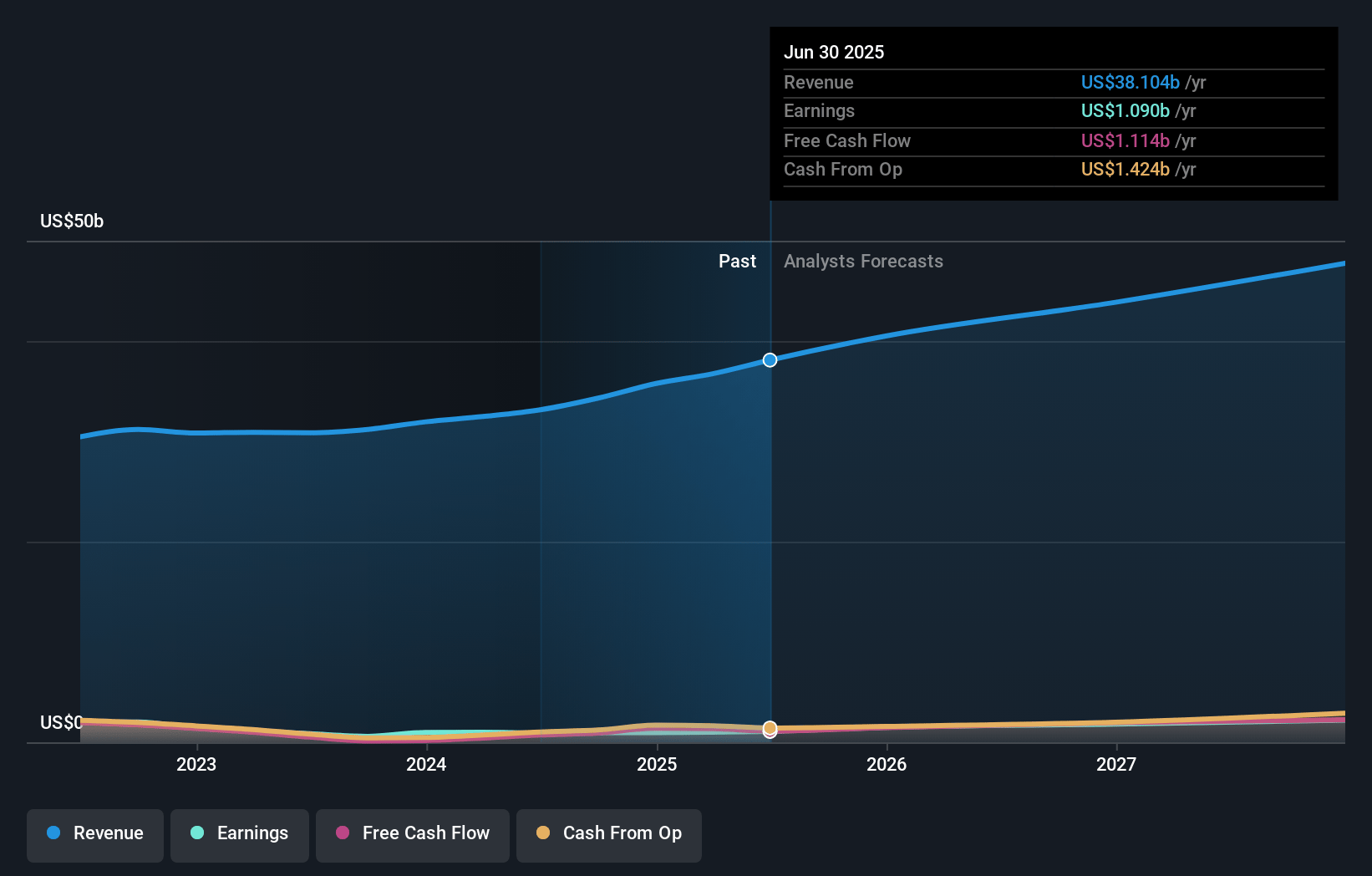

CBRE Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on CBRE Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming CBRE Group's revenue will grow by 6.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.7% today to 4.7% in 3 years time.

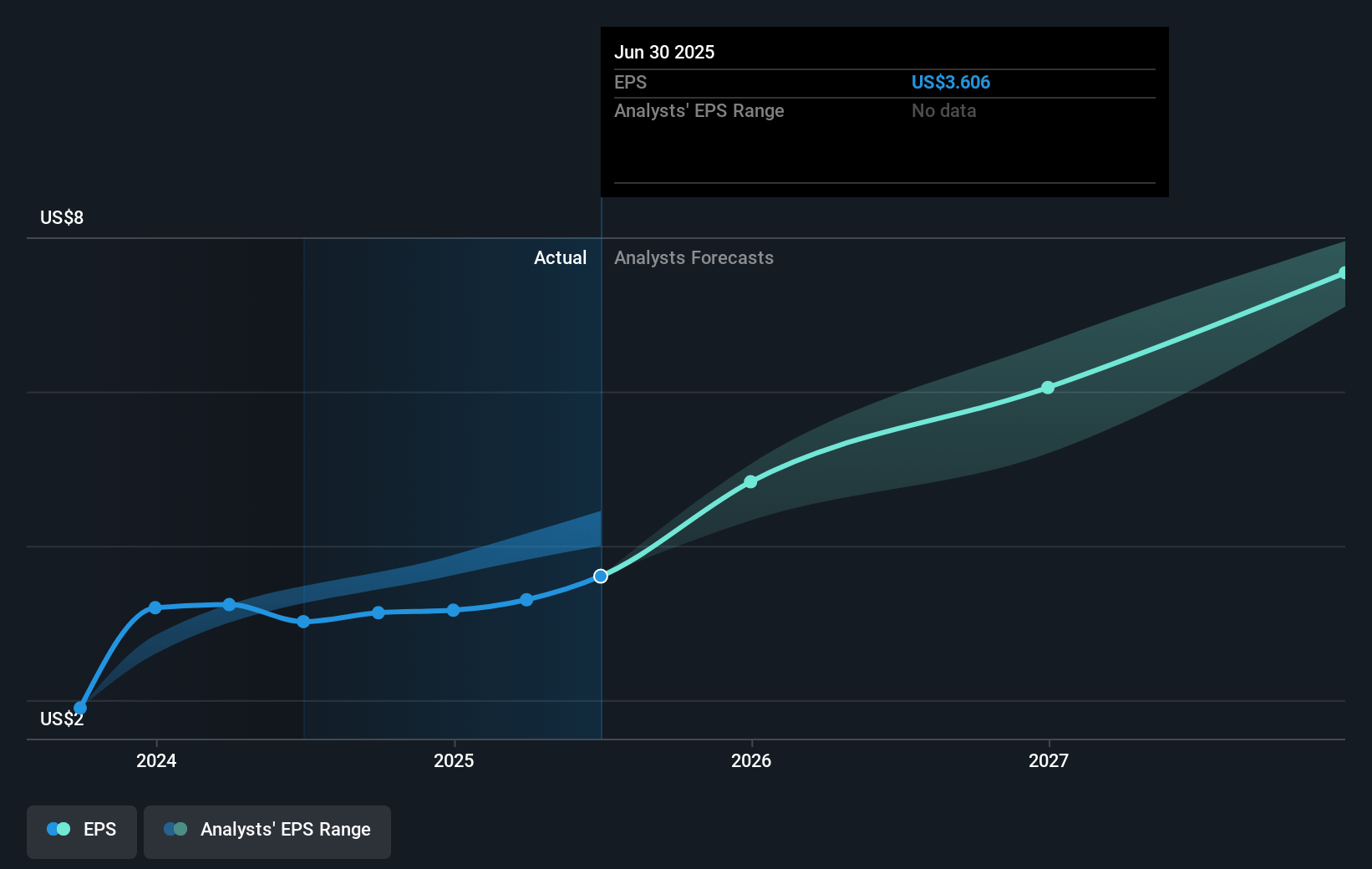

- The bearish analysts expect earnings to reach $2.0 billion (and earnings per share of $7.18) by about April 2028, up from $968.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 21.5x on those 2028 earnings, down from 35.9x today. This future PE is greater than the current PE for the US Real Estate industry at 19.3x.

- Analysts expect the number of shares outstanding to decline by 2.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.78%, as per the Simply Wall St company report.

CBRE Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- CBRE's acquisition of Industrious and the consolidation of their building management businesses into a segment called Building Operations & Experience suggest potential for increased revenue as they meet demand for flexible workplaces and improved tenant experiences.

- The combination of CBRE Project Management with Turner & Townsend positions CBRE for resilient revenue growth in infrastructure, energy, and data centers, which could expand both their top line and net margins.

- Their emphasis on the Real Estate Investments segment, particularly in Development and Investment Management, indicates significant embedded profits and opportunities for revenue and long-term earnings growth.

- Strong expected growth in their resilient businesses, which contributed significantly to SOP, and the rebound in leasing markets suggest robust future earnings and margin expansion despite lower-than-peak transaction activity.

- Strategic leadership changes and capital deployment, including share repurchases and M&A, indicate confidence in CBRE's undervalued stock, potentially leading to improved financial metrics like earnings per share.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for CBRE Group is $124.01, which represents one standard deviation below the consensus price target of $141.08. This valuation is based on what can be assumed as the expectations of CBRE Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $165.0, and the most bearish reporting a price target of just $112.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $43.3 billion, earnings will come to $2.0 billion, and it would be trading on a PE ratio of 21.5x, assuming you use a discount rate of 7.8%.

- Given the current share price of $117.62, the bearish analyst price target of $124.01 is 5.2% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystLowTarget holds no position in NYSE:CBRE. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.