Narratives are currently in beta

Key Takeaways

- Strategic acquisition of Corvus strengthens the Cyber portfolio, potentially enhancing revenue and improving margins with advanced underwriting and risk control.

- Advanced analytics in catastrophe response boost customer satisfaction and retention, supporting a stable customer base and revenue growth.

- Travelers faces volatility in earnings from natural catastrophes, elevated expenses from integrations, and challenges from economic and geopolitical uncertainties impacting profitability and revenue stability.

Catalysts

About Travelers Companies- Through its subsidiaries, provides a range of commercial and personal property, and casualty insurance products and services to businesses, government units, associations, and individuals in the United States and internationally.

- Travelers is effectively utilizing advanced analytics and geospatial tools to enhance its catastrophe response model, which improves customer satisfaction and retention. This operational excellence is likely to boost revenue by maintaining a strong customer base.

- The company is experiencing significant growth in net written premiums across its segments, with Business Insurance premiums up by 9% and Personal Insurance by 7%. This sustained top-line growth is expected to enhance future revenue.

- Increased pricing across various insurance lines, coupled with strong retention rates, reflects deliberate execution in a firm pricing environment, which may lead to improved net margins and future earnings growth.

- Travelers’ high-quality investment portfolio, especially the growth in fixed income, is driving higher net investment income, positively impacting future earnings and contributing to financial strength.

- The strategic acquisition and integration of Corvus are enhancing Travelers’ Cyber portfolio, expected to drive higher revenue and possibly improve net margins as they leverage Corvus’ proprietary underwriting and risk control capabilities.

Travelers Companies Future Earnings and Revenue Growth

Assumptions

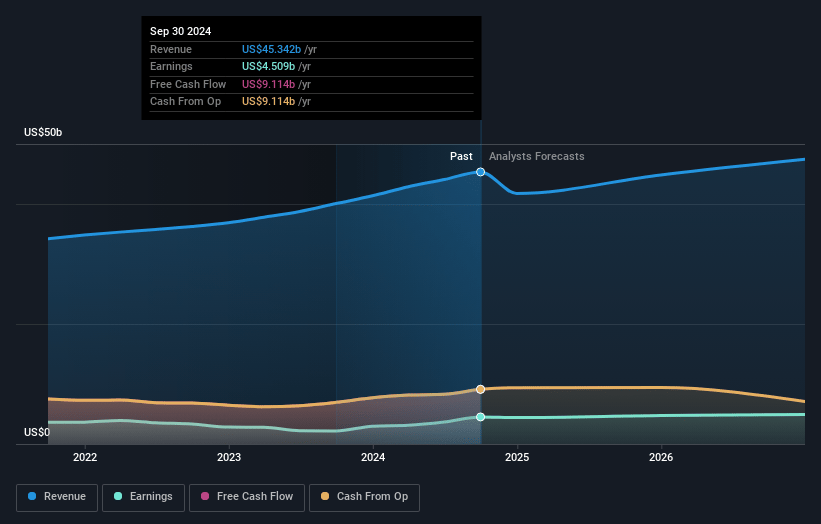

How have these above catalysts been quantified?- Analysts are assuming Travelers Companies's revenue will decrease by 0.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 9.9% today to 9.4% in 3 years time.

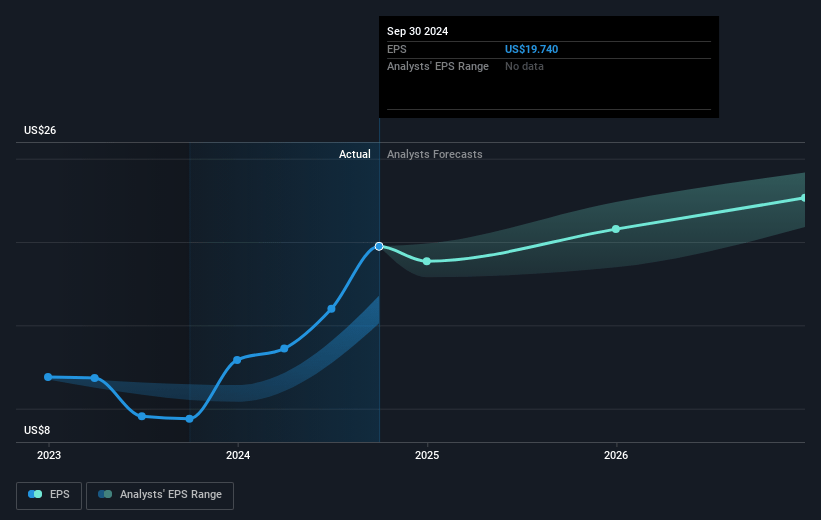

- Analysts expect earnings to reach $4.3 billion (and earnings per share of $21.15) by about November 2027, down from $4.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $5.4 billion in earnings, and the most bearish expecting $3.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.8x on those 2027 earnings, up from 12.9x today. This future PE is greater than the current PE for the US Insurance industry at 13.5x.

- Analysts expect the number of shares outstanding to decline by 3.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.04%, as per the Simply Wall St company report.

Travelers Companies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Hurricanes Helene and Milton have highlighted the significant exposure Travelers has to natural catastrophes, which could lead to fluctuating underwriting results and increased volatility in earnings.

- The integration of Corvus's operations into Bond & Specialty Insurance may lead to temporary elevated expense ratios, which could negatively impact net margins during this period.

- The uncertainty caused by political, regulatory, and geopolitical environments brings additional risk to the pricing strategies and renewal premium changes, potentially affecting revenue stability.

- There is a noted dependency on maintaining strong underwriting and pricing discipline amidst social and economic inflation headwinds, which if not managed accurately, could impact underwriting margins and overall profitability.

- Exposure to increasingly frequent severe convective storms and other catastrophic weather events could strain operating cash flows and reserve capital, potentially impacting Travelers’ ability for consistent shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $262.67 for Travelers Companies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $310.0, and the most bearish reporting a price target of just $214.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $46.0 billion, earnings will come to $4.3 billion, and it would be trading on a PE ratio of 14.8x, assuming you use a discount rate of 6.0%.

- Given the current share price of $256.67, the analyst's price target of $262.67 is 2.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives