Key Takeaways

- Strategic talent investments and platform upgrades fuel notable revenue and margin growth, supporting a positive outlook in capital markets and leasing activities.

- Industry trends like interest rate stabilization and AI-driven reshoring position Newmark for expanded market share and enhanced net margins.

- Leadership changes and international expansion plans may introduce uncertainty, risking impact on revenue growth, profitability, and operational efficiency amid market pressures and geopolitical challenges.

Catalysts

About Newmark Group- Provides commercial real estate services in the United States, the United Kingdom, and internationally.

- Newmark's investment in talent and platform enhancements over recent years has fueled a significant double-digit top-line growth across major business lines, indicating a strong potential for continued revenue growth.

- The company anticipates industry trends such as interest rate stabilization and the narrowing of bid-ask spreads will drive double-digit gains in capital markets volumes, enhancing revenues and potentially improving net margins.

- Newmark forecasts strong revenue and earnings growth in 2025, with an expected adjusted EBITDA of at least $630 million by 2026, signaling a potential increase in earnings.

- The shift towards institutional real estate allocation, coupled with the reshoring of manufacturing and data center investments, particularly driven by AI advancements, positions Newmark to capture higher market share and revenue.

- The strategy of leveraging expertise to handle complex transactions and robust growth in capital markets and leasing is expected to strengthen net margins and earnings due to operational efficiencies and increased demand.

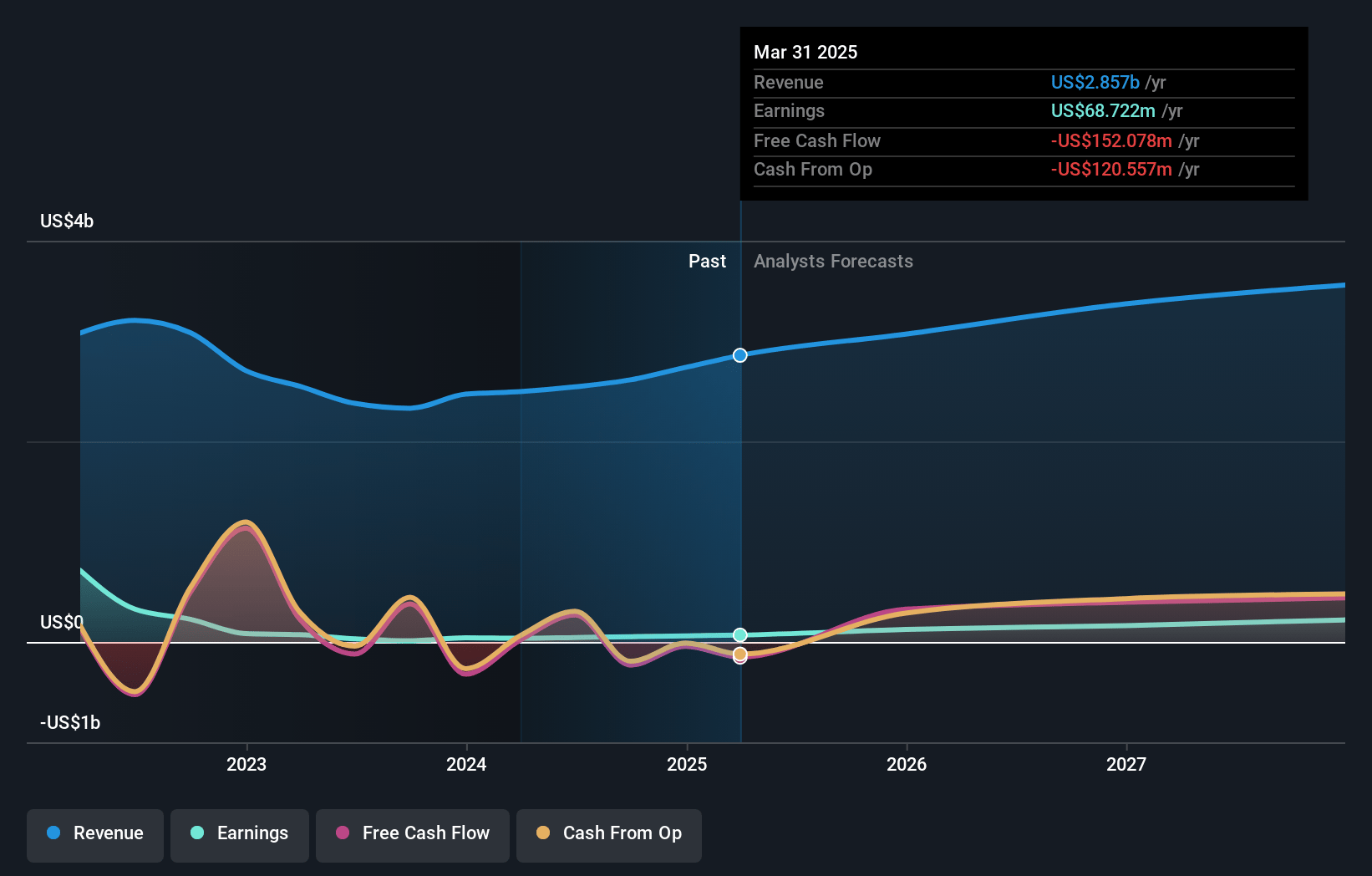

Newmark Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Newmark Group's revenue will grow by 8.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.2% today to 5.4% in 3 years time.

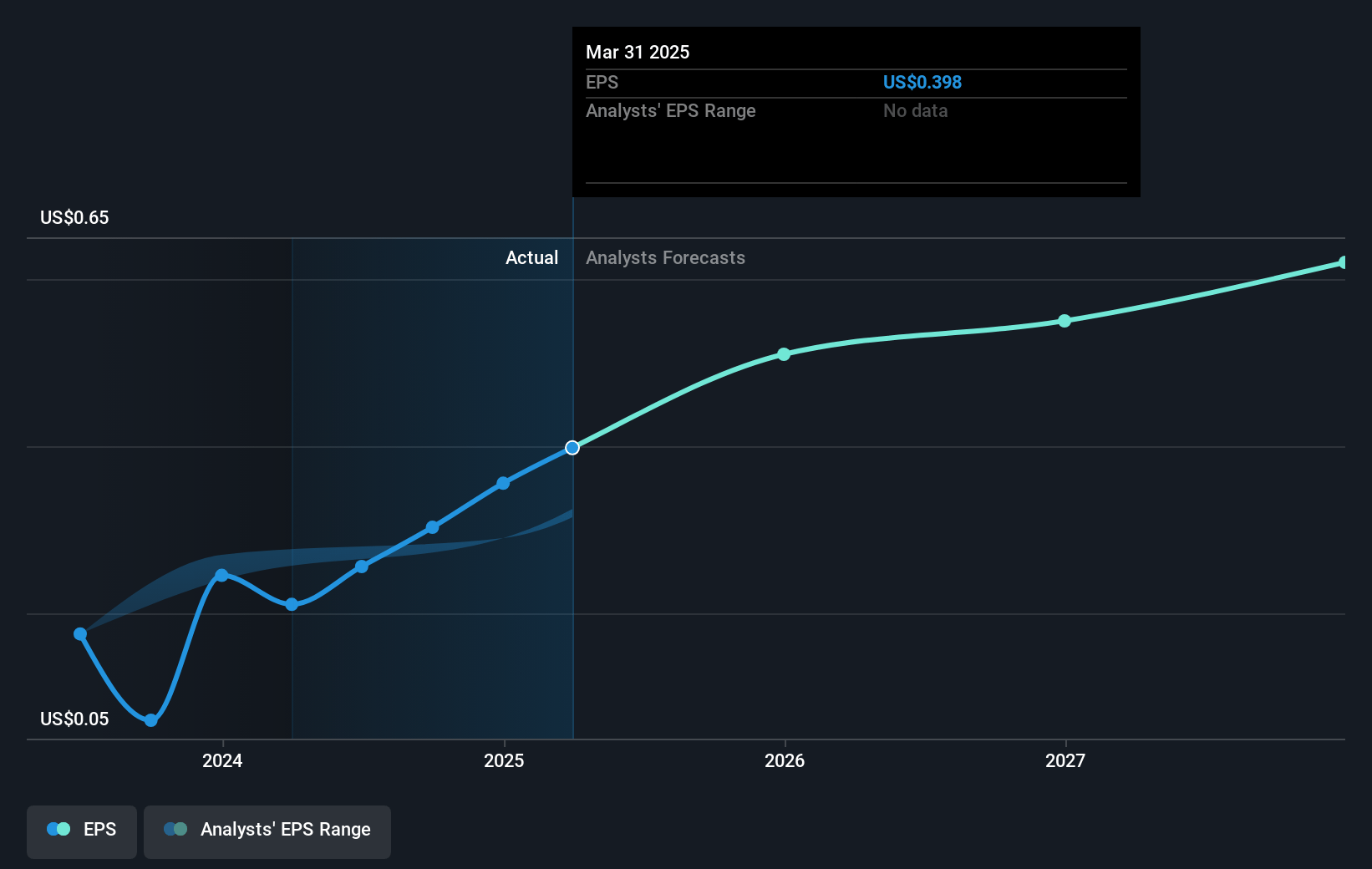

- Analysts expect earnings to reach $190.1 million (and earnings per share of $0.7) by about March 2028, up from $61.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $234 million in earnings, and the most bearish expecting $146.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.7x on those 2028 earnings, down from 36.2x today. This future PE is greater than the current PE for the US Real Estate industry at 31.7x.

- Analysts expect the number of shares outstanding to grow by 4.62% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.39%, as per the Simply Wall St company report.

Newmark Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The departure of Howard Lutnick, a key figure in Newmark's growth, could lead to uncertainties in strategic decision-making, affecting revenue and earnings if his leadership and decision-making abilities are not adequately replaced.

- Political and trade policy uncertainties, particularly concerning industrial activity and reshoring efforts, might dampen leasing activities, posing a risk to revenue growth.

- Although Newmark plans strong expansion in international markets like Germany and France, there is inherent risk in achieving the desired profitability and operational efficiency similar to the U.S., which could affect net earnings and margins.

- Competitive market pressures and potential increases in D&O premiums following organizational changes could increase operational expenses, thereby impacting net margins and overall profitability.

- Headwinds in the market are acknowledged, and while Newmark plans to counteract with market share growth, these economic uncertainties could affect capital markets activity and leasing, impacting overall revenue projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $18.0 for Newmark Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.5 billion, earnings will come to $190.1 million, and it would be trading on a PE ratio of 35.7x, assuming you use a discount rate of 9.4%.

- Given the current share price of $12.28, the analyst price target of $18.0 is 31.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.