Narratives are currently in beta

Key Takeaways

- Significant ramp-up in sales and marketing for Homes.com is expected to boost revenue and earnings as consumer awareness increases.

- Acquisitions and product expansions, fueled by strategic investments, aim to drive sustained growth and improve net margins in the real estate sector.

- Transitioning sales focus and investing in marketing for Homes.com could hinder revenue and margin growth, amid real estate market challenges and unpredictable product demand.

Catalysts

About CoStar Group- Provides information, analytics, and online marketplace services to the commercial real estate, hospitality, residential, and related professionals industries in the United States, Canada, Europe, the Asia Pacific, and Latin America.

- CoStar Group is ramping up its dedicated Homes.com sales force significantly, aiming for substantial growth in annualized billings which could boost future revenue and earnings.

- Expansion of products like the CoStar lender product and investments in additional sales teams for CoStar, LoopNet, and Apartments.com are expected to drive revenue growth, particularly as the commercial real estate market shows signs of recovery.

- Homes.com marketing campaigns have rapidly increased consumer awareness, which could translate to higher revenue and improved net margins as market share in the real estate portal space is gained.

- The acquisition of Visual Lease and upcoming integration should enhance service offerings and could lead to improvements in future earnings through synergies and expanded customer base.

- High renewal rates in CoStar’s subscription model and strategic investments in product expansions suggest potential for sustained revenue growth and stable net margins in the commercial and residential markets.

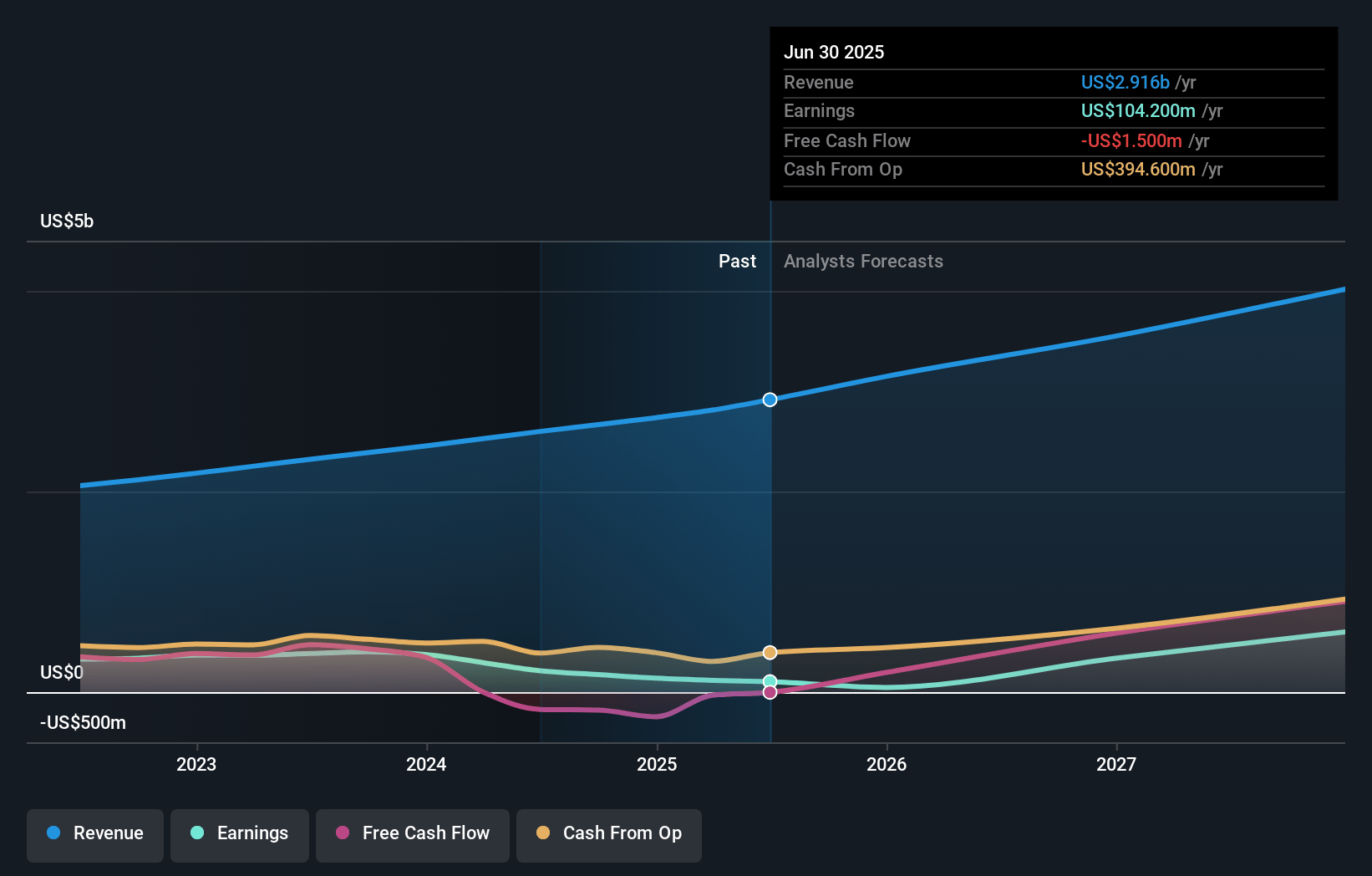

CoStar Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CoStar Group's revenue will grow by 14.6% annually over the next 3 years.

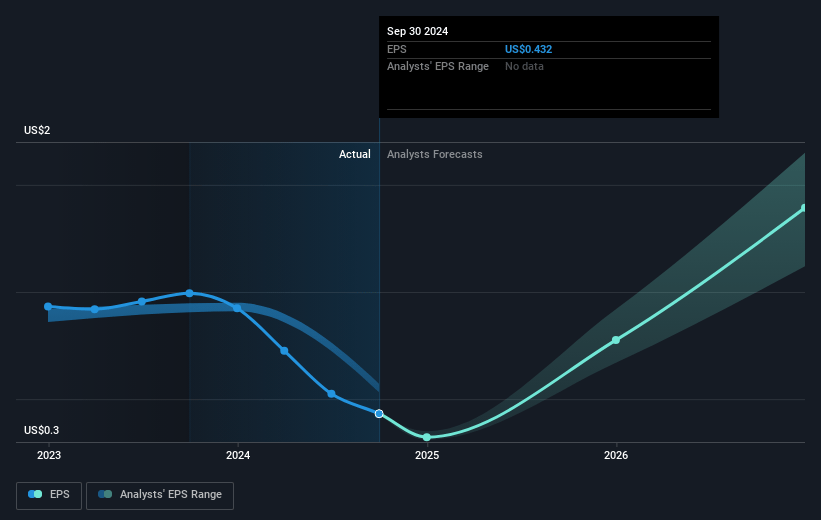

- Analysts assume that profit margins will increase from 6.6% today to 21.4% in 3 years time.

- Analysts expect earnings to reach $859.1 million (and earnings per share of $1.94) by about November 2027, up from $175.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 57.2x on those 2027 earnings, down from 177.1x today. This future PE is greater than the current PE for the US Real Estate industry at 27.7x.

- Analysts expect the number of shares outstanding to grow by 2.57% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.27%, as per the Simply Wall St company report.

CoStar Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The full impact of transitioning the entire sales force to sell Homes.com, which resulted in lower productivity and reduced renewal rates, could negatively affect overall revenue growth in the short term.

- The newly launched Homes.com has not yet achieved broad consumer awareness or profitability, and the significant marketing investment has not translated into proportional revenue, potentially impacting the company's net margins and earnings.

- High vacancy rates in the office and multifamily sectors, combined with challenges in the commercial real estate market, could limit revenue growth opportunities for CoStar's core business segments.

- The ongoing investment in expanding sales teams across multiple products could pressure short-term earnings and divert resources from the company's more established and profitable divisions.

- Changes in the real estate market dynamics due to regulatory adjustments and consumer dissatisfaction with traditional models might lead to unpredictable demand for CoStar's new products like Homes.com, impacting its future revenue projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $90.08 for CoStar Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $103.0, and the most bearish reporting a price target of just $75.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $4.0 billion, earnings will come to $859.1 million, and it would be trading on a PE ratio of 57.2x, assuming you use a discount rate of 7.3%.

- Given the current share price of $75.77, the analyst's price target of $90.08 is 15.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives